Statistik Asas

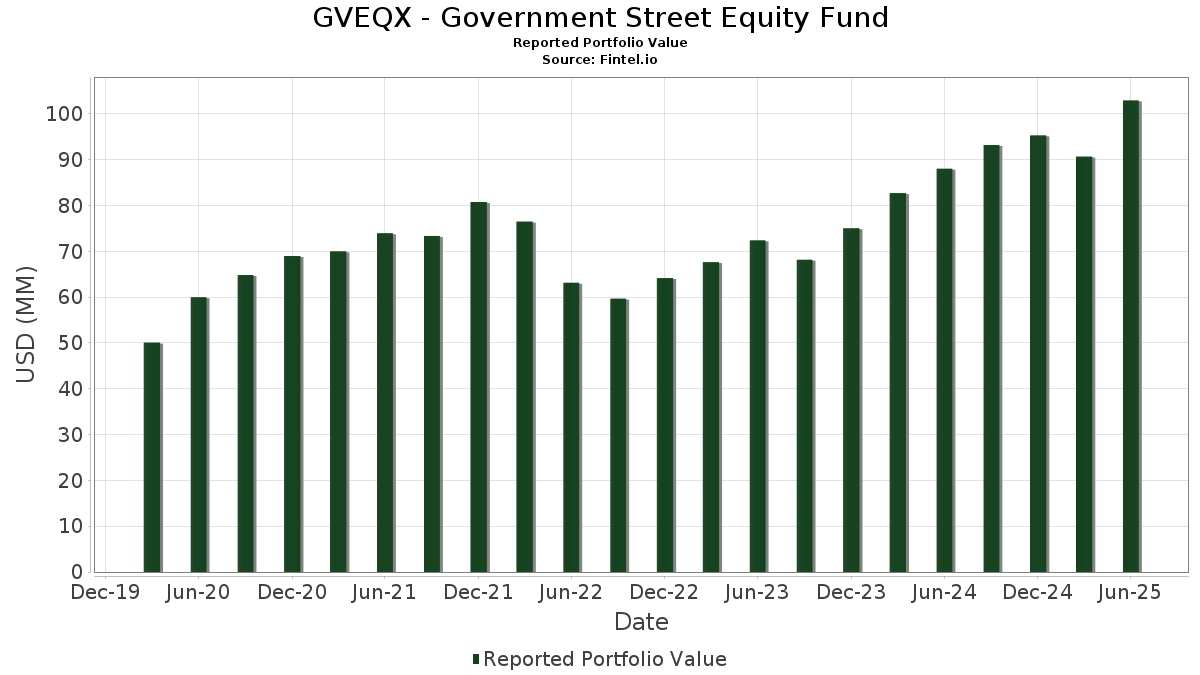

| Nilai Portfolio | $ 102,923,007 |

| Kedudukan Semasa | 81 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

GVEQX - Government Street Equity Fund telah mendedahkan 81 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 102,923,007 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas GVEQX - Government Street Equity Fund ialah NVIDIA Corporation (US:NVDA) , JPMorgan Chase & Co. (US:JPM) , Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I (US:FIGXX) , Microsoft Corporation (US:MSFT) , and Walmart Inc. (US:WMT) . Kedudukan baharu GVEQX - Government Street Equity Fund termasuk Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I (US:FIGXX) , Listed Funds Trust - Roundhill Ball Metaverse ETF (US:METV) , Listed Funds Trust - Horizon Kinetics Inflation Beneficiaries ETF (US:INFL) , The Bank of New York Mellon Corporation (US:BK) , and Broadcom Inc. (US:AVGO) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 16.19 | 15.9587 | 3.6878 | |

| 0.13 | 2.21 | 2.1817 | 2.1817 | |

| 0.03 | 1.05 | 1.0389 | 1.0389 | |

| 0.01 | 4.23 | 4.1666 | 0.6420 | |

| 0.00 | 1.03 | 1.0146 | 0.3956 | |

| 0.00 | 1.51 | 1.4903 | 0.3673 | |

| 0.00 | 0.36 | 0.3591 | 0.3591 | |

| 0.00 | 0.68 | 0.6679 | 0.3590 | |

| 0.00 | 2.36 | 2.3276 | 0.2903 | |

| 0.02 | 5.65 | 5.5711 | 0.2874 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 2.18 | 2.1492 | -1.9457 | |

| 4.41 | 4.3482 | -1.4785 | ||

| 0.01 | 2.13 | 2.1036 | -0.5579 | |

| 0.00 | 0.20 | 0.1951 | -0.5080 | |

| 0.01 | 2.40 | 2.3656 | -0.5051 | |

| 0.01 | 1.50 | 1.4741 | -0.4559 | |

| 0.01 | 1.33 | 1.3127 | -0.3532 | |

| 0.00 | 1.16 | 1.1410 | -0.3393 | |

| 0.02 | 1.08 | 1.0648 | -0.2953 | |

| 0.01 | 1.46 | 1.4396 | -0.2856 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-18 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.10 | 0.00 | 16.19 | 45.78 | 15.9587 | 3.6878 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | 0.00 | 5.65 | 18.19 | 5.5711 | 0.2874 | |||

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 4.41 | -16.34 | 4.3482 | -1.4785 | |||||

| MSFT / Microsoft Corporation | 0.01 | 0.00 | 4.23 | 32.51 | 4.1666 | 0.6420 | |||

| WMT / Walmart Inc. | 0.03 | 0.00 | 2.69 | 11.35 | 2.6499 | -0.0169 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 1.69 | 2.63 | 17.24 | 2.5944 | 0.1145 | |||

| AAPL / Apple Inc. | 0.01 | 0.00 | 2.40 | -7.62 | 2.3656 | -0.5051 | |||

| GOOG / Alphabet Inc. | 0.01 | 0.00 | 2.37 | 13.53 | 2.3320 | 0.0299 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 2.36 | 28.04 | 2.3276 | 0.2903 | |||

| METV / Listed Funds Trust - Roundhill Ball Metaverse ETF | 0.13 | 2.21 | 2.1817 | 2.1817 | |||||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.01 | -43.93 | 2.18 | -41.19 | 2.1492 | -1.9457 | |||

| ABBV / AbbVie Inc. | 0.01 | 0.00 | 2.13 | -11.42 | 2.1036 | -0.5579 | |||

| RTX / RTX Corporation | 0.01 | 0.00 | 2.04 | 10.25 | 2.0146 | -0.0338 | |||

| V / Visa Inc. | 0.01 | 0.00 | 1.78 | 1.31 | 1.7495 | -0.1861 | |||

| BN / Brookfield Corporation | 0.03 | 0.00 | 1.67 | 17.95 | 1.6457 | 0.0826 | |||

| TEL / TE Connectivity plc | 0.01 | 0.00 | 1.52 | 19.43 | 1.4960 | 0.0911 | |||

| PWR / Quanta Services, Inc. | 0.00 | 0.00 | 1.51 | 48.82 | 1.4903 | 0.3673 | |||

| BX / Blackstone Inc. | 0.01 | -20.00 | 1.50 | -14.42 | 1.4741 | -0.4559 | |||

| AFL / Aflac Incorporated | 0.01 | 0.00 | 1.48 | -5.14 | 1.4550 | -0.2645 | |||

| MCD / McDonald's Corporation | 0.01 | 0.00 | 1.46 | -6.47 | 1.4396 | -0.2856 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.00 | 1.45 | 25.72 | 1.4263 | 0.1541 | |||

| HON / Honeywell International Inc. | 0.01 | 0.00 | 1.40 | 10.00 | 1.3770 | -0.0264 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.01 | 0.00 | 1.33 | -11.67 | 1.3127 | -0.3532 | |||

| ABT / Abbott Laboratories | 0.01 | 0.00 | 1.29 | 2.54 | 1.2733 | -0.1187 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -16.67 | 1.16 | -13.66 | 1.1410 | -0.3393 | |||

| WEC / WEC Energy Group, Inc. | 0.01 | 0.00 | 1.15 | -4.34 | 1.1295 | -0.1946 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 1.12 | 2.46 | 1.1076 | -0.1034 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 1.10 | 0.00 | 1.0839 | -0.1305 | |||

| FCX / Freeport-McMoRan Inc. | 0.03 | 0.00 | 1.08 | 14.48 | 1.0680 | 0.0225 | |||

| TECH / Bio-Techne Corporation | 0.02 | 0.00 | 1.08 | -12.27 | 1.0648 | -0.2953 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 0.00 | 1.08 | 15.52 | 1.0639 | 0.0318 | |||

| GD / General Dynamics Corporation | 0.00 | 0.00 | 1.08 | 7.04 | 1.0635 | -0.0506 | |||

| INFL / Listed Funds Trust - Horizon Kinetics Inflation Beneficiaries ETF | 0.03 | 1.05 | 1.0389 | 1.0389 | |||||

| ACN / Accenture plc | 0.00 | 0.00 | 1.05 | -4.21 | 1.0309 | -0.1755 | |||

| GE / General Electric Company | 0.00 | 42.86 | 1.03 | 83.75 | 1.0146 | 0.3956 | |||

| GOOGL / Alphabet Inc. | 0.01 | 0.00 | 1.00 | 13.96 | 0.9899 | 0.0163 | |||

| LNG / Cheniere Energy, Inc. | 0.00 | 0.00 | 0.97 | 5.30 | 0.9599 | -0.0625 | |||

| CME / CME Group Inc. | 0.00 | 0.00 | 0.96 | 3.88 | 0.9507 | -0.0750 | |||

| ARES / Ares Management Corporation | 0.01 | 0.00 | 0.95 | 18.11 | 0.9388 | 0.0481 | |||

| PH / Parker-Hannifin Corporation | 0.00 | 0.00 | 0.91 | 14.94 | 0.8948 | 0.0220 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 17.65 | 0.80 | 42.27 | 0.7897 | 0.1676 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.78 | -8.80 | 0.7659 | -0.1753 | |||

| PSX / Phillips 66 | 0.01 | 0.00 | 0.76 | -3.42 | 0.7524 | -0.1205 | |||

| OKE / ONEOK, Inc. | 0.01 | 0.00 | 0.76 | -17.67 | 0.7441 | -0.2697 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.75 | 31.40 | 0.7388 | 0.1082 | |||

| PLTR / Palantir Technologies Inc. | 0.01 | 0.00 | 0.68 | 61.37 | 0.6717 | 0.2056 | |||

| ORCL / Oracle Corporation | 0.00 | 55.00 | 0.68 | 142.65 | 0.6679 | 0.3590 | |||

| PG / The Procter & Gamble Company | 0.00 | 0.00 | 0.64 | -6.46 | 0.6280 | -0.1250 | |||

| LLY / Eli Lilly and Company | 0.00 | 33.33 | 0.62 | 25.86 | 0.6146 | 0.0672 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | 0.00 | 0.62 | -8.11 | 0.6142 | -0.1355 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 0.62 | 18.58 | 0.6100 | 0.0332 | |||

| EMR / Emerson Electric Co. | 0.00 | 0.00 | 0.60 | 21.50 | 0.5913 | 0.0463 | |||

| KMI / Kinder Morgan, Inc. | 0.02 | 0.00 | 0.59 | 3.16 | 0.5795 | -0.0508 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.00 | 0.55 | -4.97 | 0.5466 | -0.0974 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.00 | 0.00 | 0.55 | -10.49 | 0.5387 | -0.1352 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.00 | 0.54 | 22.73 | 0.5322 | 0.0455 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 16.67 | 0.50 | 51.38 | 0.4882 | 0.1262 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.01 | 0.00 | 0.48 | -8.21 | 0.4745 | -0.1050 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.00 | 0.48 | 3.70 | 0.4708 | -0.0382 | |||

| LIN / Linde plc | 0.00 | 25.00 | 0.47 | 26.08 | 0.4624 | 0.0509 | |||

| CEG / Constellation Energy Corporation | 0.00 | 16.67 | 0.45 | 87.14 | 0.4453 | 0.1780 | |||

| UBER / Uber Technologies, Inc. | 0.00 | 0.00 | 0.37 | 28.18 | 0.3678 | 0.0459 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 0.00 | 0.36 | -18.57 | 0.3596 | -0.1351 | |||

| BK / The Bank of New York Mellon Corporation | 0.00 | 0.36 | 0.3591 | 0.3591 | |||||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.36 | 51.71 | 0.3507 | 0.0911 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 25.00 | 0.31 | 50.00 | 0.3025 | 0.0763 | |||

| DLR / Digital Realty Trust, Inc. | 0.00 | 0.00 | 0.31 | 22.00 | 0.3006 | 0.0237 | |||

| CCJ / Cameco Corporation | 0.00 | 0.00 | 0.30 | 80.49 | 0.2926 | 0.1107 | |||

| NVR / NVR, Inc. | 0.00 | 0.00 | 0.30 | 2.08 | 0.2911 | -0.0290 | |||

| APO / Apollo Global Management, Inc. | 0.00 | 100.00 | 0.28 | 108.09 | 0.2796 | 0.1284 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.28 | 0.2716 | 0.2716 | |||||

| ICE / Intercontinental Exchange, Inc. | 0.00 | 0.00 | 0.28 | 6.59 | 0.2712 | -0.0146 | |||

| ACGL / Arch Capital Group Ltd. | 0.00 | 0.00 | 0.27 | -5.21 | 0.2692 | -0.0495 | |||

| TSCO / Tractor Supply Company | 0.01 | 0.00 | 0.26 | -4.36 | 0.2600 | -0.0443 | |||

| KO / The Coca-Cola Company | 0.00 | 0.00 | 0.25 | -1.20 | 0.2440 | -0.0329 | |||

| CPNG / Coupang, Inc. | 0.01 | 60.00 | 0.24 | 119.27 | 0.2362 | 0.1151 | |||

| COST / Costco Wholesale Corporation | 0.00 | -80.00 | 0.20 | -65.26 | 0.1951 | -0.5080 | |||

| CRSP / CRISPR Therapeutics AG | 0.00 | 60.00 | 0.19 | 128.24 | 0.1917 | 0.0978 | |||

| AVAV / AeroVironment, Inc. | 0.00 | 0.17 | 0.1685 | 0.1685 | |||||

| NUE / Nucor Corporation | 0.00 | 0.00 | 0.13 | 7.50 | 0.1277 | -0.0053 | |||

| SHW / The Sherwin-Williams Company | 0.00 | 0.00 | 0.12 | -1.64 | 0.1184 | -0.0166 |