Clear Street Initiates Coverage of Runway Growth Finance (RWAY) with Hold Recommendation

Fintel reports that on September 5, 2025, Clear Street initiated coverage of Runway Growth Finance (NasdaqGS:RWAY) with a Hold recommendation.

Analyst Price Forecast Suggests 10.91% Upside

As of September 2, 2025, the average one-year price target for Runway Growth Finance is $11.89/share. The forecasts range from a low of $10.10 to a high of $13.65. The average price target represents an increase of 10.91% from its latest reported closing price of $10.72 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Runway Growth Finance is 204MM, an increase of 44.89%. The projected annual non-GAAP EPS is 1.91.

What is the Fund Sentiment?

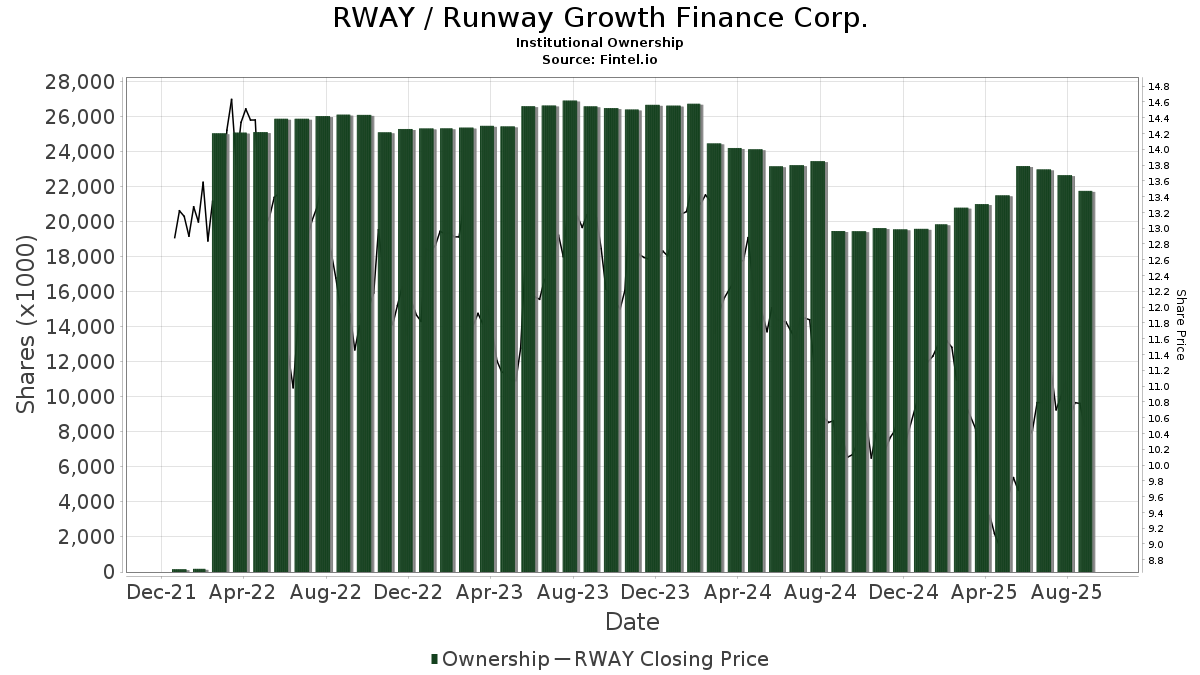

There are 91 funds or institutions reporting positions in Runway Growth Finance.

This is an decrease of 10 owner(s) or 9.90% in the last quarter.

Average portfolio weight of all funds dedicated to RWAY is 0.38%, an increase of 11.08%.

Total shares owned by institutions decreased in the last three months by 6.18% to 21,765K shares.

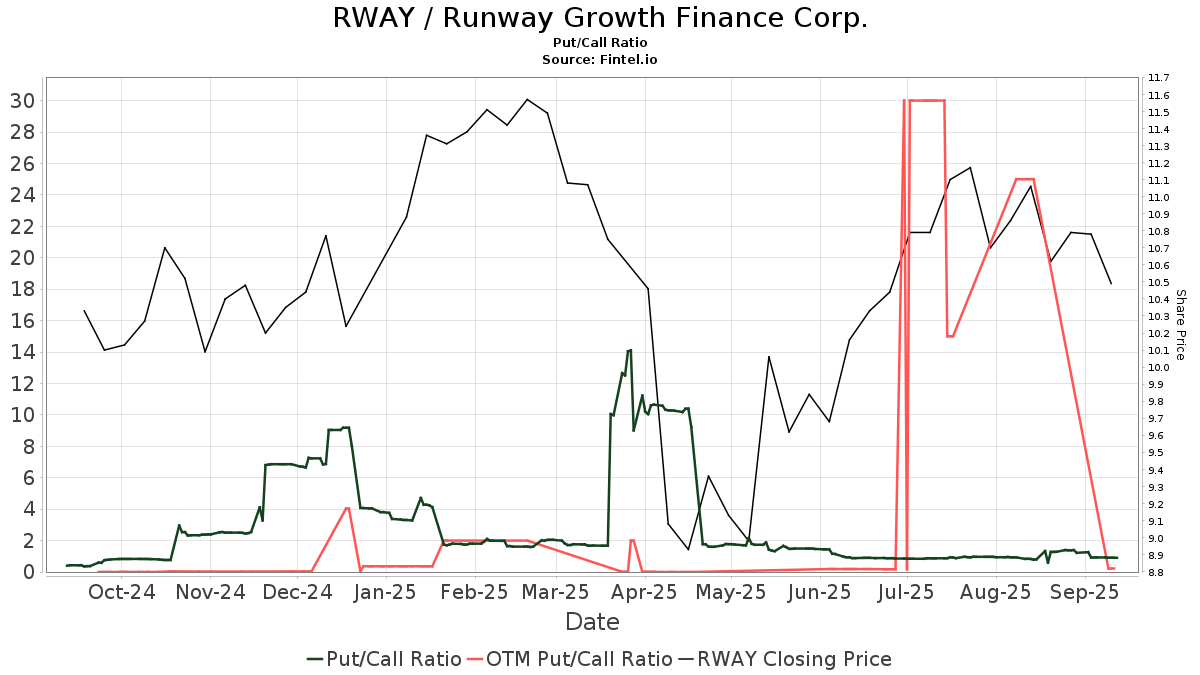

The put/call ratio of RWAY is 0.92, indicating a

bullish outlook.

The put/call ratio of RWAY is 0.92, indicating a

bullish outlook.

What are Other Shareholders Doing?

Oaktree Capital Management holds 9,780K shares. In its prior filing, the firm reported owning 10,780K shares , representing a decrease of 10.23%. The firm decreased its portfolio allocation in RWAY by 16.38% over the last quarter.

HighTower Advisors holds 1,393K shares. In its prior filing, the firm reported owning 1,246K shares , representing an increase of 10.56%. The firm increased its portfolio allocation in RWAY by 6.99% over the last quarter.

Bulldog Investors, LLP holds 1,040K shares. In its prior filing, the firm reported owning 795K shares , representing an increase of 23.55%. The firm increased its portfolio allocation in RWAY by 26.71% over the last quarter.

Allium Financial Advisors holds 964K shares. In its prior filing, the firm reported owning 1,021K shares , representing a decrease of 5.93%. The firm decreased its portfolio allocation in RWAY by 21.17% over the last quarter.

Two Sigma Advisers holds 784K shares. In its prior filing, the firm reported owning 686K shares , representing an increase of 12.55%. The firm increased its portfolio allocation in RWAY by 7.90% over the last quarter.