Statistik Asas

| Nilai Portfolio | $ 141,891,610 |

| Kedudukan Semasa | 532 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

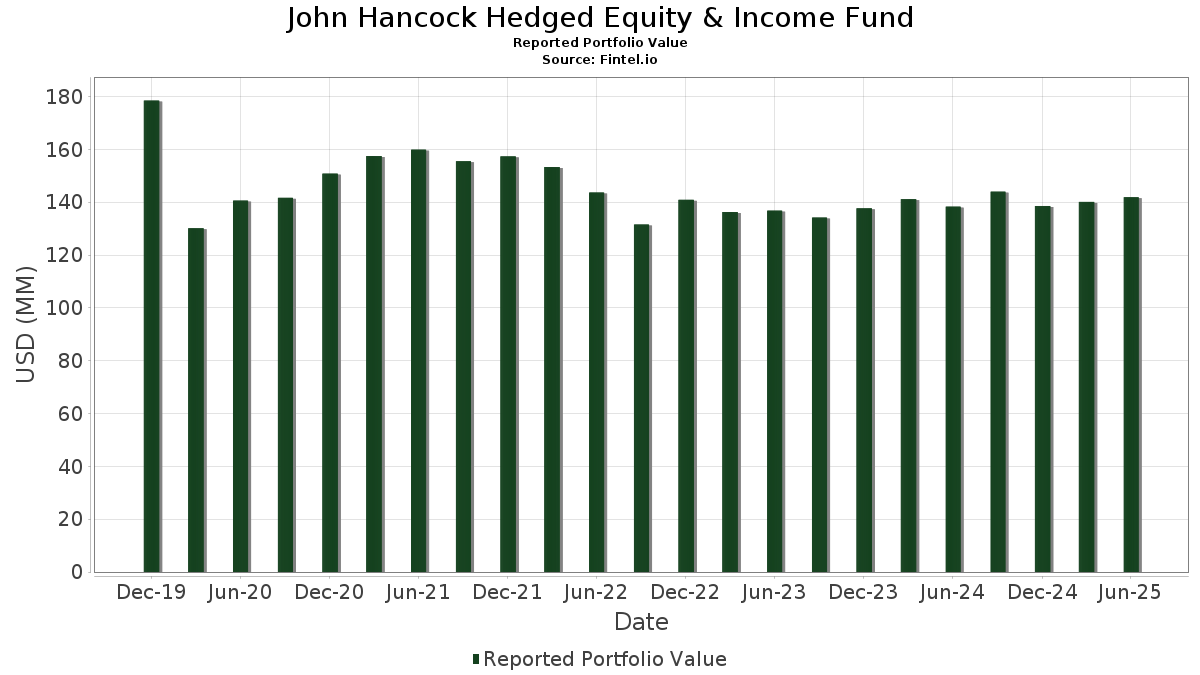

John Hancock Hedged Equity & Income Fund telah mendedahkan 532 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 141,891,610 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas John Hancock Hedged Equity & Income Fund ialah JPMorgan Chase & Co. (US:JPM) , Iberdrola, S.A. (US:IBDSF) , Exxon Mobil Corporation (US:XOM) , International Business Machines Corporation (US:IBM) , and Cisco Systems, Inc. (US:CSCO) . Kedudukan baharu John Hancock Hedged Equity & Income Fund termasuk Freddie Mac Stacr Remic Trust 2020-HQA2 (US:US35565LBE56) , Deutsche Bank Aktiengesellschaft (AT:DBK) , New China Life Insurance Company Ltd. (US:NWWCF) , China Merchants Bank Co., Ltd. (CN:600036) , and JDE Peet's N.V. (US:JDEPF) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 8.30 | 5.7880 | 5.7880 | ||

| 0.02 | 0.72 | 0.4990 | 0.4990 | |

| 0.02 | 0.70 | 0.4904 | 0.4904 | |

| 0.13 | 0.70 | 0.4896 | 0.4896 | |

| 0.69 | 0.4832 | 0.4832 | ||

| 0.11 | 0.69 | 0.4810 | 0.4810 | |

| 0.02 | 0.69 | 0.4793 | 0.4793 | |

| 0.24 | 0.69 | 0.4777 | 0.4777 | |

| 0.61 | 0.68 | 0.4762 | 0.4762 | |

| 0.03 | 0.68 | 0.4753 | 0.4753 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.59 | 0.4081 | -0.6327 | |

| 0.00 | 0.43 | 0.2991 | -0.5934 | |

| 0.00 | 0.22 | 0.1514 | -0.5868 | |

| 0.02 | 0.14 | 0.0992 | -0.5225 | |

| 0.01 | 0.17 | 0.1213 | -0.4901 | |

| 0.00 | 0.08 | 0.0550 | -0.4518 | |

| 0.01 | 1.24 | 0.8615 | -0.3229 | |

| 0.00 | 0.14 | 0.0995 | -0.3202 | |

| 0.00 | 0.07 | 0.0523 | -0.3105 | |

| 0.32 | 0.2222 | -0.2939 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-28 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GOLD TRIPARTY MORTGAGE REPO - 01Jul25 / RA (N/A) | 8.30 | 5.7880 | 5.7880 | ||||||

| JPM / JPMorgan Chase & Co. | 0.01 | -16.63 | 1.56 | -1.46 | 1.0848 | -0.0298 | |||

| IBDSF / Iberdrola, S.A. | 0.08 | 33.86 | 1.53 | 59.46 | 1.0702 | 0.3908 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -18.75 | 1.24 | -26.36 | 0.8615 | -0.3229 | |||

| IBM / International Business Machines Corporation | 0.00 | -22.79 | 1.21 | -8.47 | 0.8449 | -0.0897 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | -15.78 | 1.21 | -5.32 | 0.8435 | -0.0584 | |||

| PM / Philip Morris International Inc. | 0.01 | -31.96 | 1.17 | -21.92 | 0.8173 | -0.2427 | |||

| TRN / Terna S.p.A. | 0.11 | 108.65 | 1.10 | 137.28 | 0.7684 | 0.4406 | |||

| SGP / Stockland - Debt/Equity Composite Units | 0.29 | 54.87 | 1.01 | 77.33 | 0.7041 | 0.3022 | |||

| TXN / Texas Instruments Incorporated | 0.00 | -15.30 | 0.95 | -2.16 | 0.6643 | -0.0230 | |||

| NG. / National Grid plc | 0.06 | 104.63 | 0.93 | 130.37 | 0.6513 | 0.3649 | |||

| VZ / Verizon Communications Inc. | 0.02 | -20.48 | 0.91 | -24.15 | 0.6357 | -0.2128 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | -16.17 | 0.90 | -13.11 | 0.6286 | -0.1037 | |||

| PFE / Pfizer Inc. | 0.04 | 34.90 | 0.89 | 29.11 | 0.6191 | 0.1334 | |||

| ALIZF / Allianz SE | 0.00 | -32.37 | 0.88 | -28.31 | 0.6113 | -0.2517 | |||

| AFFIRM ASSET SECURITIZATION TR AFFRM 2024 B E 144A / ABS-O (US00835AAE82) | 0.85 | -0.59 | 0.5919 | -0.0110 | |||||

| CVX / Chevron Corporation | 0.01 | -18.39 | 0.82 | -30.17 | 0.5704 | -0.2563 | |||

| JNJ / Johnson & Johnson | 0.01 | -18.05 | 0.79 | -24.59 | 0.5480 | -0.1870 | |||

| CS / AXA SA | 0.02 | -8.34 | 0.78 | 5.26 | 0.5451 | 0.0212 | |||

| MO / Altria Group, Inc. | 0.01 | -24.85 | 0.77 | -26.60 | 0.5370 | -0.2037 | |||

| BEN / Franklin Resources, Inc. | 0.03 | -15.93 | 0.74 | 4.08 | 0.5159 | 0.0144 | |||

| US35565LBE56 / Freddie Mac Stacr Remic Trust 2020-HQA2 | 0.73 | 0.97 | 0.5067 | -0.0011 | |||||

| CZAVF / CEZ, a. s. | 0.01 | 129.56 | 0.72 | 246.86 | 0.5012 | 0.3621 | |||

| PCAR / PACCAR Inc | 0.01 | 0.24 | 0.72 | -2.18 | 0.5010 | -0.0173 | |||

| DBK / Deutsche Bank Aktiengesellschaft | 0.02 | 0.72 | 0.4990 | 0.4990 | |||||

| INDF / PT Indofood Sukses Makmur Tbk | 1.41 | 22.01 | 0.70 | 24.60 | 0.4914 | 0.0882 | |||

| CHT / Chunghwa Telecom Co., Ltd. - Depositary Receipt (Common Stock) | 0.02 | 0.70 | 0.4904 | 0.4904 | |||||

| ABBV / AbbVie Inc. | 0.00 | -2.57 | 0.70 | -13.76 | 0.4901 | -0.0848 | |||

| NWWCF / New China Life Insurance Company Ltd. | 0.13 | 0.70 | 0.4896 | 0.4896 | |||||

| MYTIL / Metlen Energy & Metals PLC | 0.01 | -31.77 | 0.70 | -0.85 | 0.4869 | -0.0120 | |||

| SANTANDER BANK AUTO CREDIT-LIN SBCLN 2024 A F 144A / ABS-O (US80290CCN20) | 0.69 | 0.4832 | 0.4832 | ||||||

| ELEZF / Endesa, S.A. | 0.02 | -16.07 | 0.69 | 23.84 | 0.4824 | 0.0840 | |||

| 600036 / China Merchants Bank Co., Ltd. | 0.11 | 0.69 | 0.4810 | 0.4810 | |||||

| REE / Red Electrica Corp SA | 0.03 | 5.56 | 0.69 | 19.41 | 0.4807 | 0.0832 | |||

| JDEPF / JDE Peet's N.V. | 0.02 | 0.69 | 0.4793 | 0.4793 | |||||

| TROW / T. Rowe Price Group, Inc. | 0.01 | 25.26 | 0.69 | 31.67 | 0.4785 | 0.1103 | |||

| BANKBARODA / Bank of Baroda Limited | 0.24 | 0.69 | 0.4777 | 0.4777 | |||||

| 2884 / E.SUN Financial Holding Company, Ltd. | 0.61 | 0.68 | 0.4762 | 0.4762 | |||||

| GAPB / Grupo Aeroportuario del Pacifico SAB de CV | 0.03 | 0.68 | 0.4753 | 0.4753 | |||||

| KPN / Koninklijke KPN N.V. | 0.14 | 180.96 | 0.68 | 276.67 | 0.4732 | 0.3450 | |||

| PPC / Public Power Corporation S.A. | 0.04 | 0.68 | 0.4713 | 0.4713 | |||||

| GET / Getlink SE | 0.03 | 0.67 | 0.4707 | 0.4707 | |||||

| LLOY / Lloyds Banking Group plc | 0.64 | -22.78 | 0.67 | -13.51 | 0.4692 | -0.0795 | |||

| ACS / Athens Medical C.S.A. | 0.01 | -37.29 | 0.67 | -13.10 | 0.4679 | -0.0800 | |||

| 600000 / Shanghai Pudong Development Bank Co., Ltd. | 0.34 | 0.67 | 0.4663 | 0.4663 | |||||

| 3045 / Taiwan Mobile Co., Ltd. | 0.17 | 5.16 | 0.67 | 34.68 | 0.4663 | 0.1125 | |||

| TD / The Toronto-Dominion Bank | 0.01 | 0.67 | 0.4660 | 0.4660 | |||||

| TFC / Truist Financial Corporation | 0.02 | 22.76 | 0.67 | 28.21 | 0.4660 | 0.0981 | |||

| 5876 / The Shanghai Commercial & Savings Bank, Ltd. | 0.42 | 0.67 | 0.4649 | 0.4649 | |||||

| HTO / Hellenic Telecommunications Organization S.A. | 0.04 | 0.67 | 0.4646 | 0.4646 | |||||

| 002027 / Focus Media Information Technology Co., Ltd. | 0.65 | 0.67 | 0.4644 | 0.4644 | |||||

| MRK / Merck & Co., Inc. | 0.01 | -5.07 | 0.66 | -16.37 | 0.4636 | -0.0971 | |||

| US05608RAQ83 / BX TR 2021-ARIA G 1ML+320 10/15/2036 144A | 0.66 | 1.38 | 0.4600 | 0.0009 | |||||

| 1209 / CHINA RESOURCES MIXC LIFESTYLE COMMON STOCK USD.00001 | 0.14 | 0.66 | 0.4599 | 0.4599 | |||||

| USB / U.S. Bancorp | 0.01 | 15.70 | 0.65 | 24.05 | 0.4533 | 0.0832 | |||

| Z74 / Singapore Telecommunications Limited | 0.21 | 0.65 | 0.4498 | 0.4498 | |||||

| OKE / ONEOK, Inc. | 0.01 | 64.69 | 0.64 | 35.65 | 0.4485 | 0.1134 | |||

| HPQ / HP Inc. | 0.03 | 11.69 | 0.64 | -1.39 | 0.4453 | -0.0117 | |||

| 600642 / Shenergy Company Limited | 0.53 | 0.64 | 0.4429 | 0.4429 | |||||

| EN / Bouygues SA | 0.01 | -28.78 | 0.62 | -18.31 | 0.4325 | -0.1034 | |||

| CME / CME Group Inc. | 0.00 | -17.45 | 0.61 | -14.19 | 0.4263 | -0.0770 | |||

| 600887 / Inner Mongolia Yili Industrial Group Co., Ltd. | 0.16 | 0.61 | 0.4233 | 0.4233 | |||||

| ROG / Roche Holding AG | 0.00 | -59.97 | 0.59 | -60.31 | 0.4081 | -0.6327 | |||

| US20754MAL19 / CAS_22-R07 | 0.59 | -1.02 | 0.4080 | -0.0096 | |||||

| 700593100 / Samsung Electronics Co., Ltd. Preferred Non Voting Shares | 0.02 | -16.56 | 0.57 | -5.47 | 0.3979 | -0.0281 | |||

| FREDDIE MAC MSCR TRUST MN6 MSCR 2023 MN6 B1 144A / ABS-MBS (US355920AB51) | 0.57 | -1.91 | 0.3949 | -0.0132 | |||||

| CARLYLE GLOBAL MARKET STRATEGI CGMS 2016 1A DR3 144A / ABS-CBDO (US14312KAS87) | 0.56 | -2.28 | 0.3889 | -0.0135 | |||||

| COMM 2024-CBM MORTGAGE TRUST COMM 2024 CBM D 144A / ABS-MBS (US12674GAL86) | 0.56 | 0.3886 | 0.3886 | ||||||

| US06745CAB63 / BARC_22-RPL1 | 0.55 | 0.3858 | 0.3858 | ||||||

| PALMER SQUARE CLO 2021-4 LTD PLMRS 2021 4A ER 144A / ABS-CBDO (US69702GAG55) | 0.55 | 0.3835 | 0.3835 | ||||||

| STX / Seagate Technology Holdings plc | 0.00 | -18.83 | 0.55 | 38.04 | 0.3826 | 0.1017 | |||

| MSFT / Microsoft Corporation | 0.00 | -14.73 | 0.55 | 13.02 | 0.3816 | 0.0397 | |||

| GLPI / Gaming and Leisure Properties, Inc. | 0.01 | -21.41 | 0.54 | -27.98 | 0.3792 | -0.1535 | |||

| US20754DAJ63 / Connecticut Avenue Securities Trust 2022-R05 | 0.54 | 0.00 | 0.3772 | -0.0041 | |||||

| RTPPF / Rio Tinto Group | 0.01 | 186.00 | 0.54 | 129.79 | 0.3771 | 0.2107 | |||

| OPAP / Organization of Football Prognostics S.A. | 0.02 | -26.17 | 0.53 | -15.71 | 0.3704 | -0.0746 | |||

| US35563GAC33 / FHLMC, Multi-Family Structured Pass-Through Certificates, Series 2021-MN3, Class B1 | 0.53 | -0.19 | 0.3692 | -0.0050 | |||||

| KNEBV / KONE Oyj | 0.01 | 84.69 | 0.53 | 121.01 | 0.3670 | 0.1985 | |||

| ROCK TRUST 2024-CNTR ROCC 2024 CNTR E 144A / ABS-MBS (US74970WAJ99) | 0.53 | 0.00 | 0.3668 | -0.0052 | |||||

| SKHSF / Sekisui House, Ltd. | 0.02 | -13.02 | 0.53 | -14.50 | 0.3665 | -0.0673 | |||

| US20754KAJ07 / CAS_21-R02 | 0.52 | -0.19 | 0.3658 | -0.0050 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.52 | -2.80 | 0.3633 | -0.0154 | |||||

| US46642NBK19 / JPMBB Commercial Mortgage Securities Trust 2014-C22 | 0.52 | 0.97 | 0.3624 | -0.0006 | |||||

| KHC / The Kraft Heinz Company | 0.02 | 21.50 | 0.52 | 3.19 | 0.3606 | 0.0065 | |||

| US94989NAL10 / Wells Fargo Commercial Mortgage Trust 2015-C30 | 0.52 | -0.58 | 0.3597 | -0.0062 | |||||

| US42806MCD92 / Hertz Vehicle Financing III LLC, Series 2023-3A, Class D | 0.51 | -0.39 | 0.3568 | -0.0055 | |||||

| US20754RAJ59 / Connecticut Avenue Securities Trust, Series 2021-R01, Class 1B2 | 0.51 | 0.20 | 0.3567 | -0.0035 | |||||

| US91835GAB05 / VOLT CV LLC VOLT 2021-CF2 A2 | 0.51 | 2.41 | 0.3557 | 0.0041 | |||||

| 900926 / Shanghai Baosight Software Co.,Ltd. | 0.38 | -16.79 | 0.51 | -36.61 | 0.3552 | -0.2118 | |||

| US92873KAB26 / Vericrest Opportunity Loan Transferee | 0.51 | 1.80 | 0.3549 | 0.0024 | |||||

| PRPM 2024-7 LLC PRPM 2024 7 A2 144A / ABS-MBS (US74448LAB45) | 0.50 | 0.40 | 0.3506 | -0.0025 | |||||

| NEUBERGER BERMAN LOAN ADVISERS NEUB 2024 59A E 144A / ABS-CBDO (US640973AA12) | 0.50 | 0.60 | 0.3481 | -0.0024 | |||||

| PG / The Procter & Gamble Company | 0.00 | -16.89 | 0.50 | -22.34 | 0.3471 | -0.1052 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | -16.83 | 0.49 | -36.96 | 0.3444 | -0.2080 | |||

| US05683JAJ07 / Bain Capital Credit CLO 2020-2 Ltd | 0.49 | 0.41 | 0.3440 | -0.0030 | |||||

| CIFC FUNDING 2013-IV LTD CIFC 2013 4A ER2 144A / ABS-CBDO (US12549HAN52) | 0.49 | 0.82 | 0.3417 | -0.0016 | |||||

| PRET 2025-RPL3 TRUST PRET 2025 RPL3 M1 144A / ABS-MBS (US69382RAF01) | 0.49 | 0.3397 | 0.3397 | ||||||

| KO / The Coca-Cola Company | 0.01 | -17.68 | 0.49 | -18.73 | 0.3392 | -0.0831 | |||

| LYB / LyondellBasell Industries N.V. | 0.01 | -13.97 | 0.48 | -29.34 | 0.3380 | -0.1460 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.01 | -2.71 | 0.48 | -23.60 | 0.3324 | -0.1082 | |||

| BLK / BlackRock, Inc. | 0.00 | -15.76 | 0.47 | -6.55 | 0.3285 | -0.0276 | |||

| AGL CLO 16 LTD AGL 2021 16A ER 144A / ABS-CBDO (US00120MAC01) | 0.47 | 0.43 | 0.3284 | -0.0027 | |||||

| DOW / Dow Inc. | 0.02 | -6.26 | 0.47 | -29.05 | 0.3277 | -0.1391 | |||

| SGE / Société Générale Société anonyme | 0.03 | -23.29 | 0.46 | -16.21 | 0.3214 | -0.0664 | |||

| BXP / Boston Properties, Inc. | 0.01 | -17.22 | 0.46 | -16.94 | 0.3182 | -0.0694 | |||

| US26827EAC93 / ECAF I Ltd | 0.46 | -12.48 | 0.3182 | -0.0502 | |||||

| PKN / Orlen S.A. | 0.02 | -19.60 | 0.45 | 4.13 | 0.3169 | 0.0085 | |||

| 7203 / Toyota Motor Corporation | 0.03 | -18.40 | 0.45 | -20.60 | 0.3124 | -0.0854 | |||

| ARES / Ares Management Corporation | 0.00 | -16.89 | 0.43 | -1.81 | 0.3020 | -0.0094 | |||

| CNA / CNA Financial Corporation | 0.01 | -16.91 | 0.43 | -23.94 | 0.3019 | -0.0997 | |||

| ZURN / Zurich Insurance Group AG | 0.00 | -66.15 | 0.43 | -66.14 | 0.2991 | -0.5934 | |||

| MH6 / Tokio Marine Holdings, Inc. | 0.01 | -18.49 | 0.43 | -11.20 | 0.2987 | -0.0419 | |||

| FSR / FirstRand Limited | 0.10 | -16.85 | 0.42 | -9.59 | 0.2961 | -0.0353 | |||

| MTB / M&T Bank Corporation | 0.00 | -17.53 | 0.42 | -10.57 | 0.2953 | -0.0387 | |||

| FREDDIE MAC MSCR TRUST MN8 MSCR 2024 MN8 M2 144A / ABS-MBS (US35563RAB15) | 0.42 | 0.48 | 0.2912 | -0.0019 | |||||

| US20753YAL65 / Connecticut Avenue Securities Trust, Series 2022-R04, Class 1B2 | 0.41 | -0.72 | 0.2873 | -0.0054 | |||||

| US126401AE85 / CSMC 2020-NQM1 Trust | 0.41 | 0.99 | 0.2861 | -0.0011 | |||||

| CAJ / Canon Inc. - ADR | 0.01 | -26.16 | 0.41 | -31.38 | 0.2856 | -0.1354 | |||

| US30227FAN06 / Extended Stay America Trust | 0.41 | 0.2841 | 0.2841 | ||||||

| RCO X MORTGAGE LLC 2025-1 RCO 2025 1 A2 144A / ABS-MBS (US75523XAB38) | 0.40 | 0.25 | 0.2808 | -0.0027 | |||||

| PRPM 2024-8 LLC PRPM 2024 8 A2 144A / ABS-MBS (US74448KAB61) | 0.40 | -0.25 | 0.2787 | -0.0037 | |||||

| MUV2 / Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München | 0.00 | -18.63 | 0.39 | -16.35 | 0.2749 | -0.0579 | |||

| PEP / PepsiCo, Inc. | 0.00 | 13.08 | 0.39 | -0.51 | 0.2731 | -0.0046 | |||

| AMIGF / Admiral Group plc | 0.01 | -19.81 | 0.38 | -2.54 | 0.2683 | -0.0102 | |||

| VCISF / Vinci SA | 0.00 | -19.66 | 0.38 | -6.22 | 0.2635 | -0.0204 | |||

| US1248EPCQ45 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.37 | 43.30 | 0.2613 | 0.0763 | |||||

| CVS / CVS Health Corporation | 0.01 | -37.88 | 0.37 | -36.78 | 0.2606 | -0.1566 | |||

| TTA / Time to Act Plc | 0.01 | -20.09 | 0.37 | -24.18 | 0.2583 | -0.0867 | |||

| CPB / The Campbell's Company | 0.01 | 333.84 | 0.37 | 235.45 | 0.2576 | 0.1793 | |||

| NVDA / NVIDIA Corporation | 0.00 | -54.82 | 0.37 | -34.17 | 0.2570 | -0.1381 | |||

| BATS / British American Tobacco p.l.c. | 0.01 | -34.98 | 0.37 | -24.59 | 0.2566 | -0.0882 | |||

| 3606 / Fuyao Glass Industry Group Co., Ltd. | 0.05 | 1,822.26 | 0.37 | 3,570.00 | 0.2560 | 0.2479 | |||

| MCD / McDonald's Corporation | 0.00 | -26.18 | 0.36 | -31.03 | 0.2516 | -0.1173 | |||

| US12592GAG82 / Commercial Mortgage Trust, Series 2014-CR19, Class D | 0.36 | -30.43 | 0.2509 | -0.1134 | |||||

| SLM / Sanlam Limited | 0.07 | 29.11 | 0.36 | 43.15 | 0.2478 | 0.0726 | |||

| GMEXICOB / Grupo Mexico SAB de CV | 0.06 | -18.15 | 0.35 | -1.13 | 0.2440 | -0.0058 | |||

| GIS / General Mills, Inc. | 0.01 | 325.42 | 0.35 | 270.97 | 0.2407 | 0.1746 | |||

| NLY / Annaly Capital Management, Inc. | 0.02 | -24.07 | 0.34 | -29.57 | 0.2394 | -0.1051 | |||

| LGGNF / Legal & General Group Plc | 0.10 | -43.55 | 0.34 | -37.43 | 0.2382 | -0.1469 | |||

| ILIAD HOLDING SASU SR SECURED REGS 04/30 5.375 / DBT (XS2943818059) | 0.33 | 11.41 | 0.2321 | 0.0213 | |||||

| HD / The Home Depot, Inc. | 0.00 | -15.94 | 0.33 | -15.95 | 0.2319 | -0.0473 | |||

| CAG / Conagra Brands, Inc. | 0.02 | -10.24 | 0.33 | -31.17 | 0.2298 | -0.1079 | |||

| UPS / United Parcel Service, Inc. | 0.00 | 108.44 | 0.32 | 91.72 | 0.2260 | 0.1064 | |||

| US91282CFB28 / United States Treasury Note/Bond | 0.32 | -56.44 | 0.2222 | -0.2939 | |||||

| PAYX / Paychex, Inc. | 0.00 | -16.77 | 0.32 | -21.59 | 0.2210 | -0.0641 | |||

| VOD / Vodacom Group Limited | 0.04 | -42.10 | 0.32 | -34.78 | 0.2203 | -0.1212 | |||

| DUK / Duke Energy Corporation | 0.00 | -17.80 | 0.31 | -20.36 | 0.2155 | -0.0589 | |||

| NJ 2025-WBRK WBRK 2025 WBRK E 144A / ABS-MBS (US65486BAL53) | 0.31 | 1.32 | 0.2147 | 0.0002 | |||||

| GRIFOLS SA SR SECURED REGS 05/30 7.125 / DBT (XS2961445090) | 0.31 | 83.23 | 0.2138 | 0.0953 | |||||

| NYC COMMERCIAL MORTGAGE TRUST NYC 2025 3BP E 144A / ABS-MBS (US67120UAN72) | 0.31 | -0.65 | 0.2132 | -0.0040 | |||||

| US579063AB46 / Condor Merger Sub Inc | 0.30 | 70.62 | 0.2107 | 0.0858 | |||||

| 6417 / Sankyo Co., Ltd. | 0.02 | -18.66 | 0.30 | 3.08 | 0.2100 | 0.0036 | |||

| OSUKF / Otsuka Corporation | 0.01 | -19.07 | 0.30 | -23.86 | 0.2097 | -0.0691 | |||

| AMANF / Amano Corporation | 0.01 | 23.91 | 0.29 | 44.12 | 0.2054 | 0.0610 | |||

| OMC / Omnicom Group Inc. | 0.00 | 3.24 | 0.29 | -10.40 | 0.2043 | -0.0266 | |||

| AAPL / Apple Inc. | 0.00 | -14.59 | 0.29 | -21.14 | 0.2035 | -0.0577 | |||

| GPC / Genuine Parts Company | 0.00 | 26.31 | 0.29 | 28.89 | 0.2023 | 0.0430 | |||

| HNDAF / Honda Motor Co., Ltd. | 0.03 | -17.77 | 0.29 | -12.50 | 0.2008 | -0.0312 | |||

| PRET 2025-NPL2 LLC PRET 2025 NPL2 A2 144A / ABS-O (US69392JAB52) | 0.29 | -1.03 | 0.2006 | -0.0046 | |||||

| SMAWF / Siemens Aktiengesellschaft | 0.00 | 67.77 | 0.29 | 120.77 | 0.2004 | 0.1081 | |||

| GEN / Gen Digital Inc. | 0.01 | -16.28 | 0.28 | -7.28 | 0.1958 | -0.0180 | |||

| 1BF / Phoenix Group Holdings plc | 0.03 | -43.50 | 0.28 | -31.08 | 0.1919 | -0.0902 | |||

| G / Assicurazioni Generali S.p.A. | 0.01 | -18.03 | 0.27 | -16.93 | 0.1852 | -0.0407 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | -37.97 | 0.27 | -25.56 | 0.1850 | -0.0681 | |||

| XS2342058034 / Allied Universal Holdco LLC/Allied Universal Finance Corp/Atlas Luxco 4 Sarl | 0.26 | 8.68 | 0.1835 | 0.0120 | |||||

| DOC / Healthpeak Properties, Inc. | 0.01 | 6.97 | 0.26 | -7.19 | 0.1802 | -0.0168 | |||

| PRET 2024-NPL6 LLC PRET 2024 NPL6 A2 144A / ABS-O (US69381QAB23) | 0.26 | -0.39 | 0.1800 | -0.0031 | |||||

| APA / APA Group - Debt/Equity Composite Units | 0.05 | -19.03 | 0.26 | -12.29 | 0.1796 | -0.0273 | |||

| WPC / W. P. Carey Inc. | 0.00 | -18.86 | 0.26 | -19.81 | 0.1783 | -0.0468 | |||

| TEXAS COMMERCIAL MORTGAGE TRUS TEXAS 2025 TWR D 144A / ABS-MBS (US88231WAG06) | 0.26 | 0.39 | 0.1780 | -0.0017 | |||||

| US46644FAX96 / JPMBB Commercial Mortgage Securities Trust 2015-C28 | 0.25 | 0.40 | 0.1778 | -0.0013 | |||||

| VOYA CLO 2018-3 LTD VOYA 2018 3A D 144A / ABS-CBDO (US92917KAE47) | 0.25 | 0.1746 | 0.1746 | ||||||

| HERTZ VEHICLE FINANCING III LL HERTZ 2025 1A D 144A / ABS-O (US42806MCW73) | 0.25 | -0.40 | 0.1738 | -0.0028 | |||||

| US30251GBD88 / FMG Resources August 2006 Pty. Ltd. | 0.25 | 48.50 | 0.1730 | 0.0545 | |||||

| COAL / Coal India Ltd | 0.05 | -18.82 | 0.25 | -19.81 | 0.1729 | -0.0453 | |||

| XS2628988730 / OLYMPUS WTR US HLDG CORP /EUR/ REGD REG S 9.62500000 | 0.25 | 120.54 | 0.1725 | 0.0930 | |||||

| US893830BX61 / Transocean Inc | 0.25 | 98.39 | 0.1721 | 0.0841 | |||||

| RATCH.F / Ratch Group PCL | 0.33 | -20.67 | 0.25 | -20.90 | 0.1716 | -0.0481 | |||

| BOELS TOPHOLDING BV SR SECURED REGS 05/30 5.75 / DBT (XS2806449190) | 0.24 | 10.41 | 0.1703 | 0.0141 | |||||

| BKR / Baker Hughes Company | 0.01 | 16.08 | 0.24 | 1.26 | 0.1695 | 0.0000 | |||

| BandM EUROPEAN VALUE RETAIL SA SR SECURED REGS 11/31 6.5 / DBT (XS2942371274) | 0.24 | 9.55 | 0.1687 | 0.0130 | |||||

| KEY / KeyCorp | 0.01 | 0.24 | 0.1684 | 0.1684 | |||||

| MSADF / MS&AD Insurance Group Holdings, Inc. | 0.01 | -2.13 | 0.24 | 0.84 | 0.1683 | -0.0011 | |||

| XS2406607171 / Teva Pharmaceutical Finance Netherlands II BV | 0.24 | 11.16 | 0.1673 | 0.0151 | |||||

| SPG / Simon Property Group, Inc. | 0.00 | -17.18 | 0.24 | -19.80 | 0.1670 | -0.0439 | |||

| XS2397198487 / Kaixo Bondco Telecom SA | 0.24 | 120.37 | 0.1666 | 0.0899 | |||||

| BARRY CALLEBAUT SERVICES NV COMPANY GUAR REGS 08/31 4.25 / DBT (BE6360449621) | 0.24 | 0.1653 | 0.1653 | ||||||

| NOV / Novo Nordisk A/S | 0.00 | 0.23 | 0.1626 | 0.1626 | |||||

| FORVIA SE SR UNSECURED REGS 06/31 5.5 / DBT (XS2774392638) | 0.23 | 123.08 | 0.1622 | 0.0885 | |||||

| BX TRUST 2025-GW BX 2025 GW E 144A / ABS-MBS (US12433GAJ58) | 0.23 | 0.1607 | 0.1607 | ||||||

| MAGNETITE XLV LTD MAGNE 2025 45A SUB 144A / ABS-CBDO (US55956DAE94) | 0.22 | 2.29 | 0.1558 | 0.0013 | |||||

| US60337JAA43 / Minerva Merger Sub Inc | 0.22 | 57.86 | 0.1544 | 0.0551 | |||||

| 005385 / Hyundai Motor Company - Preferred Stock | 0.00 | -40.23 | 0.22 | -32.21 | 0.1542 | -0.0762 | |||

| TRYG / Tryg A/S | 0.01 | -17.68 | 0.22 | -10.57 | 0.1540 | -0.0203 | |||

| ROMANIAN GOVERNMENT INTERNATIO SR UNSECURED 144A 07/32 5.875 / DBT (XS3021376259) | 0.22 | 10.66 | 0.1524 | 0.0129 | |||||

| RFR TRUST 2025-SGRM RFR 2025 SGRM E 144A / ABS-MBS (US74984NAL82) | 0.22 | -56.51 | 0.1518 | -0.2006 | |||||

| MCHP / Microchip Technology Incorporated | 0.00 | -16.20 | 0.22 | 21.91 | 0.1518 | 0.0256 | |||

| SSREF / Swiss Re AG | 0.00 | -79.57 | 0.22 | -79.23 | 0.1514 | -0.5868 | |||

| 8035 / Tokyo Electron Limited | 0.00 | -17.16 | 0.22 | 15.51 | 0.1509 | 0.0188 | |||

| US683720AA42 / Open Text Holdings Inc | 0.21 | 55.88 | 0.1483 | 0.0517 | |||||

| QGEN / Qiagen N.V. | 0.21 | 0.1481 | 0.1481 | ||||||

| US98162JAA43 / Worldwide Plaza Trust 2017-WWP | 0.21 | 0.1475 | 0.1475 | ||||||

| WE SODA INVESTMENTS HOLDING PL SR SECURED REGS 02/31 9.375 / DBT (USG95448AC32) | 0.21 | 1.95 | 0.1458 | 0.0008 | |||||

| SSUMF / Sumitomo Corporation | 0.01 | -51.60 | 0.21 | -45.41 | 0.1457 | -0.1238 | |||

| UPMKY / UPM-Kymmene Corp. | 0.01 | -16.86 | 0.21 | -15.45 | 0.1455 | -0.0286 | |||

| ARZ TRUST 2024-BILT ARZ 2024 BILT F 144A / ABS-MBS (US00218TAN46) | 0.21 | 0.49 | 0.1448 | -0.0009 | |||||

| OCP SA SR UNSECURED REGS 05/34 6.75 / DBT (XS2810168737) | 0.21 | 0.1445 | 0.1445 | ||||||

| RCO IX MORTGAGE LLC 2025-2 RCO 2025 2 A2 144A / ABS-MBS (US754930AB12) | 0.21 | 0.1440 | 0.1440 | ||||||

| 8411 / Mizuho Financial Group, Inc. | 0.01 | -16.41 | 0.20 | -15.48 | 0.1414 | -0.0279 | |||

| BELRON UK FINANCE PLC SR SECURED 144A 10/29 5.75 / DBT (US080782AA38) | 0.20 | 1.52 | 0.1406 | 0.0004 | |||||

| INFY / Infosys Limited | 0.01 | -17.16 | 0.20 | -15.61 | 0.1399 | -0.0275 | |||

| US00775CAB28 / Aegea Finance Sarl | 0.20 | 0.51 | 0.1394 | -0.0006 | |||||

| US12658HAG74 / CP ATLAS BUYER INC | 0.20 | 115.22 | 0.1384 | 0.0733 | |||||

| XS2232102876 / Altice France SA/France | 0.20 | 14.53 | 0.1381 | 0.0161 | |||||

| BRAZILIAN GOVERNMENT INTERNATI SR UNSECURED 03/34 6.125 / DBT (US105756CH10) | 0.20 | 1.55 | 0.1380 | 0.0007 | |||||

| US44409MAB28 / Hudson Pacific Properties LP | 0.20 | 432.43 | 0.1378 | 0.1112 | |||||

| US836205BC70 / Republic of South Africa Government International Bond | 0.20 | 0.1364 | 0.1364 | ||||||

| SLHN / Swiss Life Holding AG | 0.00 | 0.20 | 0.1363 | 0.1363 | |||||

| US86746CAA99 / SNVA 2020 AA A 144A | 0.19 | -3.96 | 0.1355 | -0.0075 | |||||

| ADI / Analog Devices, Inc. | 0.00 | -72.92 | 0.19 | -68.04 | 0.1354 | -0.2936 | |||

| FIBERCOP SPA SR SECURED REGS 11/33 6.375 / DBT (XS2806382938) | 0.19 | 2.11 | 0.1354 | 0.0012 | |||||

| RTPPF / Rio Tinto Group | 0.00 | -70.50 | 0.19 | -64.07 | 0.1353 | -0.2418 | |||

| BVA / Banco Bilbao Vizcaya Argentaria, S.A. | 0.01 | -18.67 | 0.19 | -8.53 | 0.1351 | -0.0140 | |||

| AVMPF / Asia Vital Components Co., Ltd. | 0.01 | -13.99 | 0.19 | 55.65 | 0.1346 | 0.0468 | |||

| 904784709 / Unilever N.V. | 0.00 | -18.94 | 0.19 | -17.03 | 0.1329 | -0.0294 | |||

| US64072TAC99 / CSC Holdings LLC | 0.19 | -1.55 | 0.1327 | -0.0043 | |||||

| EOG / EOG Resources, Inc. | 0.00 | -44.74 | 0.19 | -48.50 | 0.1322 | -0.1275 | |||

| US90320BAA70 / UPC Broadband Finco BV | 0.19 | 4.42 | 0.1319 | 0.0035 | |||||

| SandP500 EMINI FUT 0925 / DE (BBG01GZSXGL8) | 0.19 | 0.1311 | 0.1311 | ||||||

| US817565CF96 / Service Corp International/US | 0.18 | 37.59 | 0.1282 | 0.0338 | |||||

| US18539UAD72 / Clearway Energy Operating LLC | 0.18 | 110.34 | 0.1281 | 0.0660 | |||||

| VERISURE HOLDING AB SR SECURED REGS 05/30 5.5 / DBT (XS2816753979) | 0.18 | 10.91 | 0.1279 | 0.0109 | |||||

| GOLDSTORY SAS SR SECURED REGS 02/30 6.75 / DBT (XS2761223127) | 0.18 | 9.58 | 0.1279 | 0.0100 | |||||

| CROWN EUROPEAN HOLDINGS SACA COMPANY GUAR REGS 01/30 4.5 / DBT (XS2872799734) | 0.18 | 10.98 | 0.1275 | 0.0116 | |||||

| XS2247301794 / Peach Property Finance GmbH | 0.18 | 8.33 | 0.1275 | 0.0083 | |||||

| UNITED GROUP BV SR SECURED REGS 02/31 6.75 / DBT (XS2758078930) | 0.18 | 9.76 | 0.1262 | 0.0099 | |||||

| XS2083302419 / Angolan Government International Bond | 0.18 | 0.1262 | 0.1262 | ||||||

| USL79090AD51 / Rumo Luxembourg Sarl | 0.18 | 1.70 | 0.1250 | 0.0007 | |||||

| FORVIA SE SR UNSECURED REGS 06/29 5.125 / DBT (XS2774391580) | 0.18 | 11.95 | 0.1243 | 0.0119 | |||||

| XS2417090789 / WP/AP TELECOM HOLDINGS IV BV 3.750000% 01/15/2029 | 0.17 | 10.83 | 0.1219 | 0.0109 | |||||

| GJF / Gjensidige Forsikring ASA | 0.01 | -81.77 | 0.17 | -80.00 | 0.1213 | -0.4901 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -19.09 | 0.17 | -16.10 | 0.1205 | -0.0249 | |||

| US195325DR36 / Colombia Government International Bond | 0.17 | 1.78 | 0.1205 | 0.0009 | |||||

| IQVIA INC COMPANY GUAR 144A 06/32 6.25 / DBT (US46266TAG31) | 0.17 | 0.1181 | 0.1181 | ||||||

| US62482BAA08 / Mozart Debt Merger Sub Inc | 0.17 | 19.29 | 0.1171 | 0.0181 | |||||

| T / AT&T Inc. | 0.01 | -67.28 | 0.17 | -66.67 | 0.1164 | -0.2355 | |||

| ARENA LUXEMBOURG FINANCE SARL SR SECURED 144A 05/30 VAR / DBT (XS3038490507) | 0.17 | 9.93 | 0.1159 | 0.0089 | |||||

| 6669 / Wiwynn Corporation | 0.00 | -16.97 | 0.17 | 43.10 | 0.1158 | 0.0335 | |||

| ENI / Eni S.p.A. | 0.01 | -19.83 | 0.16 | -16.41 | 0.1142 | -0.0239 | |||

| 2308 / Delta Electronics, Inc. | 0.01 | 0.16 | 0.1141 | 0.1141 | |||||

| NHYKF / Norsk Hydro ASA | 0.03 | -16.26 | 0.16 | -16.84 | 0.1138 | -0.0251 | |||

| NSRGF / Nestlé S.A. | 0.00 | -18.72 | 0.16 | -20.20 | 0.1132 | -0.0301 | |||

| ES / Eversource Energy | 0.00 | 6.71 | 0.16 | 18.52 | 0.1121 | 0.0155 | |||

| PUNCH FINANCE PLC SR SECURED 144A 12/30 7.875 / DBT (XS3081707138) | 0.16 | 0.1120 | 0.1120 | ||||||

| 685847006 / SCSK CORP COMMON STOCK | 0.01 | -19.27 | 0.16 | -1.24 | 0.1111 | -0.0033 | |||

| HIGHTOWER HOLDING LLC SR UNSECURED 144A 01/30 9.125 / DBT (US43118DAB64) | 0.16 | 55.88 | 0.1109 | 0.0383 | |||||

| PDM / Piedmont Realty Trust, Inc. | 0.16 | 52.43 | 0.1102 | 0.0368 | |||||

| US855170AA41 / Star Parent Inc | 0.16 | 220.41 | 0.1100 | 0.0752 | |||||

| XS2643776680 / ADMIRAL GROUP PLC 8.5% 01/06/2034 REGS | 0.16 | 0.1090 | 0.1090 | ||||||

| 2899 / Zijin Mining Group Company Limited | 0.06 | 4.24 | 0.16 | 17.42 | 0.1086 | 0.0150 | |||

| CLEAR CHANNEL OUTDOOR HOLDINGS SR SECURED 144A 04/30 7.875 / DBT (US18453HAF38) | 0.15 | 26.23 | 0.1080 | 0.0214 | |||||

| US71654QDC33 / Petroleos Mexicanos | 0.15 | 69.23 | 0.1078 | 0.0431 | |||||

| AMGN / Amgen Inc. | 0.00 | -14.22 | 0.15 | -23.12 | 0.1069 | -0.0339 | |||

| ALX / Atlas Arteria Limited - Debt/Equity Composite Units | 0.05 | -63.08 | 0.15 | -59.36 | 0.1061 | -0.1580 | |||

| FORTRESS INTERMEDIATE 3 INC SR SECURED 144A 06/31 7.5 / DBT (US34966MAA09) | 0.15 | 19.84 | 0.1059 | 0.0170 | |||||

| MATTERHORN TELECOM SA SR SECURED REGS 01/30 4.5 / DBT (XS2985311518) | 0.15 | 0.1048 | 0.1048 | ||||||

| AVGO / Broadcom Inc. | 0.00 | -55.64 | 0.15 | -26.96 | 0.1044 | -0.0403 | |||

| BERTRAND FRANCHISE FINANCE SAS SR SECURED REGS 07/30 6.5 / DBT (XS2831585786) | 0.15 | 7.97 | 0.1040 | 0.0062 | |||||

| US88033GDH02 / Tenet Healthcare Corp | 0.15 | 54.17 | 0.1033 | 0.0351 | |||||

| TEAMSYSTEM SPA SR SECURED REGS 07/31 VAR / DBT (XS2864287466) | 0.15 | 8.89 | 0.1028 | 0.0072 | |||||

| XS2696111389 / GTCR W-2 Merger Sub LLC / GTCR W Dutch Finance Sub BV | 0.15 | 7.30 | 0.1026 | 0.0056 | |||||

| MRVL / Marvell Technology, Inc. | 0.00 | -15.68 | 0.15 | 5.80 | 0.1024 | 0.0046 | |||

| TK ELEVATOR MIDCO GMBH 2025 EUR TERM LOAN B1 / LON (XAD9000BAH50) | 0.15 | 8.96 | 0.1022 | 0.0074 | |||||

| SWK / Stanley Black & Decker, Inc. | 0.00 | -14.92 | 0.15 | -25.26 | 0.1015 | -0.0356 | |||

| US77314EAA64 / Rocket Software Inc | 0.15 | 23.93 | 0.1015 | 0.0183 | |||||

| US97360AAA51 / Windsor Holdings III LLC | 0.14 | 39.81 | 0.1009 | 0.0280 | |||||

| XS2491156902 / AA BOND CO LTD 7.375% 07/31/2050 REGS | 0.14 | 7.46 | 0.1005 | 0.0058 | |||||

| US23345MAB37 / DT MIDSTREAM INC 4.375% 06/15/2031 144A | 0.14 | 4.38 | 0.1002 | 0.0028 | |||||

| IPG / The Interpublic Group of Companies, Inc. | 0.01 | 128.50 | 0.14 | 107.25 | 0.1001 | 0.0509 | |||

| CIMPRESS PLC COMPANY GUAR 144A 09/32 7.375 / DBT (US17186HAH57) | 0.14 | 0.0998 | 0.0998 | ||||||

| SCMN / Swisscom AG | 0.00 | -78.27 | 0.14 | -75.93 | 0.0995 | -0.3202 | |||

| CPUK FINANCE LTD SECURED REGS 08/29 7.875 / DBT (XS2818818507) | 0.14 | 9.23 | 0.0994 | 0.0071 | |||||

| 2382 / Quanta Computer Inc. | 0.02 | -85.21 | 0.14 | -84.13 | 0.0992 | -0.5225 | |||

| US46643AAG85 / JPMBB Commercial Mortgage Securities Trust, Series 2014-C23, Class D | 0.14 | -2.08 | 0.0990 | -0.0032 | |||||

| SMURFIT WESTROCK PLC COMMON STOCK / EC (IE00028FXN24) | 0.00 | -55.61 | 0.14 | -61.75 | 0.0982 | -0.1477 | |||

| 005387 / Hyundai Motor Company - Preferred Stock | 0.00 | -43.76 | 0.14 | -35.19 | 0.0981 | -0.0545 | |||

| 1787 / Shandong Gold Mining Co Ltd | 0.04 | 0.14 | 0.0981 | 0.0981 | |||||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.00 | 36.94 | 0.14 | 56.18 | 0.0972 | 0.0342 | |||

| TRICON RESIDENTIAL 2025-SFR1 T TCN 2025 SFR1 E 144A / ABS-O (US895974AE33) | 0.14 | 0.00 | 0.0972 | -0.0016 | |||||

| OWENS-BROCKWAY GLASS CONTAINER COMPANY GUAR 144A 06/32 7.375 / DBT (US69073TAV52) | 0.14 | 140.35 | 0.0959 | 0.0555 | |||||

| DARLING GLOBAL FINANCE BV SR UNSECURED 144A 07/32 4.5 / DBT (XS3101876236) | 0.14 | 0.0959 | 0.0959 | ||||||

| HEATHROW FINANCE PLC SR SECURED REGS 03/31 6.625 / DBT (XS2782148261) | 0.14 | 6.25 | 0.0952 | 0.0047 | |||||

| 2383 / Elite Material Co., Ltd. | 0.00 | 0.14 | 0.0951 | 0.0951 | |||||

| SRG / Snam S.p.A. | 0.02 | -77.44 | 0.14 | -73.90 | 0.0950 | -0.2766 | |||

| US913229AA80 / United Wholesale Mortgage LLC | 0.14 | 0.75 | 0.0948 | -0.0005 | |||||

| SBK / Standard Bank Group Limited | 0.01 | -18.83 | 0.14 | -20.59 | 0.0947 | -0.0255 | |||

| US200474AE49 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0.14 | 0.0947 | 0.0947 | ||||||

| SATS / EchoStar Corporation | 0.13 | 0.0941 | 0.0941 | ||||||

| AMENTUM HOLDINGS INC COMPANY GUAR 144A 08/32 7.25 / DBT (US02352BAA35) | 0.13 | 35.71 | 0.0933 | 0.0238 | |||||

| XS1622694617 / Heathrow Finance PLC | 0.13 | 8.13 | 0.0929 | 0.0058 | |||||

| XS2346516250 / Natwest Group PLC | 0.13 | 0.0924 | 0.0924 | ||||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP 2023 4A D 144A / ABS-O (US05377RJS40) | 0.13 | 0.0912 | 0.0912 | ||||||

| US25260WAD39 / Diamond Foreign Asset Co / Diamond Finance LLC | 0.13 | 1.56 | 0.0908 | 0.0003 | |||||

| UKG INC SR SECURED 144A 02/31 6.875 / DBT (US90279XAA00) | 0.13 | 2.38 | 0.0904 | 0.0009 | |||||

| XS1752894292 / Banca Monte dei Paschi di Siena SpA | 0.13 | 9.40 | 0.0899 | 0.0067 | |||||

| HBAN / Huntington Bancshares Incorporated | 0.01 | -17.09 | 0.13 | -7.30 | 0.0888 | -0.0083 | |||

| TEQ / Telenor ASA | 0.01 | -19.55 | 0.13 | -12.50 | 0.0883 | -0.0137 | |||

| ILIAD HOLDING SASU SR SECURED REGS 04/31 6.875 / DBT (XS2810807094) | 0.13 | 0.0876 | 0.0876 | ||||||

| ROCKIES EXPRESS PIPELINE LLC SR UNSECURED 144A 03/33 6.75 / DBT (US77340RAU14) | 0.13 | 30.21 | 0.0873 | 0.0191 | |||||

| ROSSINI SARL SR SECURED REGS 12/29 6.75 / DBT (XS2854303729) | 0.12 | 10.71 | 0.0867 | 0.0070 | |||||

| XS2327414731 / Canary Wharf Group Investment Holdings PLC | 0.12 | 6.90 | 0.0867 | 0.0045 | |||||

| XS2621830681 / Emerald Debt Merger Sub LLC | 0.12 | 10.81 | 0.0863 | 0.0077 | |||||

| BX / Blackstone Inc. | 0.00 | -76.15 | 0.12 | -74.59 | 0.0863 | -0.2559 | |||

| 000815 / Samsung Fire & Marine Insurance Co., Ltd. - Preferred Stock | 0.00 | -17.99 | 0.12 | 6.96 | 0.0862 | 0.0043 | |||

| 2382 / Sunny Optical Technology (Group) Company Limited | 0.01 | -13.73 | 0.12 | -16.89 | 0.0860 | -0.0189 | |||

| CIRSA FINANCE INTERNATIONAL SA SR SECURED REGS 03/29 6.5 / DBT (XS2760863329) | 0.12 | 8.93 | 0.0857 | 0.0065 | |||||

| ECOPETROL SA SR UNSECURED 02/32 7.75 / DBT (US279158AW93) | 0.12 | 0.00 | 0.0857 | -0.0010 | |||||

| CAESARS ENTERTAINMENT INC COMPANY GUAR 144A 10/32 6 / DBT (US12769GAD25) | 0.12 | 5.17 | 0.0855 | 0.0031 | |||||

| TRIVIUM PACKAGING FINANCE BV SR SECURED 144A 07/30 6.625 / DBT (XS3080736617) | 0.12 | 0.0849 | 0.0849 | ||||||

| DDAIY / Daimler AG | 0.00 | -17.96 | 0.12 | -19.33 | 0.0848 | -0.0213 | |||

| ENERGO-PRO AS LOCAL GOVT G 144A 05/30 8 / DBT (XS3063695806) | 0.12 | 0.0848 | 0.0848 | ||||||

| Q-PARK HOLDING I BV SR SECURED REGS 02/30 5.125 / DBT (XS2848642984) | 0.12 | 11.01 | 0.0846 | 0.0073 | |||||

| PRU / Prudential Financial, Inc. | 0.00 | 0.12 | 0.0846 | 0.0846 | |||||

| SNF GROUP SACA SR UNSECURED 144A 03/32 4.5 / DBT (XS3021202000) | 0.12 | 13.08 | 0.0844 | 0.0083 | |||||

| ARDONAGH FINCO LTD SR SECURED 144A 02/31 6.875 / DBT (XS2765489484) | 0.12 | 0.0843 | 0.0843 | ||||||

| PEBBLEBROOK HOTEL LP / PEB FIN COMPANY GUAR 144A 10/29 6.375 / DBT (US70510LAA70) | 0.12 | 1.69 | 0.0841 | 0.0004 | |||||

| ACCORINVEST GROUP SA SR SECURED REGS 11/31 5.5 / DBT (XS2926264529) | 0.12 | 12.26 | 0.0836 | 0.0082 | |||||

| 2059 / King Slide Works Co., Ltd. | 0.00 | 0.12 | 0.0834 | 0.0834 | |||||

| XS2332590632 / Banco de Credito Social Cooperativo SA | 0.12 | 9.17 | 0.0833 | 0.0060 | |||||

| US045086AM71 / Ashton Woods USA LLC / Ashton Woods Finance Co | 0.12 | 5.31 | 0.0832 | 0.0034 | |||||

| CONSTELLIUM SE SR UNSECURED REGS 08/32 5.375 / DBT (XS2870878456) | 0.12 | -9.85 | 0.0832 | -0.0106 | |||||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.00 | 26.88 | 0.12 | 11.21 | 0.0832 | 0.0073 | |||

| LION/POLARIS LUX 4 SA SR SECURED REGS 07/29 VAR / DBT (XS2852970529) | 0.12 | 0.0825 | 0.0825 | ||||||

| XS2370814043 / PEOPLECERT WISDOM ISSUER PLC 5.75% 09/15/2026 REGS | 0.12 | 8.33 | 0.0822 | 0.0059 | |||||

| XS2417092132 / Wp/ap Telecom Holdings III BV | 0.12 | 0.0821 | 0.0821 | ||||||

| US105340AP80 / Brandywine Operating Partnership LP | 0.12 | 160.00 | 0.0821 | 0.0500 | |||||

| XS2275090749 / Sofima Holding SPA | 0.12 | 9.43 | 0.0815 | 0.0063 | |||||

| XS2105772201 / HEIMSTADEN BOSTAD AB 1.125% 01/21/2026 | 0.12 | 0.0812 | 0.0812 | ||||||

| XS2541618299 / VILLA DUTCH BIDCO BV 9.000000% 11/03/2029 | 0.12 | 6.42 | 0.0811 | 0.0036 | |||||

| US706451BG56 / Petroleos Mexicanos | 0.11 | 14.14 | 0.0793 | 0.0088 | |||||

| FR0013524865 / Auchan Holding SA | 0.11 | 10.78 | 0.0791 | 0.0067 | |||||

| SM / SM Energy Company | 0.11 | 0.0790 | 0.0790 | ||||||

| XS2393001891 / Grifols Escrow Issuer SA | 0.11 | 13.13 | 0.0785 | 0.0083 | |||||

| XS2111944133 / Arena Luxembourg Finance Sarl | 0.11 | 9.80 | 0.0785 | 0.0062 | |||||

| GRMN / Garmin Ltd. | 0.00 | -16.43 | 0.11 | -20.00 | 0.0785 | -0.0204 | |||

| SAMHALLSBYGGNADSBOLAGET I NORD COMPANY GUAR REGS 08/26 2.375 / DBT (XS2962827155) | 0.11 | 10.89 | 0.0784 | 0.0067 | |||||

| XS1824424706 / Petroleos Mexicanos | 0.11 | 13.13 | 0.0784 | 0.0083 | |||||

| XS2036387525 / Ardagh Packaging Finance PLC / Ardagh Holdings USA Inc | 0.11 | 0.0783 | 0.0783 | ||||||

| CIXPF / CaixaBank, S.A. | 0.01 | -18.33 | 0.11 | -9.76 | 0.0780 | -0.0089 | |||

| XS2394823418 / ZONCOLAN BIDCO SPA 4.875000% 10/21/2028 | 0.11 | 13.40 | 0.0771 | 0.0085 | |||||

| DLR / Digital Realty Trust, Inc. | 0.00 | -19.03 | 0.11 | -1.79 | 0.0771 | -0.0021 | |||

| BMW3 / Bayerische Motoren Werke Aktiengesellschaft - Preferred Stock | 0.00 | -17.93 | 0.11 | -9.09 | 0.0768 | -0.0093 | |||

| XS2272845798 / VZ Vendor Financing II BV | 0.11 | 10.42 | 0.0746 | 0.0066 | |||||

| XS2198191962 / Vertical Holdco GmbH | 0.11 | 9.28 | 0.0741 | 0.0053 | |||||

| CREDIT ACCEPTANCE CORP COMPANY GUAR 144A 12/28 9.25 / DBT (US225310AQ40) | 0.11 | 25.00 | 0.0738 | 0.0140 | |||||

| XS2310511717 / Ardagh Metal Packaging Finance USA LLC | 0.11 | 0.0736 | 0.0736 | ||||||

| PRET 2025-NPL6 LLC PRET 2025 NPL6 A2 144A / ABS-MBS (US740936AB56) | 0.11 | 0.0732 | 0.0732 | ||||||

| XS2340147813 / GLP Pte Ltd | 0.10 | 0.0730 | 0.0730 | ||||||

| US118230AJ01 / Buckeye Partners Lp 4.875% Senior Notes 02/01/21 | 0.10 | 1.98 | 0.0722 | 0.0005 | |||||

| INSIGHT ENTERPRISES INC COMPANY GUAR 144A 05/32 6.625 / DBT (US45765UAC71) | 0.10 | 37.33 | 0.0718 | 0.0185 | |||||

| NST / Northern Star Resources Limited | 0.01 | 25.53 | 0.10 | 34.21 | 0.0718 | 0.0177 | |||

| 8069 / E Ink Holdings Inc. | 0.01 | -15.79 | 0.10 | -22.14 | 0.0717 | -0.0210 | |||

| EVKG / Ever-Glory International Group, Inc. | 0.10 | 4.08 | 0.0716 | 0.0022 | |||||

| US925524AX89 / Viacom Inc Bond | 0.10 | -20.31 | 0.0714 | -0.0191 | |||||

| TALOS PRODUCTION INC SECURED 144A 02/31 9.375 / DBT (US87485LAE48) | 0.10 | 34.21 | 0.0712 | 0.0173 | |||||

| US65505PAA57 / Noble Finance II LLC | 0.10 | 2.02 | 0.0710 | 0.0004 | |||||

| US45258LAA52 / Imola Merger Corp | 0.10 | 42.25 | 0.0707 | 0.0204 | |||||

| US118230AM30 / BUCKEYE PARTNERS LP | 0.10 | 129.55 | 0.0707 | 0.0395 | |||||

| NATIONSTAR MORTGAGE HOLDINGS I COMPANY GUAR 144A 08/29 6.5 / DBT (US63861CAG42) | 0.10 | -19.84 | 0.0705 | -0.0190 | |||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP 2023 5A D 144A / ABS-O (US05377RKJ22) | 0.10 | 0.00 | 0.0704 | -0.0002 | |||||

| 2018 / AAC Technologies Holdings Inc. | 0.02 | -12.67 | 0.10 | -25.93 | 0.0704 | -0.0253 | |||

| US71654QBE17 / Petroleos Mexicanos | 0.10 | 0.0704 | 0.0704 | ||||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP 2023 3A D 144A / ABS-O (US05377RKH65) | 0.10 | 0.00 | 0.0703 | -0.0003 | |||||

| EIX / Edison International | 0.00 | -11.23 | 0.10 | -42.86 | 0.0703 | -0.0545 | |||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0.10 | 3.09 | 0.0698 | 0.0008 | |||||

| MATADOR RESOURCES CO COMPANY GUAR 144A 04/32 6.5 / DBT (US576485AG13) | 0.10 | 1.01 | 0.0698 | -0.0002 | |||||

| X-CALIBER FUNDING LLC XCAL 2025 VFN1 A 144A / ABS-MBS (US98373XBZ24) | 0.10 | 0.0697 | 0.0697 | ||||||

| D / Dominion Energy, Inc. | 0.00 | -16.97 | 0.10 | -16.10 | 0.0694 | -0.0146 | |||

| US05352TAA79 / AVANTOR FUNDING INC 4.625% 07/15/2028 144A | 0.10 | 2.08 | 0.0685 | 0.0004 | |||||

| US68245XAJ81 / 1011778 BC ULC / New Red Finance Inc | 0.10 | 2.08 | 0.0684 | 0.0005 | |||||

| MDT / Medtronic plc | 0.00 | -18.23 | 0.10 | -21.14 | 0.0681 | -0.0188 | |||

| US043436AW48 / Asbury Automotive Group Inc | 0.10 | 3.23 | 0.0673 | 0.0012 | |||||

| US71376LAE02 / Performance Food Group, Inc. | 0.10 | 3.23 | 0.0672 | 0.0012 | |||||

| ORCL / Oracle Corporation | 0.00 | -1.34 | 0.10 | 54.84 | 0.0672 | 0.0231 | |||

| US00489LAF04 / ACRISURE LLC / ACRISURE FINANCE INC | 0.10 | 2.15 | 0.0669 | 0.0009 | |||||

| US12769GAA85 / Caesars Entertainment Inc | 0.10 | 4.40 | 0.0666 | 0.0017 | |||||

| US043436AX21 / Asbury Automotive Group Inc | 0.10 | 111.11 | 0.0664 | 0.0343 | |||||

| US84748EAF79 / SPECIALTY BUILDING TERM B 1LN 10/15/2028 | 0.10 | 1.06 | 0.0663 | -0.0006 | |||||

| 9992 / Pop Mart International Group Limited | 0.00 | 0.09 | 0.0662 | 0.0662 | |||||

| US12008RAN70 / Builders FirstSource Inc | 0.09 | 30.99 | 0.0650 | 0.0144 | |||||

| LBM ACQUISITION LLC 2024 INCREMENTAL TERM LOAN B / LON (US50179JAH14) | 0.09 | 0.00 | 0.0646 | -0.0004 | |||||

| US71654QCC42 / Petroleos Mexicanos Bond | 0.09 | 5.88 | 0.0631 | 0.0028 | |||||

| KYO / Kyocera Corp. | 0.01 | -63.66 | 0.09 | -61.37 | 0.0630 | -0.1021 | |||

| LABL INC SR SECURED 144A 10/31 8.625 / DBT (US50168QAF28) | 0.09 | 50.85 | 0.0626 | 0.0206 | |||||

| 1818 / Zhaojin Mining Industry Company Limited | 0.03 | 0.09 | 0.0625 | 0.0625 | |||||

| 2345 / Accton Technology Corporation | 0.00 | 0.09 | 0.0621 | 0.0621 | |||||

| 4684 / OBIC Co.,Ltd. | 0.00 | -19.75 | 0.09 | 7.32 | 0.0619 | 0.0040 | |||

| US12008RAP29 / Builders FirstSource Inc | 0.09 | 31.34 | 0.0614 | 0.0140 | |||||

| BAS / BASF SE | 0.00 | -64.76 | 0.09 | -65.34 | 0.0609 | -0.1165 | |||

| SUN / Suncorp Group Limited | 0.01 | -19.28 | 0.09 | -5.49 | 0.0603 | -0.0040 | |||

| F / Ford Motor Company | 0.01 | -17.46 | 0.08 | -11.58 | 0.0592 | -0.0079 | |||

| 6981 / Murata Manufacturing Co., Ltd. | 0.01 | -18.09 | 0.08 | -21.50 | 0.0588 | -0.0171 | |||

| US071734AN72 / Bausch Health Cos Inc | 0.08 | 0.0588 | 0.0588 | ||||||

| US44106MAY84 / Service Properties Trust | 0.08 | 0.0586 | 0.0586 | ||||||

| 2376 / Giga-Byte Technology Co., Ltd. | 0.01 | 0.08 | 0.0585 | 0.0585 | |||||

| US893647BQ97 / CORP. NOTE | 0.08 | 76.60 | 0.0582 | 0.0247 | |||||

| US01883LAB99 / Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer | 0.08 | 0.0575 | 0.0575 | ||||||

| EMR / Emerson Electric Co. | 0.00 | -16.51 | 0.08 | 1.23 | 0.0574 | 0.0002 | |||

| ROCKET COS INC SR UNSECURED 144A 08/30 6.125 / DBT (US77311WAA99) | 0.08 | 0.0568 | 0.0568 | ||||||

| PKO / Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna | 0.00 | -18.34 | 0.08 | -12.90 | 0.0568 | -0.0090 | |||

| BRANDYWINE OPERATING PARTNERSH COMPANY GUAR 04/29 8.875 / DBT (US105340AS20) | 0.08 | 55.77 | 0.0566 | 0.0196 | |||||

| US92676XAG25 / Viking Cruises Ltd | 0.08 | 0.00 | 0.0563 | -0.0002 | |||||

| EXR / Extra Space Storage Inc. | 0.00 | -88.78 | 0.08 | -89.06 | 0.0550 | -0.4518 | |||

| US71424VAA89 / Permian Resources Operating LLC | 0.08 | 0.0542 | 0.0542 | ||||||

| US668771AK49 / NortonLifeLock Inc | 0.08 | 0.0532 | 0.0532 | ||||||

| SUNOCO LP COMPANY GUAR 144A 07/33 6.25 / DBT (US86765KAD19) | 0.08 | 52.00 | 0.0532 | 0.0178 | |||||

| US12429TAD63 / Mauser Packaging Solutions Holding Co | 0.08 | 4.11 | 0.0532 | 0.0013 | |||||

| US22282EAJ10 / Covanta Holding Corp | 0.08 | 50.00 | 0.0527 | 0.0168 | |||||

| US12543DBM11 / CHS/Community Health Systems Inc | 0.08 | 53.06 | 0.0526 | 0.0176 | |||||

| US911365BL76 / United Rentals North America Inc 5.25% 01/15/2030 | 0.08 | 0.0524 | 0.0524 | ||||||

| 3533 / Lotes Co., Ltd. | 0.00 | 0.08 | 0.0524 | 0.0524 | |||||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.00 | -85.28 | 0.07 | -85.58 | 0.0523 | -0.3105 | |||

| US85172FAR01 / Springleaf Finance Corp 5.375% 11/15/2029 | 0.07 | 2.82 | 0.0514 | 0.0011 | |||||

| SPECIALTY BUILDING PRODUCTS HO SR SECURED 144A 10/29 7.75 / DBT (US84749AAC18) | 0.07 | 217.39 | 0.0514 | 0.0351 | |||||

| 4704 / Trend Micro Incorporated | 0.00 | -33.63 | 0.07 | -32.08 | 0.0505 | -0.0247 | |||

| US70932MAB37 / PENNYMAC FIN SVCS INC REGD 144A P/P 4.25000000 | 0.07 | 2.86 | 0.0503 | 0.0008 | |||||

| PENNYMAC FINANCIAL SERVICES IN COMPANY GUAR 144A 02/33 6.875 / DBT (US70932MAF41) | 0.07 | 44.90 | 0.0500 | 0.0150 | |||||

| WFC / Wells Fargo & Company | 0.00 | -8.50 | 0.07 | 1.43 | 0.0499 | 0.0004 | |||

| BA/ / BAE Systems PLC | 0.00 | -55.26 | 0.07 | -43.09 | 0.0495 | -0.0376 | |||

| RF / Regions Financial Corporation | 0.00 | 2.33 | 0.07 | 11.11 | 0.0489 | 0.0042 | |||

| AKERB / AKER BP ASA COMMON STOCK NOK1.0 | 0.00 | -10.71 | 0.07 | -2.78 | 0.0489 | -0.0025 | |||

| US35640YAK38 / Freedom Mortgage Corp | 0.07 | 30.19 | 0.0487 | 0.0108 | |||||

| US55903VBE20 / Warnermedia Holdings Inc | 0.07 | 0.0486 | 0.0486 | ||||||

| 285 / BYD Electronic (International) Company Limited | 0.02 | -37.49 | 0.07 | -51.43 | 0.0479 | -0.0515 | |||

| US70932MAC10 / PennyMac Financial Services Inc | 0.07 | 44.68 | 0.0479 | 0.0144 | |||||

| MATV / Mativ Holdings, Inc. | 0.07 | 4.69 | 0.0474 | 0.0017 | |||||

| LHL / Lenovo Group Limited | 0.06 | -9.17 | 0.07 | -20.24 | 0.0474 | -0.0120 | |||

| FREEDOM MORTGAGE HOLDINGS LLC SR UNSECURED 144A 02/29 9.25 / DBT (US35641AAA60) | 0.07 | 34.00 | 0.0471 | 0.0112 | |||||

| EVKG / Ever-Glory International Group, Inc. | 0.07 | -9.59 | 0.0465 | -0.0052 | |||||

| IP / International Paper Company | 0.00 | -57.42 | 0.07 | -37.14 | 0.0465 | -0.0343 | |||

| US516806AH93 / Laredo Petroleum Inc | 0.07 | -8.33 | 0.0462 | -0.0053 | |||||

| SandP MID 400 EMINI 0925 / DE (BBG01NC8QNB6) | 0.07 | 0.0461 | 0.0461 | ||||||

| FREEDOM MORTGAGE HOLDINGS LLC SR UNSECURED 144A 04/32 8.375 / DBT (US35641AAC27) | 0.07 | 35.42 | 0.0458 | 0.0113 | |||||

| AVNT / Avient Corporation | 0.07 | 1.56 | 0.0458 | 0.0003 | |||||

| APO / Apollo Global Management, Inc. | 0.00 | 2.70 | 0.06 | 6.67 | 0.0451 | 0.0022 | |||

| ANZ / ANZ Group Holdings Limited | 0.00 | -18.81 | 0.06 | -14.67 | 0.0450 | -0.0086 | |||

| US040114HU71 / Argentine Republic Government International Bond | 0.06 | 0.0447 | 0.0447 | ||||||

| US87927VAR96 / Telecom Italia Capital 7.2% Senior Notes 7/18/36 | 0.06 | 5.00 | 0.0445 | 0.0020 | |||||

| CTRA / Coterra Energy Inc. | 0.00 | -18.90 | 0.06 | -29.21 | 0.0443 | -0.0187 | |||

| BMRI / PT Bank Mandiri (Persero) Tbk | 0.21 | -11.85 | 0.06 | -15.07 | 0.0435 | -0.0081 | |||

| US1248EPCE15 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.06 | 35.56 | 0.0432 | 0.0111 | |||||

| US29269RAA32 / Enerflex Ltd | 0.06 | 0.00 | 0.0431 | -0.0002 | |||||

| ACN / Accenture plc | 0.00 | -16.73 | 0.06 | -21.05 | 0.0425 | -0.0115 | |||

| SRI LANKA GOVERNMENT INTERNATI SR UNSECURED 144A 05/36 VAR / DBT (XS2966241874) | 0.06 | 0.0425 | 0.0425 | ||||||

| PLANET FINANCIAL GROUP LLC COMPANY GUAR 144A 12/29 10.5 / DBT (US72702AAA51) | 0.06 | 0.00 | 0.0419 | -0.0006 | |||||

| VELOCITY VEHICLE GROUP LLC SR UNSECURED 144A 06/29 8 / DBT (US92262TAA43) | 0.06 | 0.0418 | 0.0418 | ||||||

| KMB / Kimberly-Clark Corporation | 0.00 | -16.76 | 0.06 | -25.64 | 0.0411 | -0.0140 | |||

| BYDDY / BYD Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.06 | 0.0397 | 0.0397 | |||||

| US81105DAA37 / SCRIPPS ESCROW II INC SR SECURED 144A 01/29 3.875 | 0.06 | 0.0395 | 0.0395 | ||||||

| EVGGF / Evolution AB (publ) | 0.00 | 200.42 | 0.06 | 64.71 | 0.0394 | 0.0178 | |||

| SJM / The J. M. Smucker Company | 0.00 | -16.81 | 0.06 | -30.86 | 0.0393 | -0.0184 | |||

| ROCKET COS INC SR UNSECURED 144A 08/33 6.375 / DBT (US77311WAB72) | 0.06 | 0.0392 | 0.0392 | ||||||

| SHMZF / Shimadzu Corporation | 0.00 | -10.15 | 0.06 | -11.29 | 0.0390 | -0.0054 | |||

| ACRISURE LLC / ACRISURE FINANC SR SECURED 144A 07/32 6.75 / DBT (US004961AA64) | 0.06 | 0.0389 | 0.0389 | ||||||

| US12597YAA73 / CP ATLAS BUYER INC 7% 12/01/2028 144A | 0.06 | 17.02 | 0.0387 | 0.0052 | |||||

| US527298BT90 / LEVEL 3 FINANCING INC 3.75% 07/15/2029 144A | 0.05 | 50.00 | 0.0381 | 0.0125 | |||||

| GREAT CANADIAN GAMING CORP/RAP SR SECURED 144A 11/29 8.75 / DBT (US389925AA64) | 0.05 | -18.46 | 0.0375 | -0.0086 | |||||

| US105340AR47 / Brandywine Operating Partnership LP | 0.05 | 3.92 | 0.0374 | 0.0008 | |||||

| US85205TAN00 / Spirit AeroSystems Inc | 0.05 | 0.00 | 0.0370 | -0.0007 | |||||

| US66977WAT62 / NOVA Chemicals Corp. | 0.05 | 0.0368 | 0.0368 | ||||||

| US670001AE60 / Novelis Corp | 0.05 | 1.96 | 0.0368 | 0.0005 | |||||

| US893647BT37 / TransDigm Inc | 0.05 | 1.96 | 0.0365 | 0.0002 | |||||

| US22303XAA37 / Covert Mergeco Inc | 0.05 | 1.96 | 0.0365 | 0.0004 | |||||

| US44332EAP16 / Hub International Ltd., Term Loan | 0.05 | 4.00 | 0.0365 | 0.0005 | |||||

| US44332PAH47 / HUB International Ltd | 0.05 | 1.96 | 0.0364 | 0.0001 | |||||

| ALLIED UNIVERSAL HOLDCO LLC SR SECURED 144A 02/31 7.875 / DBT (US019576AD90) | 0.05 | 0.0364 | 0.0364 | ||||||

| US05552BAA44 / LBM Acquisition LLC | 0.05 | 1.96 | 0.0363 | 0.0002 | |||||

| LEVEL 3 FINANCING INC SECURED 144A 10/30 3.875 / DBT (US527298CF87) | 0.05 | 15.56 | 0.0363 | 0.0043 | |||||

| US38016LAC90 / Go Daddy Operating Co LLC / GD Finance Co Inc | 0.05 | 2.00 | 0.0362 | 0.0003 | |||||

| CNK / Cinemark Holdings, Inc. | 0.05 | 2.00 | 0.0362 | 0.0006 | |||||

| UNITED RENTALS NORTH AMERICA I COMPANY GUAR 144A 03/34 6.125 / DBT (US911365BR47) | 0.05 | 2.00 | 0.0359 | 0.0006 | |||||

| US55305BAV36 / M/I Homes, Inc. | 0.05 | 2.00 | 0.0359 | 0.0004 | |||||

| US88033GDQ01 / CORP. NOTE | 0.05 | 0.0355 | 0.0355 | ||||||

| US87724RAB87 / Taylor Morrison Communities, Inc. | 0.05 | -67.95 | 0.0354 | -0.0628 | |||||

| CREDIT ACCEPTANCE CORP COMPANY GUAR 144A 03/30 6.625 / DBT (US225310AS06) | 0.05 | 2.04 | 0.0353 | 0.0005 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 0.05 | 0.0352 | 0.0352 | ||||||

| US62886HBK68 / CONV. NOTE | 0.05 | 0.00 | 0.0348 | -0.0000 | |||||

| US1248EPBX05 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.05 | 0.0345 | 0.0345 | ||||||

| US988498AL59 / YUM! Brands Inc. | 0.05 | 2.08 | 0.0345 | 0.0004 | |||||

| REXFORD INDUSTRIAL REALTY LP COMPANY GUAR 144A 03/27 4.375 / DBT (US76169XAD66) | 0.05 | 0.00 | 0.0345 | -0.0007 | |||||

| US18539UAC99 / Clearway Energy Operating LLC | 0.05 | 2.08 | 0.0345 | 0.0002 | |||||

| REXFORD INDUSTRIAL REALTY LP COMPANY GUAR 144A 03/29 4.125 / DBT (US76169XAE40) | 0.05 | -2.04 | 0.0341 | -0.0008 | |||||

| US44409MAD83 / Hudson Pacific Properties LP | 0.05 | 11.63 | 0.0340 | 0.0033 | |||||

| MERITAGE HOMES CORP COMPANY GUAR 05/28 1.75 / DBT (US59001ABF84) | 0.05 | 0.0338 | 0.0338 | ||||||

| ECOPETROL SA SR UNSECURED 01/36 8.375 / DBT (US279158AV11) | 0.05 | 0.00 | 0.0336 | -0.0008 | |||||

| US86765LAZ04 / Sunoco LP/Sunoco Finance Corp. | 0.05 | 0.0335 | 0.0335 | ||||||

| US05352TAB52 / AVTR 3 7/8 11/01/29 | 0.05 | 0.0330 | 0.0330 | ||||||

| O2NS34 / ON Semiconductor Corporation - Depositary Receipt (Common Stock) | 0.05 | 119.05 | 0.0322 | 0.0170 | |||||

| US81104PAA75 / Scripps Escrow Inc 5.875% 07/15/2027 144A | 0.04 | 7.32 | 0.0310 | 0.0016 | |||||

| US44106MBB72 / Hospitality Properties Trust Note M/w Clbl Bond | 0.04 | 0.0304 | 0.0304 | ||||||

| BOUGHT CHF/SOLD USD / DFE (N/A) | 0.04 | 0.0300 | 0.0300 | ||||||

| CLYDESDALE ACQUISITION HOLDING SR SECURED 144A 01/30 6.875 / DBT (US18972EAC93) | 0.04 | -60.00 | 0.0285 | -0.0426 | |||||

| US172441BF30 / Cinemark USA Inc | 0.04 | 2.63 | 0.0278 | 0.0004 | |||||

| US71654QDD16 / Petroleos Mexicanos | 0.04 | 0.0274 | 0.0274 | ||||||

| SATS / EchoStar Corporation | 0.03 | 0.0215 | 0.0215 | ||||||

| PLANET FINANCIAL GROUP LLC COMPANY GUAR 144A 12/29 10.5 / DBT (US72702AAB35) | 0.03 | 0.0209 | 0.0209 | ||||||

| US118230AJ01 / Buckeye Partners Lp 4.875% Senior Notes 02/01/21 | 0.03 | -66.67 | 0.0181 | -0.0355 | |||||

| PENNYMAC FINANCIAL SERVICES IN COMPANY GUAR 144A 11/30 7.125 / DBT (US70932MAE75) | 0.03 | 0.0181 | 0.0181 | ||||||

| TALOS PRODUCTION INC SECURED 144A 02/29 9 / DBT (US87485LAD64) | 0.03 | 0.00 | 0.0178 | -0.0003 | |||||

| US18972EAA38 / Clydesdale Acquisition Holdings Inc | 0.03 | 0.00 | 0.0177 | -0.0001 | |||||

| PERMIAN RESOURCES OPERATING LL COMPANY GUAR 144A 02/33 6.25 / DBT (US71424VAB62) | 0.03 | -74.75 | 0.0176 | -0.0527 | |||||

| US57763RAC16 / Mauser Packaging Solutions Holding Co. | 0.02 | -48.94 | 0.0173 | -0.0160 | |||||

| US18453HAD89 / CLEAR CHANNEL OUTDOOR HOLDINGS INC 7.5% 06/01/2029 144A | 0.02 | 15.00 | 0.0161 | 0.0015 | |||||

| VTLE / Vital Energy, Inc. | 0.02 | -54.35 | 0.0149 | -0.0180 | |||||

| ADIENT GLOBAL HOLDINGS LTD COMPANY GUAR 144A 02/33 7.5 / DBT (US00687YAD76) | 0.02 | -78.49 | 0.0143 | -0.0518 | |||||

| US44409MAC01 / Hudson Pacific Properties LP | 0.02 | 0.0143 | 0.0143 | ||||||

| US 2YR NOTE CBT 0925 / DIR (US91282CKV27) | 0.02 | 0.0112 | 0.0112 | ||||||

| US05508WAC91 / B&G Foods Inc | 0.01 | -6.67 | 0.0101 | -0.0006 | |||||

| PENNYMAC FINANCIAL SERVICES IN COMPANY GUAR 144A 05/32 6.875 / DBT (US70932MAG24) | 0.01 | 0.0071 | 0.0071 | ||||||

| US912810TW80 / United States Treasury Note/Bond | 0.00 | 0.0027 | 0.0027 | ||||||

| EURO-BOBL FUTURE 0925 / DIR (DE000F1NGF61) | 0.00 | 0.0016 | 0.0016 | ||||||

| EURO-SCHATZ FUT 0925 / DIR (DE000F1NGF79) | 0.00 | 0.0009 | 0.0009 | ||||||

| CDS VOLKSWAGEN AKTIENGESELLSCHAFT P 100 20300620 / DCR (N/A) | 0.00 | 0.0008 | 0.0008 | ||||||

| SBER / Sberbank of Russia PJSC | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| VTBR / VTB Bank (public joint-stock company) - Depositary Receipt (Common Stock) | 0.06 | 0.00 | 0.00 | 0.0000 | -0.0000 | ||||

| CDS HSBC HOLDINGS plc P 100 20300620 / DCR (N/A) | -0.00 | -0.0008 | -0.0008 | ||||||

| SOLD JPY/BOUGHT USD / DFE (N/A) | -0.00 | -0.0023 | -0.0023 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | -0.00 | -0.0025 | -0.0025 | ||||||

| US 10YR ULTRA FUT 0925 / DIR (US91282CMM00) | -0.00 | -0.0027 | -0.0027 | ||||||

| LONG GILT FUTURE 0925 / DIR (GB00MP6FM953) | -0.01 | -0.0037 | -0.0037 | ||||||

| SOLD GBP/BOUGHT USD / DFE (N/A) | -0.04 | -0.0277 | -0.0277 | ||||||

| SOLD CHF/BOUGHT USD / DFE (N/A) | -0.10 | -0.0695 | -0.0695 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | -0.18 | -0.1234 | -0.1234 | ||||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | -0.27 | -0.1913 | -0.1913 |