Statistik Asas

| Nilai Portfolio | $ 3,910,386 |

| Kedudukan Semasa | 39 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

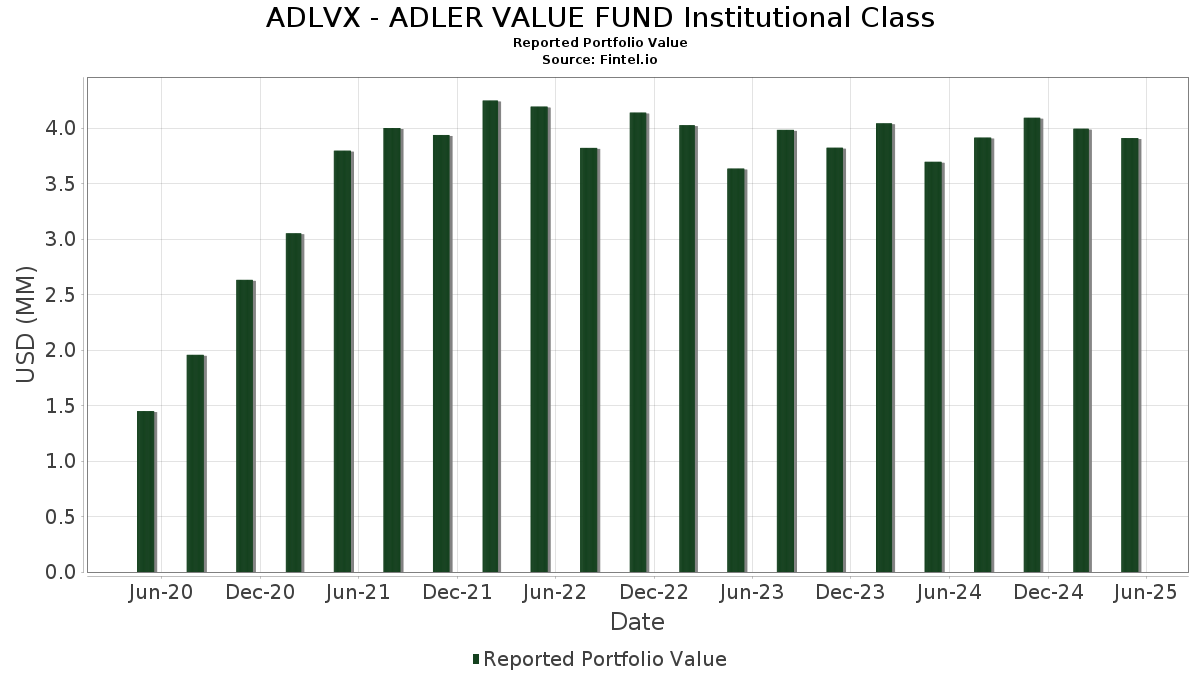

ADLVX - ADLER VALUE FUND Institutional Class telah mendedahkan 39 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 3,910,386 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas ADLVX - ADLER VALUE FUND Institutional Class ialah Federated Treasury Obligations Fund (US:US60934N8728) , Jackson Financial Inc. (US:JXN) , Aflac Incorporated (US:AFL) , Equitable Holdings, Inc. (US:EQH) , and Citigroup Inc. (US:C) . Kedudukan baharu ADLVX - ADLER VALUE FUND Institutional Class termasuk Federated Treasury Obligations Fund (US:US60934N8728) , Novo Nordisk A/S - Depositary Receipt (Common Stock) (US:NVO) , Amcor plc (US:AMCR) , Salesforce, Inc. (US:CRM) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.11 | 2.7367 | 2.7367 | |

| 0.01 | 0.15 | 3.7319 | 2.6654 | |

| 0.01 | 0.10 | 2.4525 | 2.4525 | |

| 0.01 | 0.14 | 3.5149 | 1.0016 | |

| 0.01 | 0.21 | 5.3682 | 0.9309 | |

| 0.00 | 0.24 | 6.0863 | 0.7258 | |

| 0.00 | 0.02 | 0.4719 | 0.4719 | |

| 0.00 | 0.01 | 0.3381 | 0.3381 | |

| 0.01 | 0.09 | 2.2414 | 0.3229 | |

| 0.00 | 0.01 | 0.2709 | 0.2709 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.55 | 14.1347 | -2.4532 | ||

| 0.01 | 0.45 | 11.4956 | -1.0852 | |

| 0.00 | 0.17 | 4.3573 | -0.6046 | |

| 0.00 | 0.10 | 2.6424 | -0.4541 | |

| 0.00 | 0.10 | 2.4457 | -0.3623 | |

| 0.00 | 0.24 | 6.1503 | -0.2365 | |

| 0.00 | 0.26 | 6.6051 | -0.2268 | |

| 0.00 | 0.10 | 2.5409 | -0.2157 | |

| 0.00 | 0.25 | 6.4757 | -0.1172 | |

| 0.01 | 0.02 | 0.5305 | -0.1121 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-29 untuk tempoh pelaporan 2025-05-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US60934N8728 / Federated Treasury Obligations Fund | 0.55 | -16.72 | 14.1347 | -2.4532 | |||||

| JXN / Jackson Financial Inc. | 0.01 | 0.00 | 0.45 | -10.54 | 11.4956 | -1.0852 | |||

| AFL / Aflac Incorporated | 0.00 | 0.00 | 0.26 | -5.49 | 6.6051 | -0.2268 | |||

| EQH / Equitable Holdings, Inc. | 0.00 | 0.00 | 0.25 | -4.17 | 6.4757 | -0.1172 | |||

| C / Citigroup Inc. | 0.00 | 0.00 | 0.24 | -5.49 | 6.1503 | -0.2365 | |||

| SCHW / The Charles Schwab Corporation | 0.00 | 0.00 | 0.24 | 11.21 | 6.0863 | 0.7258 | |||

| CPNG / Coupang, Inc. | 0.01 | 0.00 | 0.21 | 18.64 | 5.3682 | 0.9309 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.17 | -14.14 | 4.3573 | -0.6046 | |||

| PCG / PG&E Corporation | 0.01 | 0.00 | 0.17 | 3.07 | 4.3073 | 0.2282 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.01 | 225.00 | 0.15 | 247.62 | 3.7319 | 2.6654 | |||

| XP / XP Inc. | 0.01 | 0.00 | 0.14 | 37.00 | 3.5149 | 1.0016 | |||

| CI / The Cigna Group | 0.00 | 0.00 | 0.13 | 2.44 | 3.2319 | 0.1479 | |||

| VTRS / Viatris Inc. | 0.01 | 0.00 | 0.11 | -4.39 | 2.7891 | -0.0761 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.00 | 0.11 | 2.7367 | 2.7367 | |||||

| BDX / Becton, Dickinson and Company | 0.00 | 9.09 | 0.10 | -16.94 | 2.6424 | -0.4541 | |||

| MDT / Medtronic plc | 0.00 | 0.00 | 0.10 | -10.00 | 2.5409 | -0.2157 | |||

| AMCR / Amcor plc | 0.01 | 0.10 | 2.4525 | 2.4525 | |||||

| SLB / Schlumberger Limited | 0.00 | 7.41 | 0.10 | -15.18 | 2.4457 | -0.3623 | |||

| GLW / Corning Incorporated | 0.00 | 0.00 | 0.09 | -1.11 | 2.2777 | 0.0242 | |||

| OI / O-I Glass, Inc. | 0.01 | 0.00 | 0.09 | 14.47 | 2.2414 | 0.3229 | |||

| BAYRY / Bayer Aktiengesellschaft - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.04 | 19.35 | 0.9471 | 0.1700 | |||

| ATUS / Altice USA, Inc. | 0.01 | 0.00 | 0.02 | -20.00 | 0.5305 | -0.1121 | |||

| CMCSA / Comcast Corporation | 0.00 | 0.00 | 0.02 | -4.76 | 0.5293 | -0.0081 | |||

| CFG / Citizens Financial Group, Inc. | 0.00 | 0.00 | 0.02 | -9.09 | 0.5148 | -0.0565 | |||

| Citigroup, Inc. Call @ $65.00, Expiring September 2025 / DE (N/A) | 0.00 | 0.02 | 0.4719 | 0.4719 | |||||

| XP, Inc. Call @ $15.00, Expiring January 2026 / DE (N/A) | 0.00 | 0.01 | 0.3381 | 0.3381 | |||||

| CRM / Salesforce, Inc. | 0.00 | 0.01 | 0.2709 | 0.2709 | |||||

| NOVO NORDISK A/S Call @ $70.00, Expiring September 2025 / DE (N/A) | 0.00 | 0.01 | 0.2161 | 0.2161 | |||||

| PG&E Corporation Call @ $17.00, Expiring January 2026 / DE (N/A) | 0.00 | 0.00 | 0.1123 | 0.1123 | |||||

| AMCOR PLC Call @ $9.00, Expiring December 2025 / DE (N/A) | 0.00 | 0.00 | 0.0651 | 0.0651 | |||||

| COMCAST CORP Call @ $35, Expiring September 2025 / DE (N/A) | 0.00 | 0.00 | 0.0487 | 0.0487 | |||||

| SCHLUMBERGER LTD Call @ $35.00, Expiring January 2026 / DE (N/A) | 0.00 | 0.00 | 0.0387 | 0.0387 | |||||

| AMCOR PLC Call @ $10.00, Expiring December 2025 / DE (N/A) | 0.00 | 0.00 | 0.0299 | 0.0299 | |||||

| PG&E Corporation Call @ $17.00, Expiring September 2025 / DE (N/A) | 0.00 | 0.00 | 0.0283 | 0.0283 | |||||

| PG&E Corporation Call @ $20, Expiring September 2025 / DE (N/A) | 0.00 | 0.00 | 0.0207 | 0.0207 | |||||

| Schlumberger LTD Call @ $40, Expiring August 2025 / DE (N/A) | 0.00 | 0.00 | 0.0115 | 0.0115 | |||||

| Viatris, Inc. Call @ $10.00, Expiring January 2027 / DE (N/A) | 0.00 | 0.00 | 0.0101 | 0.0101 | |||||

| MAGNERA CORPORATION Call @ $17.50, Expiring September 2025 / DE (N/A) | 0.00 | 0.00 | 0.0064 | 0.0064 | |||||

| SCHLUMBERGER LTD Call @ $40.00, Expiring September 2025 / DE (N/A) | 0.00 | 0.00 | 0.0063 | 0.0063 |