Clear Street Initiates Coverage of Capital Southwest (CSWC) with Hold Recommendation

Fintel reports that on September 5, 2025, Clear Street initiated coverage of Capital Southwest (NasdaqGS:CSWC) with a Hold recommendation.

Analyst Price Forecast Suggests 6.43% Upside

As of September 3, 2025, the average one-year price target for Capital Southwest is $24.48/share. The forecasts range from a low of $21.21 to a high of $28.35. The average price target represents an increase of 6.43% from its latest reported closing price of $23.00 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Capital Southwest is 186MM, a decrease of 10.94%. The projected annual non-GAAP EPS is 2.97.

What is the Fund Sentiment?

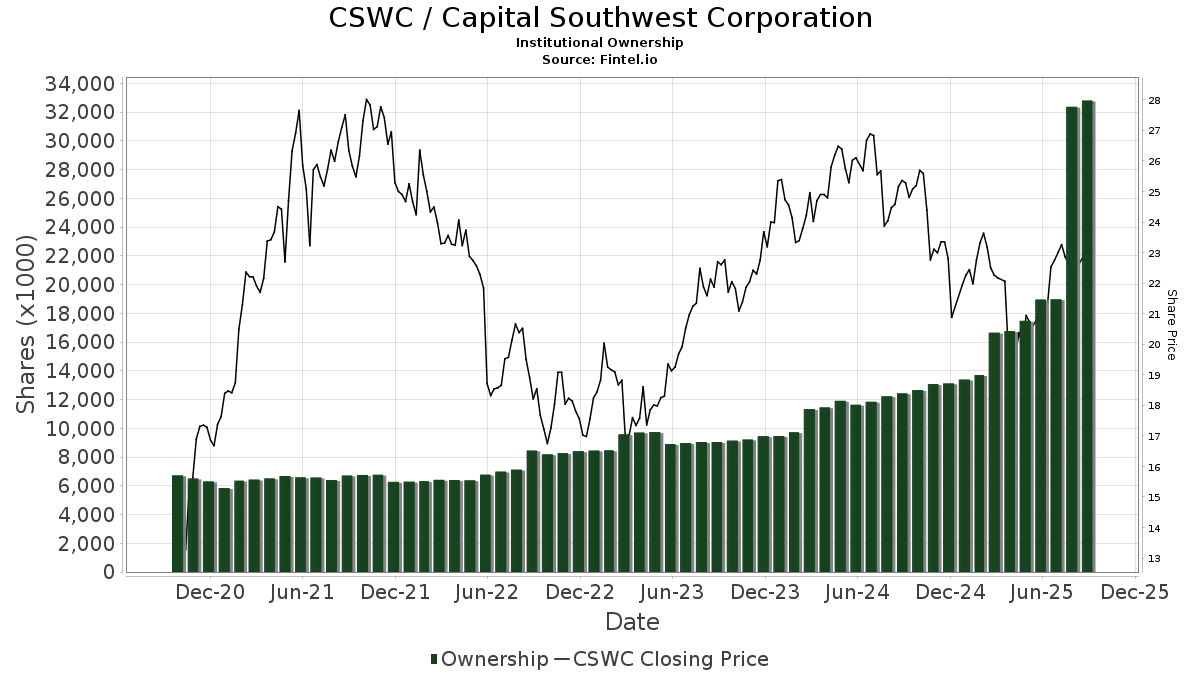

There are 192 funds or institutions reporting positions in Capital Southwest.

This is unchanged over the last quarter.

Average portfolio weight of all funds dedicated to CSWC is 0.25%, an increase of 1.53%.

Total shares owned by institutions increased in the last three months by 72.91% to 32,770K shares.

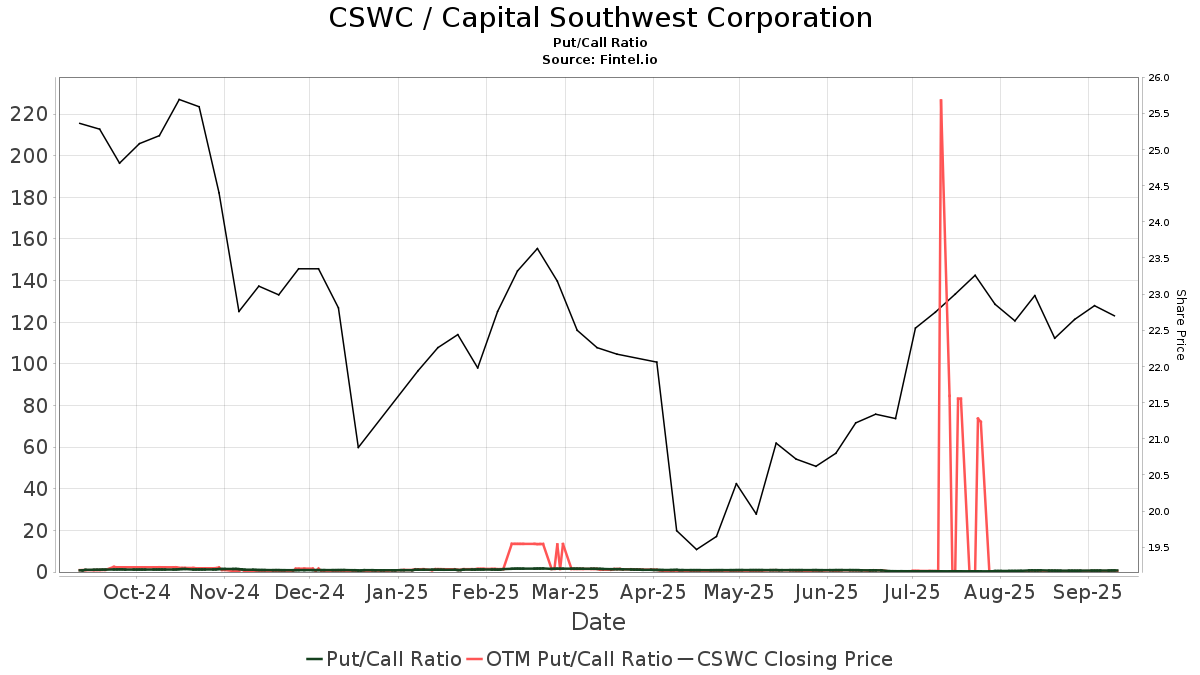

The put/call ratio of CSWC is 0.69, indicating a

bullish outlook.

The put/call ratio of CSWC is 0.69, indicating a

bullish outlook.

What are Other Shareholders Doing?

Kingstone Capital Partners Texas holds 13,090K shares representing 23.53% ownership of the company.

Sanders Morris Harris holds 1,390K shares representing 2.50% ownership of the company. In its prior filing, the firm reported owning 1,433K shares , representing a decrease of 3.07%. The firm increased its portfolio allocation in CSWC by 48.15% over the last quarter.

Van Eck Associates holds 1,347K shares representing 2.42% ownership of the company. In its prior filing, the firm reported owning 1,167K shares , representing an increase of 13.39%. The firm decreased its portfolio allocation in CSWC by 0.17% over the last quarter.

BIZD - VanEck Vectors BDC Income ETF holds 1,242K shares representing 2.23% ownership of the company. In its prior filing, the firm reported owning 1,114K shares , representing an increase of 10.29%. The firm increased its portfolio allocation in CSWC by 4.91% over the last quarter.

Two Sigma Advisers holds 984K shares representing 1.77% ownership of the company. In its prior filing, the firm reported owning 1,015K shares , representing a decrease of 3.19%. The firm decreased its portfolio allocation in CSWC by 12.90% over the last quarter.