Gordon Haskett Downgrades Dollar Tree (BMV:DLTR)

Fintel reports that on September 3, 2025, Gordon Haskett downgraded their outlook for Dollar Tree (BMV:DLTR) from Hold to Reduce.

What is the Fund Sentiment?

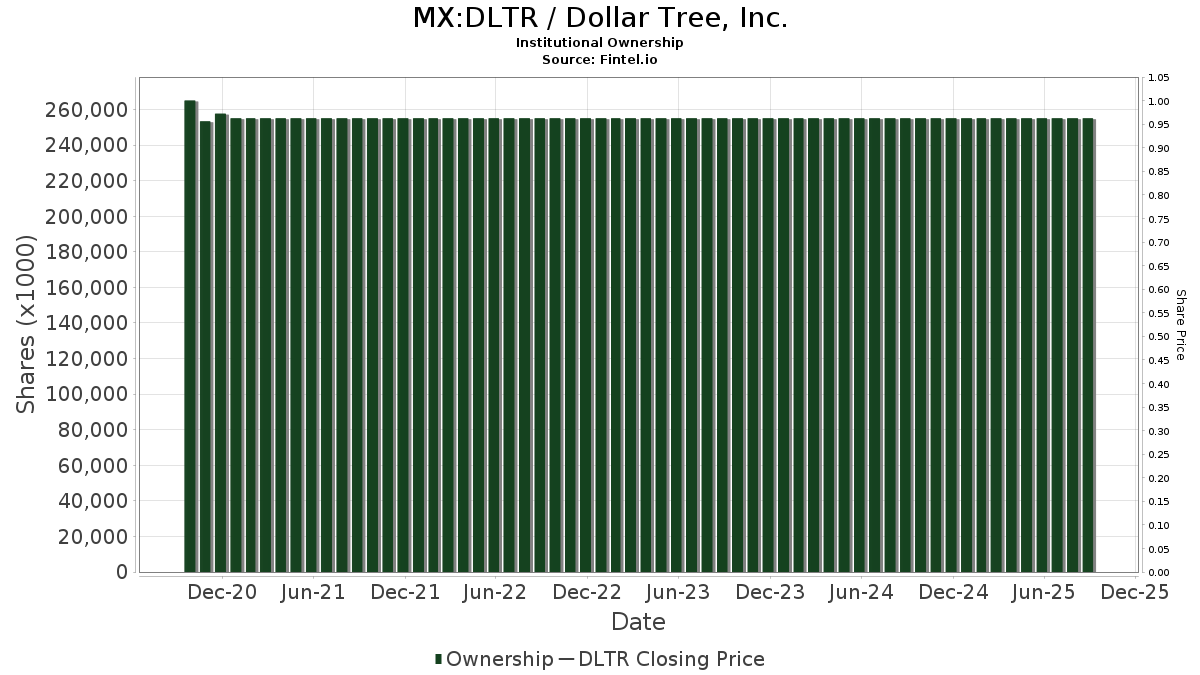

There are 1,495 funds or institutions reporting positions in Dollar Tree. This is an decrease of 4 owner(s) or 0.27% in the last quarter. Average portfolio weight of all funds dedicated to DLTR is 0.35%, an increase of 8.93%. Total shares owned by institutions decreased in the last three months by 0.09% to 255,041K shares.

What are Other Shareholders Doing?

Mantle Ridge holds 12,104K shares representing 5.15% ownership of the company. No change in the last quarter.

EdgePoint Investment Group holds 10,826K shares representing 4.60% ownership of the company. In its prior filing, the firm reported owning 9,642K shares , representing an increase of 10.94%. The firm increased its portfolio allocation in DLTR by 38.33% over the last quarter.

Capital International Investors holds 9,532K shares representing 4.05% ownership of the company. In its prior filing, the firm reported owning 9,954K shares , representing a decrease of 4.43%. The firm increased its portfolio allocation in DLTR by 10.66% over the last quarter.

T. Rowe Price Investment Management holds 8,046K shares representing 3.42% ownership of the company. In its prior filing, the firm reported owning 9,995K shares , representing a decrease of 24.23%. The firm increased its portfolio allocation in DLTR by 1.37% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 6,428K shares representing 2.73% ownership of the company. In its prior filing, the firm reported owning 6,475K shares , representing a decrease of 0.73%. The firm increased its portfolio allocation in DLTR by 16.85% over the last quarter.