Pengenalan

Halaman ini menyediakan analisis menyeluruh tentang sejarah dagangan orang dalam yang diketahui Jesse G Singh. Orang dalam ialah pegawai, pengarah atau pelabur penting dalam syarikat. Adalah haram bagi orang dalam untuk membuat perdagangan dalam syarikat mereka berdasarkan maklumat khusus bukan awam. Ini tidak bermakna haram bagi mereka untuk membuat sebarang perdagangan dalam syarikat mereka sendiri. Tetapi mereka mesti melaporkan semua perdagangan kepada SEC melalui Borang 4. Walaupun terdapat sekatan ini, penyelidikan akademik menunjukkan bahawa orang dalam - secara amnya - cenderung untuk mengatasi prestasi pasaran dalam syarikat mereka sendiri.

Purata Keuntungan Perdagangan

Purata keuntungan perdagangan ialah purata pulangan semua pembelian pasaran terbuka yang dibuat oleh orang dalam dalam tempoh tiga tahun terakhir. Untuk mengira ini, kami memeriksa setiap pembelian pasaran terbuka yang tidak dirancang oleh orang dalam, tidak termasuk semua dagangan yang ditandakan sebagai sebahagian daripada pelan dagangan 10b5-1. Kami kemudian mengira prestasi purata dagangan tersebut sepanjang 3, 6 dan 12 bulan, dengan purata setiap tempoh tersebut untuk menjana metrik prestasi akhir bagi setiap dagangan. Akhir sekali, kami puratakan semua metrik prestasi untuk mengira metrik prestasi untuk orang dalam. Senarai ini hanya termasuk orang dalam yang telah membuat sekurang-kurangnya tiga dagangan dalam dua tahun lepas.

Jika keuntungan berdagang orang dalam ini ialah "N/A", maka orang dalam sama ada tidak membuat sebarang pembelian pasaran terbuka dalam tempoh tiga tahun terakhir, atau dagangan yang mereka buat adalah terlalu baru untuk mengira metrik prestasi yang boleh dipercayai.

Kekerapan Kemas Kini: Harian

Syarikat dengan Kedudukan Orang Dalam yang Dilaporkan

Pemfailan SEC menunjukkan Jesse G Singh telah melaporkan pegangan atau perdagangan dalam syarikat berikut:

| Sekuriti | Tajuk | Pegangan Terkini Dilaporkan |

|---|---|---|

| US:AZEK / The AZEK Company Inc. | CEO and President, Director | 0 |

| US:CSL / Carlisle Companies Incorporated | Director | 4,177 |

| US:MMM / 3M Company | Senior Vice President | 0 |

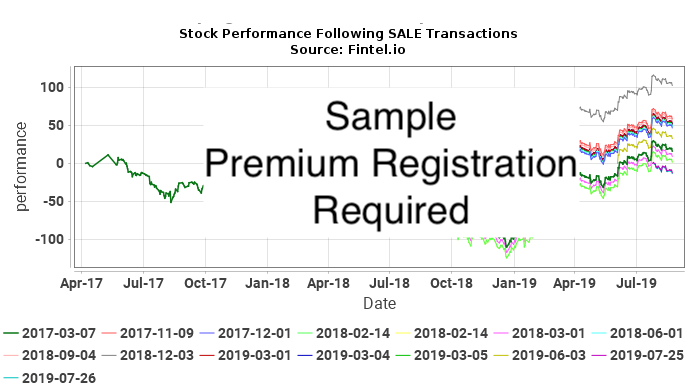

Bagaimana Mentafsir Carta

Carta berikut menunjukkan prestasi saham sekuriti selepas setiap dagangan pasaran terbuka dan tidak dirancang yang dibuat oleh Jesse G Singh. Perdagangan tidak dirancang ialah dagangan yang tidak dibuat sebagai sebahagian daripada pelan dagangan 10b5-1. Prestasi saham dicatatkan sebagai perubahan peratus kumulatif dalam harga saham. Sebagai contoh, jika perdagangan orang dalam dibuat pada 1 Januari 2019, carta akan menunjukkan perubahan peratusan harian sekuriti kepada hari ini. Jika harga saham naik dari $10 kepada $15 pada masa ini, perubahan peratus terkumpul dalam harga saham ialah 50%. Perubahan dalam harga daripada $10 kepada $20 ialah 100% dan perubahan dalam harga $10 hingga $5 ialah -50%.

Secara dasarnya, kami cuba untuk menentukan sejauh mana dagangan orang dalam berkait rapat dengan pulangan berlebihan (positif atau negatif) dalam harga saham untuk melihat sama ada orang dalam menetapkan masa dagangan mereka untuk mendapat keuntungan daripada maklumat orang dalam. Pertimbangkan situasi di mana orang dalam melakukan perkara ini. Dalam keadaan ini, kami menjangkakan sama ada (a) pulangan positif selepas pembelian, atau (b) pulangan negatif selepas jualan. Dalam kes (a), carta PEMBELIAN akan menunjukkan satu siri keluk condong ke atas, menunjukkan pulangan positif selepas setiap transaksi pembelian. Dalam kes (b), carta JUALAN akan menunjukkan satu siri keluk condong ke bawah, menunjukkan pulangan negatif selepas setiap transaksi jualan.

Walau bagaimanapun, ini sahaja tidak cukup untuk membuat kesimpulan. Jika, sebagai contoh, harga saham syarikat berada dalam pendakian bukan disebabkan kitaran selama bertahun-tahun, maka kami menjangkakan semua plot selepas pembelian akan condong ke atas. Begitu juga, kemerosotan bukan disebabkan kitaran selama bertahun-tahun akan mengakibatkan plot pasca perdagangan condong ke bawah. Kedua-dua carta ini tidak akan mencadangkan aktiviti perdagangan orang dalam.

Penunjuk terkuat ialah keadaan di mana harga saham adalah sangat kitaran, dan terdapat kedua-dua isyarat positif dalam carta PEMBELIAN dan plot negatif pada carta JUALAN. Situasi ini akan sangat menunjukkan orang dalam yang menentukan masa perdagangan untuk kelebihan kewangan mereka.

Pembelian Orang Dalam CSL / Carlisle Companies Incorporated - Analisis Keuntungan Jangka Pendek

Dalam bahagian ini, kami menganalisis keuntungan setiap pembelian orang dalam pasaran terbuka yang tidak dirancang yang dibuat dalam CSL / Carlisle Companies Incorporated. Analisis ini membantu untuk memahami sama ada orang dalam secara konsisten menjana pulangan tidak normal dan patut diikuti. Analisis ini adalah untuk satu tahun selepas setiap perdagangan, dan hasilnya adalah bersifat teori .

Jadual berikut menunjukkan pembelian pasaran terbuka terkini yang bukan sebahagian daripada pelan dagangan automatik.

| Tarikh Dagangan | Simbol Saham | Orang dalam | Saham Dilaporkan |

Harga Dilaporkan |

Saham Dilaraskan |

Harga Dilaraskan |

Asas Kos | Hari ke Maks |

Harga pada Maks |

Maks Keuntungan ($) |

Pulangan Maks (%) |

|---|---|---|---|---|---|---|---|

| Tiada dagangan pasaran terbuka tidak dirancang yang tidak diketahui untuk gabungan orang dalam dan sekuriti ini |

Harga Larasan ialah harga larasan berpecah. Saham Larasan ialah saham terlaras berpecah.

Jualan Orang Dalam CSL / Carlisle Companies Incorporated - Analisis Kerugian Jangka Pendek

Dalam bahagian ini, kami menganalisis pengelakan kerugian jangka pendek bagi setiap jualan dalaman pasaran terbuka yang tidak dirancang yang dibuat dalam CSL / Carlisle Companies Incorporated. Corak pengelakan kerugian yang konsisten mungkin mencadangkan bahawa urus niaga jualan masa hadapan mungkin meramalkan penurunan harga. Analisis ini adalah untuk satu tahun selepas setiap perdagangan, dan hasilnya adalah teori .

Jadual berikut menunjukkan jualan pasaran terbuka terkini yang bukan sebahagian daripada pelan dagangan automatik.

| Tarikh Dagangan | Simbol Saham | Orang dalam | Saham Dilaporkan |

Harga Dilaporkan |

Saham Dilaraskan |

Harga Dilaraskan |

Asas Kos | Hari ke Min |

Harga pada Min |

Kerugian Maks Dielakkan ($) |

Kerugian Maks Dielakkan (%) |

|---|---|---|---|---|---|---|---|

| Tiada dagangan pasaran terbuka tidak dirancang yang tidak diketahui untuk gabungan orang dalam dan sekuriti ini |

Harga Larasan ialah harga larasan berpecah. Saham Larasan ialah saham terlaras berpecah.

Sejarah Dagangan Orang Dalam

Jadual ini menunjukkan senarai lengkap dagangan orang dalam yang dibuat oleh Jesse G Singh seperti yang didedahkan kepada Suruhanjaya Bursa Sekuriti (SEC).

| Tarikh Fail | Tarikh Tran | Borang | Simbol Saham | Sekuriti | Kod | Saham | Baki Saham | Peratus Ubah |

Saham harga |

Tran Nilai |

Baki Nilai |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-02 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

D - Sale to Issuer | -100,000 | 0 | -100.00 | ||||

| 2025-07-02 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

D - Sale to Issuer | -232,705 | 0 | -100.00 | ||||

| 2025-07-02 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

D - Sale to Issuer | -234,793 | 0 | -100.00 | ||||

| 2025-07-02 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

D - Sale to Issuer | -9,476 | 0 | -100.00 | ||||

| 2025-07-02 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

D - Sale to Issuer | -112,207 | 0 | -100.00 | ||||

| 2025-07-02 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

D - Sale to Issuer | -832,765 | 0 | -100.00 | ||||

| 2025-06-11 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -20,000 | 832,765 | -2.35 | 54.43 | -1,088,600 | 45,327,399 | |

| 2025-05-14 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | 46,000 | 232,705 | 24.64 | ||||

| 2025-05-14 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | -46,000 | 0 | -100.00 | ||||

| 2025-05-14 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -20,000 | 852,765 | -2.29 | 51.40 | -1,028,000 | 43,832,121 | |

| 2025-04-30 |

|

4 | CSL |

CARLISLE COMPANIES INC

Common Stock |

A - Award | 462 | 4,177 | 12.44 | ||||

| 2025-04-11 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -16,579 | 843,765 | -1.93 | 46.56 | -771,918 | 39,285,698 | |

| 2025-04-11 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -8,421 | 860,344 | -0.97 | 45.89 | -386,440 | 39,481,186 | |

| 2025-03-11 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -4,091 | 868,765 | -0.47 | 41.74 | -170,758 | 36,262,251 |

| 2025-03-11 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -4,500 | 872,856 | -0.51 | 41.01 | -184,545 | 35,795,825 |

| 2025-03-11 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -6,409 | 877,356 | -0.73 | 40.59 | -260,141 | 35,611,880 |

| 2025-02-11 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -20,387 | 883,765 | -2.25 | 50.08 | -1,020,981 | 44,258,951 | |

| 2025-01-13 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -19,613 | 904,152 | -2.12 | 44.98 | -882,193 | 40,668,757 | |

| 2024-12-17 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -6,394 | 923,765 | -0.69 | 53.57 | -342,527 | 49,486,091 | |

| 2024-12-17 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -13,606 | 930,159 | -1.44 | 53.20 | -723,839 | 49,484,459 | |

| 2024-12-17 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

A - Award | 19,857 | 943,765 | 2.15 | ||||

| 2024-12-16 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

F - Taxes | -6,147 | 923,908 | -0.66 | 53.96 | -331,692 | 49,854,076 | |

| 2024-12-16 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

F - Taxes | -3,484 | 930,055 | -0.37 | 53.15 | -185,175 | 49,432,423 | |

| 2024-12-11 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

F - Taxes | -4,896 | 933,539 | -0.52 | 54.25 | -265,608 | 50,644,491 | |

| 2024-12-11 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

A - Award | 15,651 | 938,435 | 1.70 | ||||

| 2024-11-20 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

F - Taxes | -1,660 | 922,784 | -0.18 | 46.46 | -77,124 | 42,872,545 | |

| 2024-08-16 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -20,000 | 186,705 | -9.68 | 41.47 | -829,400 | 7,742,656 | |

| 2024-07-12 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -13,000 | 1,024,444 | -1.25 | 41.75 | -542,750 | 42,770,537 | |

| 2024-06-20 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -20,000 | 234,793 | -7.85 | 46.45 | -929,000 | 10,906,135 | |

| 2024-06-20 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -20,000 | 1,037,444 | -1.89 | 46.72 | -934,400 | 48,469,384 | |

| 2024-06-20 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -4,412 | 1,057,444 | -0.42 | 47.42 | -209,217 | 50,143,994 | |

| 2024-06-20 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -8,588 | 1,061,856 | -0.80 | 46.62 | -400,373 | 49,503,727 | |

| 2024-05-20 |

|

4/A | CSL |

CARLISLE COMPANIES INC

Common Stock |

A - Award | 451 | 3,715 | 13.82 | ||||

| 2024-05-10 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -6,866 | 1,070,444 | -0.64 | 46.14 | -316,797 | 49,390,286 | |

| 2024-05-10 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -6,134 | 1,077,310 | -0.57 | 45.77 | -280,753 | 49,308,479 | |

| 2024-05-01 |

|

4 | CSL |

CARLISLE COMPANIES INC

Common Stock |

A - Award | 438 | 3,702 | 13.42 | ||||

| 2024-04-12 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -7,089 | 1,083,444 | -0.65 | 48.55 | -344,171 | 52,601,206 | |

| 2024-04-12 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -5,911 | 1,090,533 | -0.54 | 48.01 | -283,787 | 52,356,489 | |

| 2024-03-12 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -13,000 | 1,096,444 | -1.17 | 47.76 | -620,880 | 52,366,165 | |

| 2024-03-04 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | 100,000 | 112,207 | 819.20 | ||||

| 2024-03-04 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | -100,000 | 1,109,444 | -8.27 | ||||

| 2024-02-28 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -25,000 | 12,207 | -67.19 | 48.03 | -1,200,750 | 586,302 | |

| 2024-02-14 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -40,000 | 37,207 | -51.81 | 44.50 | -1,780,000 | 1,655,712 | |

| 2024-02-14 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -13,000 | 1,184,444 | -1.09 | 45.34 | -589,420 | 53,702,691 |

| 2024-01-10 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -13,000 | 1,227,444 | -1.05 | 37.23 | -483,990 | 45,697,740 |

| 2023-12-19 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | -8,300 | 1,240,444 | -0.66 | ||||

| 2023-12-19 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

A - Award | 23,592 | 1,248,744 | 1.93 | ||||

| 2023-12-13 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

F - Taxes | -6,266 | 1,225,152 | -0.51 | 35.30 | -221,190 | 43,247,866 | |

| 2023-12-13 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -25,000 | 9,476 | -72.51 | 34.77 | -869,250 | 329,481 | |

| 2023-12-13 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

F - Taxes | -23,499 | 1,231,418 | -1.87 | 34.73 | -816,120 | 42,767,147 | |

| 2023-12-13 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

A - Award | 57,715 | 1,254,917 | 4.82 | ||||

| 2023-12-13 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -13,000 | 1,197,202 | -1.07 | 34.79 | -452,270 | 41,650,658 |

| 2023-12-05 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

F - Taxes | -1,911 | 1,210,202 | -0.16 | 34.91 | -66,713 | 42,248,152 | |

| 2023-11-20 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

F - Taxes | -1,711 | 1,212,113 | -0.14 | 31.12 | -53,246 | 37,720,957 | |

| 2023-11-13 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -13,000 | 1,213,824 | -1.06 | 28.39 | -369,070 | 34,460,463 |

| 2023-10-11 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -13,000 | 1,226,824 | -1.05 | 28.49 | -370,370 | 34,952,216 |

| 2023-09-12 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -13,000 | 1,239,824 | -1.04 | 32.66 | -424,580 | 40,492,652 |

| 2023-09-08 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -30,000 | 206,705 | -12.67 | 32.86 | -985,800 | 6,792,326 | |

| 2023-09-08 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -30,000 | 70,000 | -30.00 | 33.32 | -999,600 | 2,332,400 | |

| 2023-08-14 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | 8,524 | 1,252,824 | 0.69 | ||||

| 2023-08-14 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | -8,524 | 34,476 | -19.82 | ||||

| 2023-05-09 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -40,000 | 1,244,300 | -3.11 | 25.34 | -1,013,600 | 31,530,562 | |

| 2023-05-03 |

|

4 | CSL |

CARLISLE COMPANIES INC

Common Stock |

A - Award | 755 | 3,264 | 30.09 | ||||

| 2023-03-21 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -7,000 | 43,000 | -14.00 | 21.95 | -153,650 | 943,850 | |

| 2023-03-21 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | 50,000 | 50,000 | |||||

| 2023-03-21 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | -50,000 | 1,284,300 | -3.75 | ||||

| 2023-03-16 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -13,000 | 254,793 | -4.85 | 22.72 | -295,360 | 5,788,897 | |

| 2023-03-16 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | -8,160 | 1,334,300 | -0.61 | ||||

| 2022-12-14 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

A - Award | 41,626 | 1,442,460 | 2.97 | ||||

| 2022-12-05 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

F - Taxes | -2,248 | 1,100,834 | -0.20 | 20.15 | -45,297 | 22,181,805 | |

| 2022-11-21 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

F - Taxes | -2,013 | 1,103,082 | -0.18 | 18.86 | -37,965 | 20,804,127 | |

| 2022-11-07 |

|

5 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | -3,555 | 1,105,095 | -0.32 | ||||

| 2022-11-07 |

|

5 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | 123,000 | 123,000 | |||||

| 2022-11-07 |

|

5 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | -123,000 | 177,000 | -41.00 | ||||

| 2022-05-04 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 65 | 65 | 266.00 | 17,290 | 17,290 | ||

| 2022-05-04 |

|

4 | CSL |

CARLISLE COMPANIES INC

Common Stock |

A - Award | 602 | 2,509 | 31.57 | ||||

| 2022-03-04 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

P - Purchase | 3,600 | 1,108,650 | 0.33 | 27.31 | 98,316 | 30,277,232 | |

| 2022-03-01 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 7 | 7 | |||||

| 2022-03-01 |

|

4 | CSL |

CARLISLE COMPANIES INC

Restriced Stock Units |

A - Award | 9 | 3,867 | 0.23 | ||||

| 2022-02-10 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 74 | 74 | 222.35 | 16,454 | 16,454 | ||

| 2021-12-08 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 67 | 67 | 242.99 | 16,280 | 16,280 | ||

| 2021-12-07 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

F - Taxes | -2,122 | 1,105,050 | -0.19 | 39.09 | -82,949 | 43,196,404 | |

| 2021-12-01 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 6 | 6 | |||||

| 2021-12-01 |

|

4 | CSL |

CARLISLE COMPANIES INC

Restriced Stock Units |

A - Award | 9 | 3,858 | 0.23 | ||||

| 2021-11-23 |

|

4 | AZEK |

AZEK Co Inc.

Non-qualified stock options (right-to-buy) |

A - Award | 42,373 | 42,373 | |||||

| 2021-11-23 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

A - Award | 16,987 | 1,107,172 | 1.56 | ||||

| 2021-11-15 |

|

5 | AZEK |

AZEK Co Inc.

Class A common stock |

G - Gift | 267,793 | 267,793 | |||||

| 2021-11-15 |

|

5 | AZEK |

AZEK Co Inc.

Class A common stock |

G - Gift | -267,793 | 77,207 | -77.62 | ||||

| 2021-11-15 |

|

5 | AZEK |

AZEK Co Inc.

Class A common stock |

G - Gift | 345,000 | 345,000 | |||||

| 2021-11-15 |

|

5 | AZEK |

AZEK Co Inc.

Class A common stock |

G - Gift | -345,000 | 1,090,185 | -24.04 | ||||

| 2021-09-08 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 288 | 288 | 204.38 | 58,861 | 58,861 | ||

| 2021-09-03 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -90,000 | 1,435,185 | -5.90 | 42.80 | -3,852,000 | 61,425,918 |

| 2021-09-01 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 6 | 6 | 209.15 | 1,255 | 1,255 | ||

| 2021-09-01 |

|

4 | CSL |

CARLISLE COMPANIES INC

Restriced Stock Units |

A - Award | 10 | 3,849 | 0.26 | ||||

| 2021-07-02 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -11,400 | 1,525,185 | -0.74 | 42.37 | -483,018 | 64,622,088 |

| 2021-07-02 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -38,600 | 1,536,585 | -2.45 | 41.53 | -1,603,058 | 63,814,375 |

| 2021-06-21 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -35,000 | 1,575,185 | -2.17 | 39.86 | -1,395,100 | 62,786,874 | |

| 2021-06-21 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -20,000 | 1,610,185 | -1.23 | 39.60 | -792,000 | 63,763,326 | |

| 2021-06-15 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -12,613 | 1,630,185 | -0.77 | 41.34 | -521,421 | 67,391,848 | |

| 2021-06-15 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -1,387 | 1,642,798 | -0.08 | 42.01 | -58,268 | 69,013,944 | |

| 2021-06-15 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -5,414 | 1,644,185 | -0.33 | 42.04 | -227,605 | 69,121,537 | |

| 2021-06-10 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -4,786 | 1,649,599 | -0.29 | 42.00 | -201,012 | 69,283,158 | |

| 2021-06-10 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -20,000 | 1,654,385 | -1.19 | 41.55 | -831,000 | 68,739,697 | |

| 2021-06-10 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -25,000 | 1,674,385 | -1.47 | 42.25 | -1,056,250 | 70,742,766 | |

| 2021-06-01 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 6 | 6 | 192.12 | 1,153 | 1,153 | ||

| 2021-06-01 |

|

4 | CSL |

CARLISLE COMPANIES INC

Restriced Stock Units |

A - Award | 10 | 3,839 | 0.26 | 192.12 | 1,921 | 737,549 | |

| 2021-05-07 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -20,000 | 1,699,385 | -1.16 | 50.64 | -1,012,800 | 86,056,856 |

| 2021-05-06 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 85 | 85 | 192.60 | 16,371 | 16,371 | ||

| 2021-05-06 |

|

4 | CSL |

CARLISLE COMPANIES INC

Common Stock |

A - Award | 701 | 1,907 | 58.13 | ||||

| 2021-05-05 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -55,000 | 1,719,385 | -3.10 | 49.27 | -2,709,850 | 84,714,099 |

| 2021-04-20 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -18,000 | 1,774,385 | -1.00 | 47.95 | -863,100 | 85,081,761 |

| 2021-04-15 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -2,000 | 1,792,385 | -0.11 | 47.92 | -95,840 | 85,891,089 |

| 2021-03-03 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | X | -55,000 | 2,244,385 | -2.39 | 44.86 | -2,467,300 | 100,683,111 |

| 2021-03-03 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | 150,000 | 236,705 | 173.00 | ||||

| 2021-03-03 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | -150,000 | 1,794,385 | -7.71 | ||||

| 2021-03-03 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | 300,000 | 300,000 | |||||

| 2021-03-03 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | -300,000 | 1,944,385 | -13.37 | ||||

| 2021-03-02 |

|

4 | CSL |

CARLISLE COMPANIES INC

Restriced Stock Units |

A - Award | 13 | 3,829 | 0.34 | 147.95 | 1,923 | 566,501 | |

| 2021-02-02 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 110 | 110 | 150.00 | 16,500 | 16,500 | ||

| 2020-12-18 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

G - Gift | -6,000 | 2,299,385 | -0.26 | ||||

| 2020-12-09 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 106 | 106 | 154.64 | 16,392 | 16,392 | ||

| 2020-12-08 |

|

4 | AZEK |

AZEK Co Inc.

Non-qualified stock options (right-to-buy) |

A - Award | 55,273 | 55,273 | |||||

| 2020-12-08 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

A - Award | 18,968 | 2,305,385 | 0.83 | ||||

| 2020-09-15 |

|

4 | AZEK |

AZEK Co Inc.

Class A Common Stock |

S - Sale | -276,000 | 2,286,417 | -10.77 | 33.25 | -9,177,000 | 76,023,365 | |

| 2020-09-11 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 474 | 474 | 124.30 | 58,918 | 58,918 | ||

| 2020-06-18 |

|

4 | AZEK |

AZEK Co Inc.

Nonqualified stock option (right to buy) |

A - Award | 162,409 | 162,409 | |||||

| 2020-06-18 |

|

4 | AZEK |

AZEK Co Inc.

Nonqualified stock option (right to buy) |

A - Award | 796,087 | 796,087 | |||||

| 2020-06-11 | 3 | AZEK |

AZEK Co Inc.

Class A common stock, par value $0.001 |

5,211,539 | ||||||||

| 2020-06-11 | 3 | AZEK |

AZEK Co Inc.

Class A common stock, par value $0.001 |

2,735,827 | ||||||||

| 2020-06-11 | 3 | AZEK |

AZEK Co Inc.

Class A common stock, par value $0.001 |

5,211,539 | ||||||||

| 2020-06-11 | 3 | AZEK |

AZEK Co Inc.

Class A common stock, par value $0.001 |

2,735,827 | ||||||||

| 2020-06-11 | 3 | AZEK |

AZEK Co Inc.

Class A common stock, par value $0.001 |

5,211,539 | ||||||||

| 2020-06-11 | 3 | AZEK |

AZEK Co Inc.

Class A common stock, par value $0.001 |

2,735,827 | ||||||||

| 2020-05-07 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 0 | 101 | 0.00 | 111.98 | 11,310 | ||

| 2020-05-07 |

|

4 | CSL |

CARLISLE COMPANIES INC

Common Stock |

A - Award | 1,206 | 1,206 | |||||

| 2020-02-05 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 101 | 101 | 160.00 | 16,160 | 16,160 | ||

| 2020-02-05 |

|

4 | CSL |

CARLISLE COMPANIES INC

Restriced Stock Units |

A - Award | 837 | 3,759 | 28.64 | ||||

| 2019-12-11 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 104 | 104 | 157.37 | 16,366 | 16,366 | ||

| 2019-09-11 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 399 | 399 | 147.76 | 58,956 | 58,956 | ||

| 2019-05-08 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 121 | 121 | 136.03 | 16,460 | 16,460 | ||

| 2019-02-07 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 146 | 146 | 112.36 | 16,405 | 16,405 | ||

| 2019-02-07 |

|

4 | CSL |

CARLISLE COMPANIES INC

Restriced Stock Units |

A - Award | 1,219 | 2,885 | 73.17 | ||||

| 2018-12-13 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 158 | 158 | 99.94 | 15,791 | 15,791 | ||

| 2018-09-13 |

|

4 | CSL |

CARLISLE COMPANIES INC

Deferred Stock Units |

A - Award | 437 | 437 | 127.72 | 55,814 | 55,814 | ||

| 2018-02-07 |

|

4 | CSL |

CARLISLE COMPANIES INC

Restriced Stock Units |

A - Award | 1,196 | 1,643 | 267.56 | ||||

| 2017-12-13 |

|

4 | CSL |

CARLISLE COMPANIES INC

Restriced Stock Units |

A - Award | 447 | 447 | |||||

| 2017-12-13 | 3 | CSL |

CARLISLE COMPANIES INC

Common Stock |

0 | ||||||||

| 2016-05-13 |

|

4 | MMM |

3M CO

Non-qualified Stock Option (Right to Buy) |

M - Exercise | -9,795 | 0 | -100.00 | ||||

| 2016-05-13 |

|

4 | MMM |

3M CO

Non-qualified Stock Option (Right to Buy) |

M - Exercise | -12,497 | 0 | -100.00 | ||||

| 2016-05-13 |

|

4 | MMM |

3M CO

Non-qualified Stock Option (Right to Buy) |

M - Exercise | -10,922 | 0 | -100.00 | ||||

| 2016-05-13 |

|

4 | MMM |

3M CO

Non-qualified Stock Option (Right to Buy) |

M - Exercise | -3,564 | 0 | -100.00 | ||||

| 2016-05-13 |

|

4 | MMM |

3M CO

Non-qualified Stock Option (Right to Buy) |

M - Exercise | -8,906 | 0 | -100.00 | ||||

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -300 | 4,575 | -6.15 | 170.03 | -51,009 | 777,887 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -2,600 | 4,875 | -34.78 | 170.01 | -442,026 | 828,799 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -6,800 | 7,475 | -47.64 | 170.00 | -1,156,034 | 1,270,787 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -95 | 14,275 | -0.66 | 169.99 | -16,149 | 2,426,607 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

M - Exercise | 9,795 | 14,370 | 214.10 | 101.49 | 994,095 | 1,458,411 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 4,575 | -2.14 | 170.04 | -17,004 | 777,910 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -11,700 | 4,675 | -71.45 | 169.95 | -1,988,415 | 794,516 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 16,375 | -0.61 | 169.94 | -16,994 | 2,782,768 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -200 | 16,475 | -1.20 | 169.91 | -33,982 | 2,799,267 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -200 | 16,675 | -1.19 | 169.90 | -33,979 | 2,832,999 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 16,875 | -0.59 | 169.86 | -16,986 | 2,866,388 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -97 | 16,975 | -0.57 | 169.84 | -16,474 | 2,883,034 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

M - Exercise | 12,497 | 17,072 | 273.16 | 87.89 | 1,098,361 | 1,500,458 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -10,300 | 4,575 | -69.24 | 169.96 | -1,750,588 | 777,567 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 14,875 | -0.67 | 169.90 | -16,990 | 2,527,337 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -522 | 14,975 | -3.37 | 169.88 | -88,677 | 2,543,953 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

M - Exercise | 10,922 | 15,497 | 238.73 | 89.47 | 977,191 | 1,386,517 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -964 | 4,575 | -17.40 | 169.97 | -163,851 | 777,613 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 5,539 | -1.77 | 169.96 | -16,996 | 941,408 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -400 | 5,639 | -6.62 | 169.94 | -67,976 | 958,292 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -300 | 6,039 | -4.73 | 169.93 | -50,979 | 1,026,207 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 6,339 | -1.55 | 169.92 | -16,992 | 1,077,123 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -150 | 6,439 | -2.28 | 169.89 | -25,484 | 1,093,922 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -1,550 | 6,589 | -19.04 | 169.82 | -263,221 | 1,118,944 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

M - Exercise | 3,564 | 8,139 | 77.90 | 78.72 | 280,558 | 640,702 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -300 | 4,575 | -6.15 | 170.00 | -50,998 | 777,727 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -500 | 4,875 | -9.30 | 169.99 | -84,995 | 828,701 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -204 | 5,375 | -3.66 | 169.98 | -34,677 | 913,669 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -500 | 5,579 | -8.23 | 169.98 | -84,990 | 948,318 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -400 | 6,079 | -6.17 | 169.98 | -67,990 | 1,033,278 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -406 | 6,479 | -5.90 | 169.97 | -69,008 | 1,101,236 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 6,885 | -1.43 | 169.96 | -16,996 | 1,170,209 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -200 | 6,985 | -2.78 | 169.96 | -33,992 | 1,187,171 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -2,250 | 7,185 | -23.85 | 169.95 | -382,388 | 1,221,091 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -200 | 9,435 | -2.08 | 169.94 | -33,989 | 1,603,431 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 9,635 | -1.03 | 169.94 | -16,994 | 1,637,372 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -500 | 9,735 | -4.89 | 169.93 | -84,965 | 1,654,269 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -200 | 10,235 | -1.92 | 169.91 | -33,982 | 1,739,029 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -200 | 10,435 | -1.88 | 169.89 | -33,978 | 1,772,802 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 10,635 | -0.93 | 169.88 | -16,988 | 1,806,621 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -300 | 10,735 | -2.72 | 169.87 | -50,961 | 1,823,554 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 11,035 | -0.90 | 169.86 | -16,986 | 1,874,405 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -846 | 11,135 | -7.06 | 169.85 | -143,693 | 1,891,280 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 11,981 | -0.83 | 169.84 | -16,984 | 2,034,913 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -600 | 12,081 | -4.73 | 169.84 | -101,904 | 2,051,837 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 12,681 | -0.78 | 169.84 | -16,984 | 2,153,709 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -400 | 12,781 | -3.03 | 169.83 | -67,932 | 2,170,597 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 13,181 | -0.75 | 169.82 | -16,982 | 2,238,397 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 13,281 | -0.75 | 169.81 | -16,981 | 2,255,247 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 13,381 | -0.74 | 169.80 | -16,980 | 2,272,159 | |

| 2016-05-13 |

|

4 | MMM |

3M CO

Common Stock |

M - Exercise | 8,906 | 13,481 | 194.67 | 78.72 | 701,080 | 1,061,224 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Non-qualified Stock Option (Right to Buy) |

M - Exercise | -12,616 | 0 | -100.00 | ||||

| 2016-05-04 |

|

4 | MMM |

3M CO

Non-qualified Stock Option (Right to Buy) |

M - Exercise | -6,736 | 0 | -100.00 | ||||

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -1,405 | 4,575 | -23.49 | 167.96 | -235,984 | 768,417 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -100 | 5,980 | -1.64 | 167.95 | -16,795 | 1,004,341 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -647 | 6,080 | -9.62 | 167.93 | -108,651 | 1,021,014 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -242 | 6,727 | -3.47 | 167.92 | -40,637 | 1,129,598 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -500 | 6,969 | -6.69 | 167.91 | -83,955 | 1,170,165 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -200 | 7,469 | -2.61 | 167.90 | -33,580 | 1,254,045 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -500 | 7,669 | -6.12 | 167.89 | -83,945 | 1,287,548 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -1,100 | 8,169 | -11.87 | 167.88 | -184,668 | 1,371,412 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -300 | 9,269 | -3.14 | 167.87 | -50,361 | 1,555,987 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -300 | 9,569 | -3.04 | 167.86 | -50,358 | 1,606,252 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -300 | 9,869 | -2.95 | 167.85 | -50,355 | 1,656,512 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -7,022 | 10,169 | -40.85 | 167.84 | -1,178,572 | 1,706,765 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

M - Exercise | 12,616 | 17,191 | 275.76 | 77.18 | 973,703 | 1,326,801 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -6,736 | 4,575 | -59.55 | 168.00 | -1,131,630 | 768,588 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

M - Exercise | 6,736 | 11,311 | 147.23 | 84.78 | 571,078 | 958,947 | |

| 2016-05-04 |

|

4 | MMM |

3M CO

Common Stock |

G - Gift | -247 | 4,435 | -5.28 | ||||

| 2016-02-04 |

|

4 | MMM |

3M CO

Non-qualified Stock Option (Right to Buy) |

A - Award | 17,708 | 17,708 | |||||

| 2016-02-04 |

|

4 | MMM |

3M CO

Common Stock |

F - Taxes | -955 | 4,682 | -16.94 | ||||

| 2016-02-04 |

|

4 | MMM |

3M CO

Common Stock |

A - Award | 2,774 | 5,637 | 96.90 | ||||

| 2015-02-18 |

|

4/A | MMM |

3M CO

Common Stock |

F - Taxes | -973 | 2,897 | -25.14 | 165.94 | -161,460 | 480,779 | |

| 2015-02-06 |

|

4 | MMM |

3M CO

Non-qualified Stock Option (Right to Buy) |

M - Exercise | -12,000 | 0 | -100.00 | ||||

| 2015-02-06 |

|

4 | MMM |

3M CO

Common Stock |

G - Gift | -188 | 2,957 | -5.98 | ||||

| 2015-02-06 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -1,100 | 3,145 | -25.91 | 166.14 | -182,760 | 522,526 | |

| 2015-02-06 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -200 | 4,245 | -4.50 | 166.13 | -33,226 | 705,222 | |

| 2015-02-06 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -122 | 4,445 | -2.67 | 166.11 | -20,265 | 738,359 | |

| 2015-02-06 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -6,510 | 4,567 | -58.77 | 166.07 | -1,081,110 | 758,438 | |

| 2015-02-06 |

|

4 | MMM |

3M CO

Common Stock |

S - Sale | -4,068 | 11,077 | -26.86 | 166.03 | -675,410 | 1,839,114 | |

| 2015-02-06 |

|

4 | MMM |

3M CO

Common Stock |

M - Exercise | 12,000 | 15,145 | 381.56 | 87.35 | 1,048,200 | 1,322,916 | |

| 2015-02-05 |

|

4 | MMM |

3M CO

Non-qualified Stock Option (Right to Buy) |

A - Award | 20,719 | 20,719 | |||||

| 2015-02-05 |

|

4 | MMM |

3M CO

Common Stock |

F - Taxes | -725 | 3,146 | -18.73 | 165.94 | -120,306 | 522,022 | |

| 2015-02-05 |

|

4 | MMM |

3M CO

Common Stock |

A - Award | 2,096 | 3,871 | 118.08 | ||||

| 2015-01-07 |

|

5 | MMM |

3M CO

Common Stock |

G - Gift | -353 | 1,750 | -16.79 | ||||

| 2014-02-06 |

|

4 | MMM |

3M CO

Non-qualified Stock Option (Right to Buy) |

A - Award | 17,721 | 17,721 | |||||

| 2014-02-06 |

|

4 | MMM |

3M CO

Common Stock |

F - Taxes | -577 | 1,908 | -23.22 | 126.72 | -73,117 | 241,750 | |

| 2014-02-06 |

|

4 | MMM |

3M CO

Common Stock |

A - Award | 1,716 | 2,485 | 223.11 | ||||

| 2014-01-06 |

|

4 | MMM |

3M CO

Restricted Stock Units |

M - Exercise | -443 | 0 | -100.00 | ||||

| 2014-01-06 |

|

4 | MMM |

3M CO

Common Stock |

F - Taxes | -173 | 769 | -18.37 | 138.13 | -23,896 | 106,222 | |

| 2014-01-06 |

|

4 | MMM |

3M CO

Common Stock |

M - Exercise | 443 | 942 | 88.78 | 138.13 | 61,192 | 130,118 | |

| 2014-01-03 | 3 | MMM |

3M CO

Common Stock |

499 | ||||||||

| 2014-01-03 | 3 | MMM |

3M CO

Common Stock |

4 |