Statistik Asas

| Nilai Portfolio | $ 346,870,351 |

| Kedudukan Semasa | 101 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

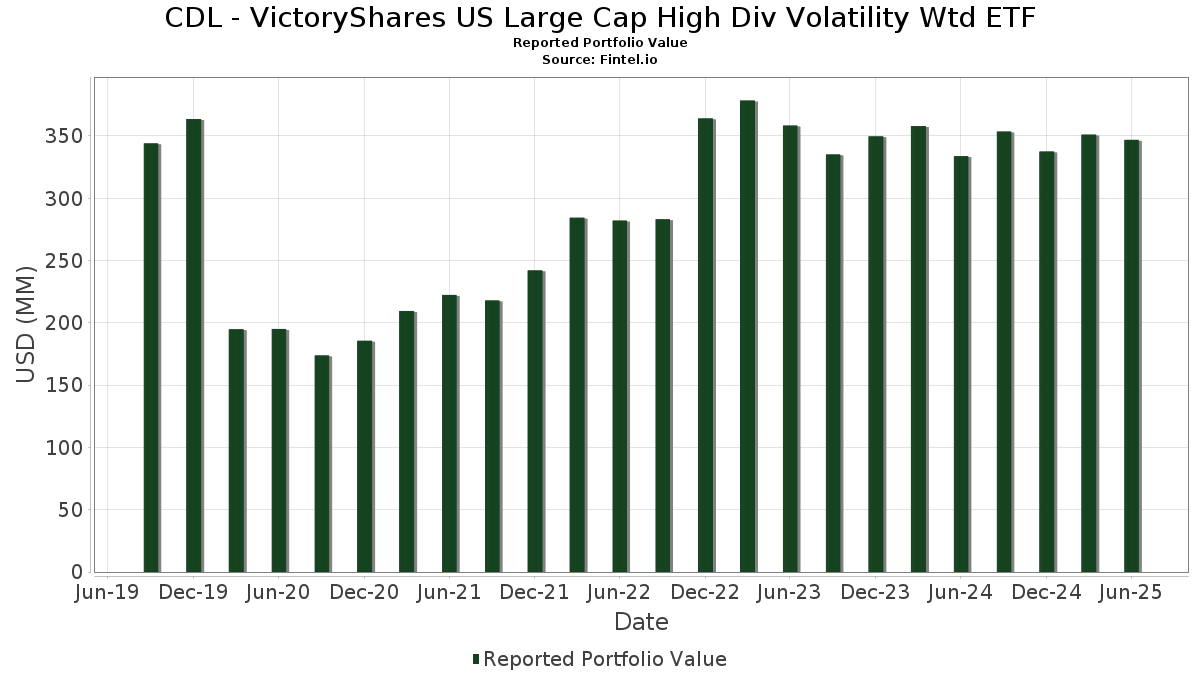

CDL - VictoryShares US Large Cap High Div Volatility Wtd ETF telah mendedahkan 101 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 346,870,351 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas CDL - VictoryShares US Large Cap High Div Volatility Wtd ETF ialah Evergy, Inc. (US:EVRG) , CME Group Inc. (US:CME) , The Coca-Cola Company (US:KO) , WEC Energy Group, Inc. (US:WEC) , and PPL Corporation (US:PPL) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 3.87 | 1.1085 | 0.4725 | |

| 0.03 | 4.11 | 1.1753 | 0.2838 | |

| 0.03 | 2.36 | 0.6768 | 0.2214 | |

| 0.04 | 3.92 | 1.1217 | 0.2012 | |

| 0.02 | 2.78 | 0.7960 | 0.1984 | |

| 0.02 | 3.11 | 0.8894 | 0.1704 | |

| 0.02 | 3.93 | 1.1234 | 0.1696 | |

| 0.04 | 3.02 | 0.8650 | 0.1606 | |

| 0.08 | 3.97 | 1.1374 | 0.1289 | |

| 0.01 | 2.85 | 0.8158 | 0.1262 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.14 | 2.90 | 0.8307 | -0.2251 | |

| 0.09 | 2.81 | 0.8047 | -0.2177 | |

| 0.09 | 2.50 | 0.7163 | -0.2061 | |

| 0.06 | 3.26 | 0.9317 | -0.1740 | |

| 0.03 | 3.08 | 0.8807 | -0.1726 | |

| 0.05 | 2.54 | 0.7263 | -0.1713 | |

| 0.03 | 3.77 | 1.0781 | -0.1495 | |

| 0.03 | 2.79 | 0.7993 | -0.1492 | |

| 0.13 | 3.47 | 0.9923 | -0.1476 | |

| 0.07 | 2.37 | 0.6780 | -0.1417 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-28 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| EVRG / Evergy, Inc. | 0.09 | 1.88 | 6.20 | 1.86 | 1.7738 | 0.0477 | |||

| CME / CME Group Inc. | 0.02 | 1.87 | 5.64 | 5.83 | 1.6155 | 0.1027 | |||

| KO / The Coca-Cola Company | 0.08 | 1.87 | 5.36 | 0.64 | 1.5333 | 0.0233 | |||

| WEC / WEC Energy Group, Inc. | 0.05 | 1.85 | 5.13 | -2.62 | 1.4669 | -0.0259 | |||

| PPL / PPL Corporation | 0.15 | 1.85 | 5.06 | -4.42 | 1.4491 | -0.0534 | |||

| CMS / CMS Energy Corporation | 0.07 | 1.85 | 5.06 | -6.05 | 1.4477 | -0.0796 | |||

| DUK / Duke Energy Corporation | 0.04 | 1.83 | 5.03 | -1.47 | 1.4396 | -0.0086 | |||

| SO / The Southern Company | 0.05 | 1.81 | 4.88 | 1.69 | 1.3979 | 0.0354 | |||

| DTE / DTE Energy Company | 0.04 | 1.83 | 4.82 | -2.45 | 1.3792 | -0.0220 | |||

| JNJ / Johnson & Johnson | 0.03 | 1.83 | 4.75 | -6.22 | 1.3596 | -0.0771 | |||

| ED / Consolidated Edison, Inc. | 0.05 | 1.82 | 4.70 | -7.61 | 1.3444 | -0.0977 | |||

| AEP / American Electric Power Company, Inc. | 0.04 | 1.80 | 4.63 | -3.34 | 1.3244 | -0.0335 | |||

| EXC / Exelon Corporation | 0.11 | 1.79 | 4.58 | -4.10 | 1.3122 | -0.0436 | |||

| MO / Altria Group, Inc. | 0.08 | 1.81 | 4.58 | -0.56 | 1.3121 | 0.0045 | |||

| FE / FirstEnergy Corp. | 0.11 | 1.80 | 4.54 | 1.41 | 1.2985 | 0.0294 | |||

| LNT / Alliant Energy Corporation | 0.07 | 1.79 | 4.53 | -4.33 | 1.2960 | -0.0467 | |||

| KDP / Keurig Dr Pepper Inc. | 0.14 | 1.79 | 4.47 | -1.67 | 1.2806 | -0.0100 | |||

| MDLZ / Mondelez International, Inc. | 0.07 | 1.78 | 4.40 | 1.15 | 1.2600 | 0.0256 | |||

| HRL / Hormel Foods Corporation | 0.14 | 1.78 | 4.32 | -0.48 | 1.2356 | 0.0050 | |||

| XEL / Xcel Energy Inc. | 0.06 | 1.78 | 4.31 | -2.09 | 1.2336 | -0.0150 | |||

| KMB / Kimberly-Clark Corporation | 0.03 | 1.79 | 4.27 | -7.73 | 1.2227 | -0.0906 | |||

| T / AT&T Inc. | 0.15 | 1.74 | 4.22 | 4.12 | 1.2086 | 0.0582 | |||

| SYY / Sysco Corporation | 0.06 | 1.75 | 4.17 | 2.71 | 1.1935 | 0.0418 | |||

| VZ / Verizon Communications Inc. | 0.10 | 1.76 | 4.15 | -2.92 | 1.1887 | -0.0249 | |||

| NTRS / Northern Trust Corporation | 0.03 | 1.66 | 4.11 | 30.64 | 1.1753 | 0.2838 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.05 | 1.72 | 4.06 | 4.05 | 1.1614 | 0.0551 | |||

| PEP / PepsiCo, Inc. | 0.03 | 1.74 | 4.06 | -10.41 | 1.1608 | -0.1232 | |||

| XOM / Exxon Mobil Corporation | 0.04 | 1.72 | 4.02 | -7.78 | 1.1494 | -0.0861 | |||

| MDT / Medtronic plc | 0.05 | 1.73 | 3.99 | -1.31 | 1.1414 | -0.0048 | |||

| ADM / Archer-Daniels-Midland Company | 0.08 | 1.67 | 3.97 | 11.79 | 1.1374 | 0.1289 | |||

| ES / Eversource Energy | 0.06 | 1.74 | 3.97 | 4.23 | 1.1360 | 0.0557 | |||

| PM / Philip Morris International Inc. | 0.02 | 1.73 | 3.93 | 16.75 | 1.1234 | 0.1696 | |||

| STT / State Street Corporation | 0.04 | 1.68 | 3.92 | 20.77 | 1.1217 | 0.2012 | |||

| D / Dominion Energy, Inc. | 0.07 | 1.72 | 3.89 | 2.53 | 1.1145 | 0.0372 | |||

| LMT / Lockheed Martin Corporation | 0.01 | 1.75 | 3.88 | 5.50 | 1.1101 | 0.0672 | |||

| STX / Seagate Technology Holdings plc | 0.03 | 1.66 | 3.87 | 72.75 | 1.1085 | 0.4725 | |||

| KMI / Kinder Morgan, Inc. | 0.13 | 1.68 | 3.79 | 4.78 | 1.0858 | 0.0588 | |||

| CVX / Chevron Corporation | 0.03 | 1.69 | 3.77 | -12.94 | 1.0781 | -0.1495 | |||

| WMB / The Williams Companies, Inc. | 0.06 | 1.66 | 3.65 | 6.87 | 1.0458 | 0.0758 | |||

| TSN / Tyson Foods, Inc. | 0.07 | 1.68 | 3.64 | -10.86 | 1.0428 | -0.1166 | |||

| PFE / Pfizer Inc. | 0.15 | 1.66 | 3.58 | -2.74 | 1.0243 | -0.0196 | |||

| GIS / General Mills, Inc. | 0.07 | 1.71 | 3.57 | -11.87 | 1.0219 | -0.1272 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.02 | 1.64 | 3.51 | 7.77 | 1.0045 | 0.0810 | |||

| FNF / Fidelity National Financial, Inc. | 0.06 | 1.64 | 3.47 | -12.45 | 0.9944 | -0.1312 | |||

| KHC / The Kraft Heinz Company | 0.13 | 1.68 | 3.47 | -13.71 | 0.9923 | -0.1476 | |||

| EOG / EOG Resources, Inc. | 0.03 | 1.62 | 3.45 | -5.23 | 0.9865 | -0.0450 | |||

| TROW / T. Rowe Price Group, Inc. | 0.03 | 1.63 | 3.37 | 6.74 | 0.9653 | 0.0691 | |||

| FITB / Fifth Third Bancorp | 0.08 | 1.60 | 3.35 | 6.59 | 0.9577 | 0.0673 | |||

| LYB / LyondellBasell Industries N.V. | 0.06 | 1.61 | 3.26 | -16.50 | 0.9317 | -0.1740 | |||

| PFG / Principal Financial Group, Inc. | 0.04 | 1.59 | 3.26 | -4.35 | 0.9317 | -0.0337 | |||

| GILD / Gilead Sciences, Inc. | 0.03 | 1.61 | 3.23 | 0.56 | 0.9253 | 0.0132 | |||

| PRU / Prudential Financial, Inc. | 0.03 | 1.59 | 3.16 | -2.26 | 0.9042 | -0.0127 | |||

| USB / U.S. Bancorp | 0.07 | 1.58 | 3.14 | 8.87 | 0.8993 | 0.0807 | |||

| MTB / M&T Bank Corporation | 0.02 | 1.56 | 3.14 | 10.22 | 0.8986 | 0.0906 | |||

| COP / ConocoPhillips | 0.03 | 1.57 | 3.12 | -13.20 | 0.8941 | -0.1269 | |||

| AMGN / Amgen Inc. | 0.01 | 1.63 | 3.12 | -8.92 | 0.8940 | -0.0788 | |||

| RF / Regions Financial Corporation | 0.13 | 1.54 | 3.12 | 9.89 | 0.8936 | 0.0878 | |||

| MS / Morgan Stanley | 0.02 | 1.55 | 3.11 | 22.61 | 0.8894 | 0.1704 | |||

| NEE / NextEra Energy, Inc. | 0.04 | 1.61 | 3.10 | -0.51 | 0.8869 | 0.0035 | |||

| HBAN / Huntington Bancshares Incorporated | 0.18 | 1.55 | 3.08 | 13.37 | 0.8810 | 0.1110 | |||

| CTRA / Coterra Energy Inc. | 0.12 | 1.58 | 3.08 | -10.81 | 0.8809 | -0.0978 | |||

| CLX / The Clorox Company | 0.03 | 1.62 | 3.08 | -17.13 | 0.8807 | -0.1726 | |||

| CMCSA / Comcast Corporation | 0.09 | 1.55 | 3.06 | -1.77 | 0.8754 | -0.0079 | |||

| C / Citigroup Inc. | 0.04 | 1.50 | 3.02 | 21.71 | 0.8650 | 0.1606 | |||

| HSY / The Hershey Company | 0.02 | 1.55 | 3.02 | -1.47 | 0.8637 | -0.0050 | |||

| DRI / Darden Restaurants, Inc. | 0.01 | 1.55 | 2.98 | 6.55 | 0.8526 | 0.0595 | |||

| OMC / Omnicom Group Inc. | 0.04 | 1.55 | 2.97 | -11.88 | 0.8513 | -0.1062 | |||

| ETR / Entergy Corporation | 0.04 | 1.54 | 2.95 | -1.27 | 0.8441 | -0.0033 | |||

| CAG / Conagra Brands, Inc. | 0.14 | 1.60 | 2.90 | -22.03 | 0.8307 | -0.2251 | |||

| TFC / Truist Financial Corporation | 0.07 | 1.48 | 2.88 | 6.04 | 0.8243 | 0.0538 | |||

| SRE / Sempra | 0.04 | 1.54 | 2.86 | 7.81 | 0.8184 | 0.0661 | |||

| ABBV / AbbVie Inc. | 0.02 | 1.54 | 2.86 | -10.05 | 0.8176 | -0.0831 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 1.48 | 2.85 | 17.24 | 0.8158 | 0.1262 | |||

| PSX / Phillips 66 | 0.02 | 1.49 | 2.85 | -1.93 | 0.8143 | -0.0087 | |||

| MRK / Merck & Co., Inc. | 0.04 | 1.53 | 2.84 | -10.48 | 0.8141 | -0.0870 | |||

| CPB / The Campbell's Company | 0.09 | 1.60 | 2.81 | -22.00 | 0.8047 | -0.2177 | |||

| OKE / ONEOK, Inc. | 0.03 | 1.52 | 2.79 | -16.48 | 0.7993 | -0.1492 | |||

| DG / Dollar General Corporation | 0.02 | 1.49 | 2.78 | 32.05 | 0.7960 | 0.1984 | |||

| VLO / Valero Energy Corporation | 0.02 | 1.47 | 2.74 | 3.28 | 0.7841 | 0.0316 | |||

| KVUE / Kenvue Inc. | 0.13 | 1.51 | 2.68 | -11.43 | 0.7675 | -0.0910 | |||

| CFG / Citizens Financial Group, Inc. | 0.06 | 1.40 | 2.65 | 10.75 | 0.7579 | 0.0797 | |||

| EIX / Edison International | 0.05 | 1.50 | 2.64 | -11.10 | 0.7561 | -0.0869 | |||

| F / Ford Motor Company | 0.24 | 1.39 | 2.56 | 9.65 | 0.7320 | 0.0706 | |||

| TAP / Molson Coors Beverage Company | 0.05 | 1.50 | 2.54 | -19.82 | 0.7263 | -0.1713 | |||

| DOW / Dow Inc. | 0.09 | 1.49 | 2.50 | -23.06 | 0.7163 | -0.2061 | |||

| IP / International Paper Company | 0.05 | 1.44 | 2.50 | -10.95 | 0.7144 | -0.0808 | |||

| DVN / Devon Energy Corporation | 0.08 | 1.43 | 2.48 | -13.74 | 0.7097 | -0.1056 | |||

| ALLY / Ally Financial Inc. | 0.06 | 1.34 | 2.47 | 8.23 | 0.7076 | 0.0597 | |||

| CG / The Carlyle Group Inc. | 0.05 | 1.30 | 2.42 | 19.42 | 0.6936 | 0.1181 | |||

| GPC / Genuine Parts Company | 0.02 | 1.43 | 2.42 | 3.28 | 0.6934 | 0.0280 | |||

| UPS / United Parcel Service, Inc. | 0.02 | 1.36 | 2.38 | -7.01 | 0.6803 | -0.0445 | |||

| SLB / Schlumberger Limited | 0.07 | 1.38 | 2.37 | -18.00 | 0.6780 | -0.1417 | |||

| MCHP / Microchip Technology Incorporated | 0.03 | 1.32 | 2.36 | 47.29 | 0.6768 | 0.2214 | |||

| HPQ / HP Inc. | 0.09 | 1.37 | 2.27 | -10.46 | 0.6495 | -0.0694 | |||

| OVV / Ovintiv Inc. | 0.06 | 1.31 | 2.21 | -9.95 | 0.6321 | -0.0634 | |||

| CVS / CVS Health Corporation | 0.03 | 1.24 | 2.20 | 3.09 | 0.6310 | 0.0243 | |||

| OWL / Blue Owl Capital Inc. | 0.11 | 1.25 | 2.08 | -2.95 | 0.5944 | -0.0125 | |||

| SWK / Stanley Black & Decker, Inc. | 0.03 | 1.23 | 2.05 | -10.78 | 0.5873 | -0.0652 | |||

| BBY / Best Buy Co., Inc. | 0.03 | 1.31 | 2.03 | -7.60 | 0.5807 | -0.0422 | |||

| TGT / Target Corporation | 0.02 | 1.03 | 1.73 | -4.54 | 0.4942 | -0.0186 | |||

| S P 500 EMINI FUTURE SEP25 / DE (N/A) | 0.06 | 0.0164 | 0.0164 |