Statistik Asas

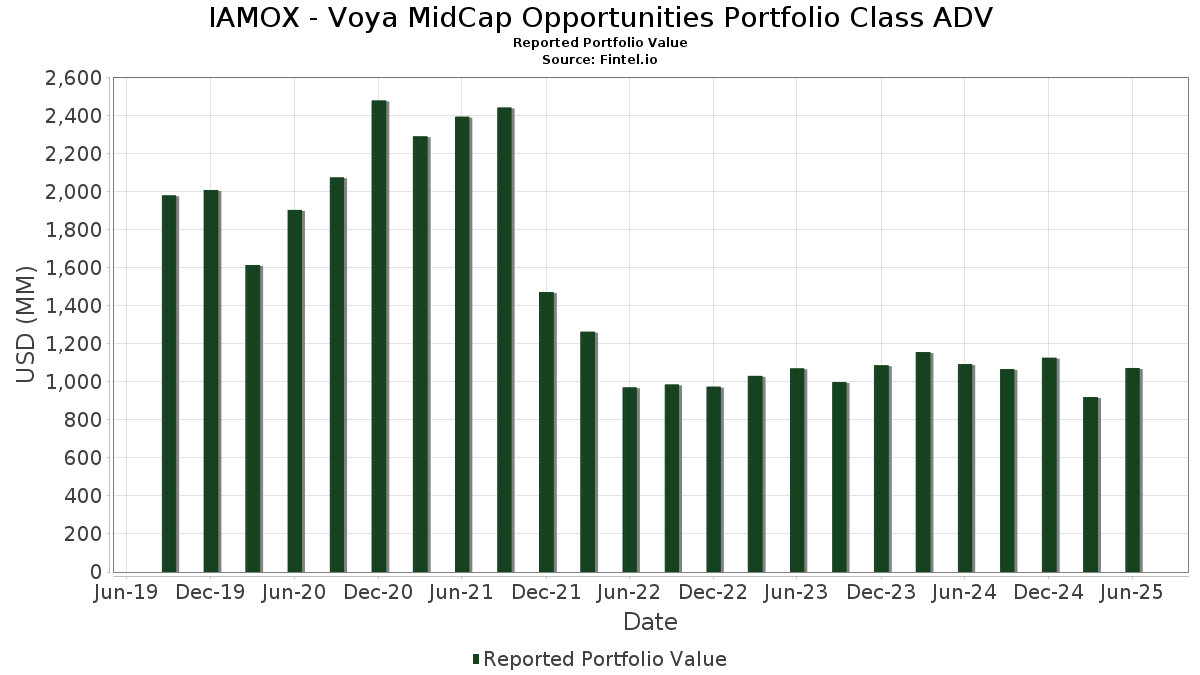

| Nilai Portfolio | $ 1,072,151,756 |

| Kedudukan Semasa | 93 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

IAMOX - Voya MidCap Opportunities Portfolio Class ADV telah mendedahkan 93 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,072,151,756 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas IAMOX - Voya MidCap Opportunities Portfolio Class ADV ialah Royal Caribbean Cruises Ltd. (US:RCL) , Cencora, Inc. (US:COR) , Howmet Aerospace Inc. (US:HWM) , Roblox Corporation (US:RBLX) , and Verisk Analytics, Inc. (US:VRSK) . Kedudukan baharu IAMOX - Voya MidCap Opportunities Portfolio Class ADV termasuk Cloudflare, Inc. (US:NET) , DraftKings Inc. (US:DKNG) , Johnson Controls International plc (DE:TYIA) , Tapestry, Inc. (US:TPR) , and Coupang, Inc. (US:CPNG) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.13 | 40.64 | 3.8723 | 2.1577 | |

| 0.04 | 21.26 | 2.0253 | 2.0253 | |

| 0.02 | 19.29 | 1.8383 | 1.8383 | |

| 0.14 | 26.38 | 2.5135 | 1.8277 | |

| 0.17 | 31.93 | 3.0429 | 1.6712 | |

| 0.08 | 16.53 | 1.5756 | 1.5756 | |

| 0.06 | 16.50 | 1.5723 | 1.5723 | |

| 0.30 | 31.46 | 2.9975 | 1.4157 | |

| 0.34 | 14.42 | 1.3743 | 1.3743 | |

| 0.13 | 13.56 | 1.2923 | 1.2923 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -6.2499 | ||

| 0.02 | 7.12 | 0.6784 | -2.9847 | |

| 0.13 | 18.84 | 1.7953 | -1.5188 | |

| 0.24 | 5.06 | 0.4817 | -1.0863 | |

| 0.05 | 10.71 | 1.0210 | -1.0681 | |

| 0.02 | 5.01 | 0.4775 | -0.8378 | |

| 0.10 | 12.18 | 1.1601 | -0.8347 | |

| 0.04 | 15.46 | 1.4735 | -0.8080 | |

| 0.98 | 18.83 | 1.7945 | -0.8043 | |

| 0.09 | 6.56 | 0.6252 | -0.7054 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-26 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| RCL / Royal Caribbean Cruises Ltd. | 0.13 | 69.47 | 40.64 | 158.33 | 3.8723 | 2.1577 | |||

| COR / Cencora, Inc. | 0.12 | 5.83 | 35.92 | 14.11 | 3.4230 | -0.0080 | |||

| HWM / Howmet Aerospace Inc. | 0.17 | -37.62 | 31.93 | 114.52 | 3.0429 | 1.6712 | |||

| RBLX / Roblox Corporation | 0.30 | 20.10 | 31.46 | 116.75 | 2.9975 | 1.4157 | |||

| VRSK / Verisk Analytics, Inc. | 0.09 | -0.71 | 28.61 | 3.92 | 2.7264 | -0.2745 | |||

| AXON / Axon Enterprise, Inc. | 0.03 | -9.81 | 26.99 | 41.98 | 2.5719 | 0.5000 | |||

| VST / Vistra Corp. | 0.14 | 154.01 | 26.38 | 319.23 | 2.5135 | 1.8277 | |||

| FIX / Comfort Systems USA, Inc. | 0.05 | 13.93 | 24.76 | 89.53 | 2.3596 | 0.9355 | |||

| DDOG / Datadog, Inc. | 0.16 | -12.70 | 22.01 | 18.21 | 2.0972 | 0.0679 | |||

| FICO / Fair Isaac Corporation | 0.01 | 13.12 | 21.83 | 12.13 | 2.0799 | -0.0418 | |||

| MPWR / Monolithic Power Systems, Inc. | 0.03 | -0.04 | 21.28 | 26.05 | 2.0281 | 0.1879 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.04 | 21.26 | 2.0253 | 2.0253 | |||||

| ALC / Alcon Inc. | 0.22 | 14.79 | 19.43 | 6.75 | 1.8515 | -0.1323 | |||

| GWW / W.W. Grainger, Inc. | 0.02 | 19.29 | 1.8383 | 1.8383 | |||||

| TW / Tradeweb Markets Inc. | 0.13 | -37.17 | 18.84 | -38.04 | 1.7953 | -1.5188 | |||

| OWL / Blue Owl Capital Inc. | 0.98 | -17.61 | 18.83 | -21.02 | 1.7945 | -0.8043 | |||

| TSCO / Tractor Supply Company | 0.35 | 4.29 | 18.51 | -0.12 | 1.7636 | -0.2560 | |||

| MSCI / MSCI Inc. | 0.03 | 19.21 | 16.63 | 21.58 | 1.5848 | 0.0939 | |||

| ALNY / Alnylam Pharmaceuticals, Inc. | 0.05 | 56.05 | 16.62 | 187.32 | 1.5834 | 1.0075 | |||

| NET / Cloudflare, Inc. | 0.08 | 16.53 | 1.5756 | 1.5756 | |||||

| HLT / Hilton Worldwide Holdings Inc. | 0.06 | 16.50 | 1.5723 | 1.5723 | |||||

| TXRH / Texas Roadhouse, Inc. | 0.08 | -0.71 | 15.93 | 11.67 | 1.5175 | -0.0368 | |||

| WELL / Welltower Inc. | 0.10 | -14.97 | 15.69 | -14.68 | 1.4947 | -0.5090 | |||

| DPZ / Domino's Pizza, Inc. | 0.03 | -0.71 | 15.65 | -2.63 | 1.4916 | -0.2605 | |||

| WAT / Waters Corporation | 0.04 | -22.00 | 15.46 | -26.13 | 1.4735 | -0.8080 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.06 | 8.10 | 15.24 | 70.75 | 1.4525 | 0.7089 | |||

| KTOS / Kratos Defense & Security Solutions, Inc. | 0.32 | -9.74 | 14.79 | 41.22 | 1.4091 | 0.2678 | |||

| DKNG / DraftKings Inc. | 0.34 | 14.42 | 1.3743 | 1.3743 | |||||

| WING / Wingstop Inc. | 0.04 | -20.13 | 14.35 | 19.23 | 1.3675 | 0.0557 | |||

| CH1134540470 / On Holding AG | 0.27 | 22.16 | 13.85 | 44.77 | 1.3198 | 0.2771 | |||

| TYIA / Johnson Controls International plc | 0.13 | 13.56 | 1.2923 | 1.2923 | |||||

| SLM / SLM Corporation | 0.40 | -0.71 | 13.26 | 10.85 | 1.2636 | -0.0402 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.03 | -0.72 | 12.87 | 43.42 | 1.2263 | 0.2483 | |||

| HUBS / HubSpot, Inc. | 0.02 | -0.71 | 12.76 | -3.26 | 1.2158 | -0.2217 | |||

| TPR / Tapestry, Inc. | 0.14 | 12.25 | 1.1677 | 1.1677 | |||||

| EXE / Expand Energy Corporation | 0.10 | -36.68 | 12.18 | -33.48 | 1.1601 | -0.8347 | |||

| LAZ / Lazard, Inc. | 0.25 | -19.62 | 11.92 | -10.93 | 1.1356 | -0.3227 | |||

| VRT / Vertiv Holdings Co | 0.09 | 18.93 | 11.83 | 111.52 | 1.1271 | 0.5176 | |||

| HOOD / Robinhood Markets, Inc. | 0.13 | 15.25 | 11.72 | 159.26 | 1.1164 | 0.6239 | |||

| SN / SharkNinja, Inc. | 0.12 | 10.88 | 11.57 | 31.60 | 1.1029 | 0.1443 | |||

| TRGP / Targa Resources Corp. | 0.06 | -0.71 | 11.10 | -13.79 | 1.0573 | -0.3453 | |||

| BURL / Burlington Stores, Inc. | 0.05 | -42.74 | 10.71 | -44.10 | 1.0210 | -1.0681 | |||

| TTD / The Trade Desk, Inc. | 0.15 | -35.83 | 10.69 | -15.57 | 1.0184 | -0.3612 | |||

| CPNG / Coupang, Inc. | 0.35 | 10.62 | 1.0120 | 1.0120 | |||||

| 7PV / Birkenstock Holding plc | 0.21 | -0.71 | 10.53 | 6.50 | 1.0036 | -0.0743 | |||

| GDDY / GoDaddy Inc. | 0.06 | -54.94 | 10.53 | 42.08 | 1.0030 | 0.5212 | |||

| VEEV / Veeva Systems Inc. | 0.04 | -0.13 | 10.50 | 12.58 | 1.0006 | 0.3366 | |||

| SNOW / Snowflake Inc. | 0.05 | 10.48 | 0.9983 | 0.9983 | |||||

| TDG / TransDigm Group Incorporated | 0.01 | 10.12 | 10.26 | 21.06 | 0.9778 | 0.0539 | |||

| AJG / Arthur J. Gallagher & Co. | 0.03 | -26.52 | 9.82 | -31.86 | 0.9361 | -0.6353 | |||

| 6B6 / monday.com Ltd. | 0.03 | -38.51 | 8.76 | -20.48 | 0.8346 | -0.3659 | |||

| FTI / TechnipFMC plc | 0.25 | -33.72 | 8.49 | -27.97 | 0.8091 | -0.4756 | |||

| CORZ / Core Scientific, Inc. | 0.47 | 8.01 | 0.7635 | 0.7635 | |||||

| AIT / Applied Industrial Technologies, Inc. | 0.03 | -0.71 | 8.00 | 2.42 | 0.7619 | -0.0890 | |||

| CVNA / Carvana Co. | 0.02 | 7.94 | 0.7563 | 0.7563 | |||||

| BLDR / Builders FirstSource, Inc. | 0.07 | -13.43 | 7.79 | -19.15 | 0.7425 | -0.3079 | |||

| DRS / Leonardo DRS, Inc. | 0.16 | 7.55 | 0.7192 | 0.7192 | |||||

| TREX / Trex Company, Inc. | 0.13 | -17.11 | 7.28 | -22.42 | 0.6935 | -0.3290 | |||

| APP / AppLovin Corporation | 0.02 | -83.97 | 7.12 | -78.82 | 0.6784 | -2.9847 | |||

| ELF / e.l.f. Beauty, Inc. | 0.06 | 7.01 | 0.6682 | 0.6682 | |||||

| TEAM / Atlassian Corporation | 0.03 | -34.29 | 6.91 | -37.11 | 0.6588 | -0.5394 | |||

| DGX / Quest Diagnostics Incorporated | 0.04 | 6.78 | 0.6457 | 0.6457 | |||||

| MKC / McCormick & Company, Incorporated | 0.09 | -41.66 | 6.56 | -46.26 | 0.6252 | -0.7054 | |||

| WSM / Williams-Sonoma, Inc. | 0.04 | 6.33 | 0.6035 | 0.6035 | |||||

| SITM / SiTime Corporation | 0.03 | -0.71 | 6.29 | 38.40 | 0.5996 | 0.1041 | |||

| ALAB / Astera Labs, Inc. | 0.07 | -0.71 | 6.19 | 50.46 | 0.5901 | 0.1415 | |||

| DOCU / DocuSign, Inc. | 0.08 | -0.71 | 5.92 | -4.99 | 0.5645 | -0.1151 | |||

| RMBS / Rambus Inc. | 0.09 | -0.71 | 5.67 | 22.79 | 0.5407 | 0.0369 | |||

| BXP / Boston Properties, Inc. | 0.08 | -0.71 | 5.65 | -0.30 | 0.5382 | -0.0792 | |||

| MLTX / MoonLake Immunotherapeutics | 0.12 | -42.23 | 5.58 | -30.21 | 0.5317 | -0.3397 | |||

| RGEN / Repligen Corporation | 0.04 | -29.05 | 5.35 | -30.64 | 0.5101 | -0.3311 | |||

| KVYO / Klaviyo, Inc. | 0.16 | -9.02 | 5.21 | 0.97 | 0.4966 | -0.0660 | |||

| MTD / Mettler-Toledo International Inc. | 0.00 | -51.46 | 5.12 | -51.72 | 0.4881 | -0.6681 | |||

| KVUE / Kenvue Inc. | 0.24 | -59.74 | 5.06 | -64.86 | 0.4817 | -1.0863 | |||

| VMC / Vulcan Materials Company | 0.02 | -62.86 | 5.01 | -58.48 | 0.4775 | -0.8378 | |||

| TOST / Toast, Inc. | 0.11 | 5.00 | 0.4765 | 0.4765 | |||||

| DUOL / Duolingo, Inc. | 0.01 | 4.95 | 0.4717 | 0.4717 | |||||

| CHD / Church & Dwight Co., Inc. | 0.05 | -0.71 | 4.88 | -13.33 | 0.4648 | -0.1486 | |||

| VERA / Vera Therapeutics, Inc. | 0.19 | -16.27 | 4.37 | -17.87 | 0.4160 | -0.1634 | |||

| IT / Gartner, Inc. | 0.01 | -55.05 | 4.32 | -56.72 | 0.4120 | -0.6766 | |||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 4.09 | -58.97 | 4.09 | -58.97 | 0.3901 | -0.6974 | |||

| SMCI / Super Micro Computer, Inc. | 0.08 | 3.85 | 0.3669 | 0.3669 | |||||

| VKTX / Viking Therapeutics, Inc. | 0.14 | -0.71 | 3.76 | 8.92 | 0.3584 | -0.0179 | |||

| COIN / Coinbase Global, Inc. | 0.01 | -67.28 | 2.88 | -33.42 | 0.2748 | -0.1972 | |||

| STATE OF WISCONSIN INVESTMENT BOARD / RA (000000000) | 2.67 | 0.2541 | 0.2541 | ||||||

| DAIWA CAPITAL MARKETS AMERICA INC / RA (000000000) | 2.30 | 0.2194 | 0.2194 | ||||||

| CANTOR FITZGERALD SECURITIES / RA (000000000) | 2.18 | 0.2079 | 0.2079 | ||||||

| HSBC SECURITIES (USA) INC / RA (000000000) | 1.44 | 0.1372 | 0.1372 | ||||||

| MIZUHO BANK LTD (NEW YORK BRANCH) / DBT (000000000) | 0.22 | 0.0210 | 0.0210 | ||||||

| ROYAL BANK OF CANADA (TORONTO BRANCH) / DBT (000000000) | 0.22 | 0.0210 | 0.0210 | ||||||

| CANADIAN IMPERIAL BANK OF COMMERCE (TORONTO BRANCH) / DBT (000000000) | 0.22 | 0.0210 | 0.0210 | ||||||

| LANDESBANK HESSEN THUERINGEN GIROZENTRALE(NEW YORK BRANCH) / DBT (000000000) | 0.21 | 0.0200 | 0.0200 | ||||||

| BNP PARIBAS SA / RA (000000000) | 0.17 | 0.0166 | 0.0166 | ||||||

| PLTR / Palantir Technologies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -6.2499 |