Statistik Asas

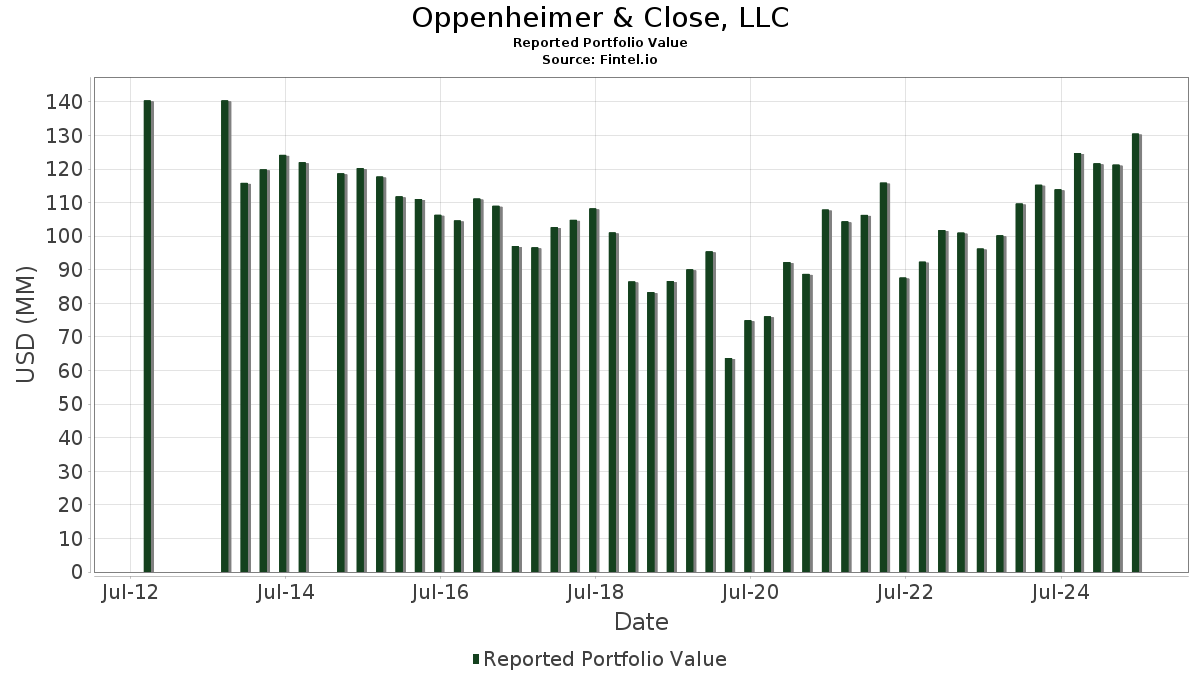

| Nilai Portfolio | $ 130,508,159 |

| Kedudukan Semasa | 52 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Oppenheimer & Close, LLC telah mendedahkan 52 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 130,508,159 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Oppenheimer & Close, LLC ialah Agnico Eagle Mines Limited (US:AEM) , Build-A-Bear Workshop, Inc. (US:BBW) , Hurco Companies, Inc. (US:HURC) , Alamos Gold Inc. (US:AGI) , and Hecla Mining Company (US:HL) . Kedudukan baharu Oppenheimer & Close, LLC termasuk Barrick Mining Corporation (US:B) , Carter Bankshares, Inc. (US:CARE) , Mid Penn Bancorp, Inc. (US:MPB) , Winchester Bancorp, Inc. (US:WSBK) , and Rio Tinto Group - Depositary Receipt (Common Stock) (US:RIO) . Industri teratas Oppenheimer & Close, LLC ialah "Business Services" (sic 73) , "Printing, Publishing, And Allied Industries" (sic 27) , and "Real Estate" (sic 65) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.97 | 5.80 | 4.4456 | 3.1810 | |

| 0.12 | 2.52 | 1.9273 | 1.9273 | |

| 0.14 | 5.13 | 3.9318 | 0.9378 | |

| 0.13 | 5.45 | 4.1766 | 0.8343 | |

| 0.06 | 1.08 | 0.8304 | 0.8304 | |

| 0.03 | 0.90 | 0.6904 | 0.6904 | |

| 0.35 | 6.61 | 5.0662 | 0.5794 | |

| 1.04 | 5.15 | 3.9425 | 0.4988 | |

| 0.24 | 2.09 | 1.6033 | 0.4503 | |

| 0.19 | 9.56 | 7.3279 | 0.4162 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 4.49 | 3.4400 | -1.2333 | |

| 0.34 | 5.32 | 4.0746 | -0.6972 | |

| 0.23 | 6.22 | 4.7622 | -0.3959 | |

| 0.05 | 2.48 | 1.8988 | -0.3546 | |

| 0.09 | 2.28 | 1.7437 | -0.3367 | |

| 0.09 | 2.50 | 1.9192 | -0.2782 | |

| 0.03 | 1.50 | 1.1506 | -0.1995 | |

| 0.10 | 2.16 | 1.6546 | -0.1668 | |

| 0.09 | 1.41 | 1.0804 | -0.1658 | |

| 0.55 | 2.81 | 2.1533 | -0.1486 |

Pemfailan 13D/G

Ini ialah senarai pemfailan 13D dan 13G yang dibuat pada tahun lepas (jika ada). Klik ikon pautan untuk melihat sejarah transaksi penuh. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup.

| Tarikh Fail | Borang | Sekuriti | Saham Terdahulu |

Saham Semasa |

ΔSaham % | % Pemilikan |

% ΔPemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-02-13 | CPTP / Capital Properties, Inc. | 344,581 | 5.22 | |||||

| 2024-11-04 | HURC / Hurco Companies, Inc. |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-12 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AEM / Agnico Eagle Mines Limited | 0.08 | -3.51 | 9.67 | 5.85 | 7.4128 | -0.1245 | |||

| BBW / Build-A-Bear Workshop, Inc. | 0.19 | -17.74 | 9.56 | 14.10 | 7.3279 | 0.4162 | |||

| HURC / Hurco Companies, Inc. | 0.35 | -0.27 | 6.61 | 21.53 | 5.0662 | 0.5794 | |||

| AGI / Alamos Gold Inc. | 0.23 | 0.00 | 6.22 | -0.62 | 4.7622 | -0.3959 | |||

| HL / Hecla Mining Company | 0.97 | 251.20 | 5.80 | 278.41 | 4.4456 | 3.1810 | |||

| GLD / SPDR Gold Trust | 0.02 | 1.10 | 5.63 | 6.96 | 4.3124 | -0.0272 | |||

| TAYD / Taylor Devices, Inc. | 0.13 | 0.00 | 5.45 | 34.50 | 4.1766 | 0.8343 | |||

| BRT / BRT Apartments Corp. | 0.34 | -0.11 | 5.32 | -8.11 | 4.0746 | -0.6972 | |||

| NGD / New Gold Inc. | 1.04 | -7.65 | 5.15 | 23.23 | 3.9425 | 0.4988 | |||

| IIIN / Insteel Industries, Inc. | 0.14 | -0.10 | 5.13 | 41.35 | 3.9318 | 0.9378 | |||

| CSCO / Cisco Systems, Inc. | 0.07 | -1.37 | 4.59 | 10.89 | 3.5196 | 0.1037 | |||

| GLW / Corning Incorporated | 0.09 | -0.66 | 4.53 | 14.14 | 3.4697 | 0.1975 | |||

| SENEA / Seneca Foods Corporation | 0.04 | -30.45 | 4.49 | -20.77 | 3.4400 | -1.2333 | |||

| NEM / Newmont Corporation | 0.07 | 0.00 | 3.93 | 20.68 | 3.0090 | 0.3253 | |||

| SMHI / SEACOR Marine Holdings Inc. | 0.55 | -0.11 | 2.81 | 0.68 | 2.1533 | -0.1486 | |||

| CPBI / Central Plains Bancshares, Inc. | 0.17 | 0.00 | 2.65 | 1.34 | 2.0277 | -0.1255 | |||

| B / Barrick Mining Corporation | 0.12 | 2.52 | 1.9273 | 1.9273 | |||||

| FRPH / FRP Holdings, Inc. | 0.09 | -0.13 | 2.50 | -6.01 | 1.9192 | -0.2782 | |||

| UHALB / U-Haul Holding Company - Series N | 0.05 | -1.29 | 2.48 | -9.30 | 1.8988 | -0.3546 | |||

| BVFL / BV Financial, Inc. | 0.15 | 0.00 | 2.28 | -0.22 | 1.7505 | -0.1372 | |||

| PFE / Pfizer Inc. | 0.09 | -5.70 | 2.28 | -9.79 | 1.7437 | -0.3367 | |||

| TRC / Tejon Ranch Co. | 0.13 | 0.00 | 2.23 | 7.00 | 1.7112 | -0.0100 | |||

| INTC / Intel Corporation | 0.10 | -0.88 | 2.16 | -2.22 | 1.6546 | -0.1668 | |||

| CDE / Coeur Mining, Inc. | 0.24 | 0.00 | 2.09 | 49.64 | 1.6033 | 0.4503 | |||

| HTB / HomeTrust Bancshares, Inc. | 0.05 | 0.00 | 2.00 | 9.13 | 1.5309 | 0.0211 | |||

| ESSA / ESSA Bancorp, Inc. | 0.09 | 0.00 | 1.67 | 2.89 | 1.2810 | -0.0586 | |||

| NE / Noble Corporation plc | 0.06 | 0.00 | 1.63 | 12.04 | 1.2486 | 0.0490 | |||

| SFBC / Sound Financial Bancorp, Inc. | 0.03 | 0.00 | 1.50 | -8.31 | 1.1506 | -0.1995 | |||

| NBBK / NB Bancorp, Inc. | 0.08 | 0.00 | 1.48 | -1.13 | 1.1358 | -0.1010 | |||

| PBHC / Pathfinder Bancorp, Inc. | 0.09 | 0.00 | 1.41 | -6.75 | 1.0804 | -0.1658 | |||

| AXR / AMREP Corporation | 0.07 | 0.00 | 1.40 | 4.40 | 1.0737 | -0.0333 | |||

| CNH / CNH Industrial N.V. | 0.10 | 0.00 | 1.29 | 5.46 | 0.9915 | -0.0196 | |||

| CARE / Carter Bankshares, Inc. | 0.06 | 1.08 | 0.8304 | 0.8304 | |||||

| IROQ / IF Bancorp, Inc. | 0.04 | 0.00 | 1.08 | 1.03 | 0.8274 | -0.0537 | |||

| ASRV / AmeriServ Financial, Inc. | 0.35 | 0.00 | 1.07 | 25.12 | 0.8213 | 0.1147 | |||

| ECBK / ECB Bancorp, Inc. | 0.06 | 0.00 | 0.94 | 1.84 | 0.7218 | -0.0404 | |||

| CEF / Sprott Physical Gold and Silver Trust | 0.03 | 0.00 | 0.93 | 5.90 | 0.7162 | -0.0113 | |||

| MPB / Mid Penn Bancorp, Inc. | 0.03 | 0.90 | 0.6904 | 0.6904 | |||||

| TCBS / Texas Community Bancshares, Inc. | 0.05 | 0.00 | 0.87 | 0.34 | 0.6701 | -0.0489 | |||

| BRBS / Blue Ridge Bankshares, Inc. | 0.20 | 0.23 | 0.72 | 10.28 | 0.5514 | 0.0137 | |||

| INVX / Innovex International, Inc. | 0.04 | 0.00 | 0.69 | -13.07 | 0.5305 | -0.1260 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.01 | 0.00 | 0.57 | 13.21 | 0.4403 | 0.0219 | |||

| RMBI / Richmond Mutual Bancorporation, Inc. | 0.04 | 0.00 | 0.55 | 7.81 | 0.4230 | 0.0007 | |||

| VLO / Valero Energy Corporation | 0.00 | 7.22 | 0.50 | 8.97 | 0.3823 | 0.0053 | |||

| MRAM / Everspin Technologies, Inc. | 0.07 | 0.00 | 0.47 | 23.30 | 0.3615 | 0.0460 | |||

| WSBK / Winchester Bancorp, Inc. | 0.05 | 0.45 | 0.3429 | 0.3429 | |||||

| UHAL / U-Haul Holding Company | 0.01 | -0.08 | 0.36 | -7.40 | 0.2782 | -0.0452 | |||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.00 | 0.26 | 0.2011 | 0.2011 | |||||

| FFWM / First Foundation Inc. | 0.04 | 0.23 | 0.1735 | 0.1735 | |||||

| TSBK / Timberland Bancorp, Inc. | 0.01 | 0.22 | 0.1691 | 0.1691 | |||||

| MUX / McEwen Inc. | 0.01 | -0.88 | 0.11 | 27.38 | 0.0821 | 0.0121 | |||

| KOS / Kosmos Energy Ltd. | 0.01 | 0.02 | 0.0134 | 0.0134 | |||||

| SVT / Servotronics, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OR / OR Royalties Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GOLD / Barrick Mining Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XOM / Exxon Mobil Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WMPN / William Penn Bancorporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GOOGL / Alphabet Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GLDD / Great Lakes Dredge & Dock Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |