Statistik Asas

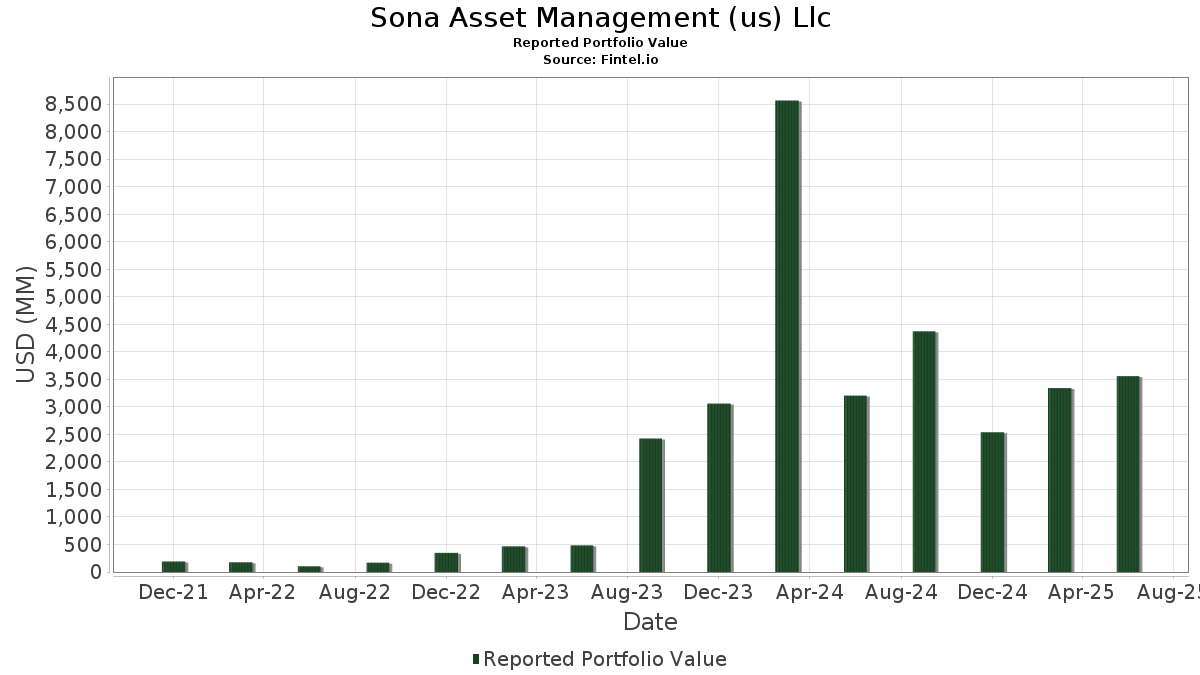

| Nilai Portfolio | $ 3,558,024,720 |

| Kedudukan Semasa | 114 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Sona Asset Management (us) Llc telah mendedahkan 114 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 3,558,024,720 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Sona Asset Management (us) Llc ialah iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF (US:LQD) , iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF (US:HYG) , Apollo Global Management, Inc. - Preferred Stock (US:APO.PRA) , iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF (US:IGSB) , and CONVERTIBLE ZERO (US:US009066AB74) . Kedudukan baharu Sona Asset Management (us) Llc termasuk iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF (US:IGSB) , CONVERTIBLE ZERO (US:US009066AB74) , CONVERTIBLE ZERO (US:US90353TAJ97) , CONVERTIBLE ZERO (US:US345370CZ16) , and Shopify Inc. (US:SHOP) . Industri teratas Sona Asset Management (us) Llc ialah "Electric, Gas, And Sanitary Services " (sic 49) , "Automotive Dealers And Gasoline Service Stations" (sic 55) , and "Transportation Equipment" (sic 37) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.54 | 133.75 | 3.7590 | 3.7590 | |

| 0.23 | 70.11 | 1.9705 | 1.9705 | |

| 1.25 | 103.65 | 2.9131 | 1.5676 | |

| 104.75 | 2.9442 | 1.5383 | ||

| 0.93 | 52.11 | 1.4645 | 1.4645 | |

| 0.44 | 50.75 | 1.4265 | 1.4265 | |

| 0.50 | 47.88 | 1.3458 | 1.3458 | |

| 44.97 | 1.2638 | 1.1748 | ||

| 74.18 | 2.0849 | 1.1524 | ||

| 115.72 | 3.2524 | 1.0942 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.11 | 61.62 | 1.7318 | -3.8805 | |

| 0.42 | 37.06 | 1.0417 | -3.5887 | |

| 10.67 | 0.2998 | -2.1887 | ||

| 5.77 | 632.90 | 17.7879 | -1.8626 | |

| 117.28 | 3.2963 | -1.1110 | ||

| 0.20 | 9.44 | 0.2654 | -1.0352 | |

| 0.00 | 0.00 | -0.7015 | ||

| 0.00 | 0.00 | -0.5716 | ||

| 0.72 | 69.43 | 1.9515 | -0.4741 | |

| 0.50 | 43.82 | 1.2315 | -0.4028 |

Pemfailan 13D/G

Ini ialah senarai pemfailan 13D dan 13G yang dibuat pada tahun lepas (jika ada). Klik ikon pautan untuk melihat sejarah transaksi penuh. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup.

| Tarikh Fail | Borang | Sekuriti | Saham Terdahulu |

Saham Semasa |

ΔSaham % | % Pemilikan |

% ΔPemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-05-15 | CCIR / Cohen Circle Acquisition Corp. I | 1,859,033 | 7.84 | |||||

| 2024-11-12 | GFR / Greenfire Resources Ltd. | 4,966,102 | 2,585,801 | -47.93 | 3.70 | -48.61 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-14 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 5.77 | -4.44 | 632.90 | -3.63 | 17.7879 | -1.8626 | |||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | Put | 2.12 | 6.20 | 171.30 | 8.57 | 4.8145 | 0.0935 | ||

| APO.PRA / Apollo Global Management, Inc. - Preferred Stock | 2.10 | 27.27 | 158.09 | 30.55 | 4.4431 | 0.8198 | |||

| ALIBABA GROUP HLDG LTD / NOTE 0.500% 6/0 (01609WBG6) | 134.33 | 0.0000 | |||||||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 2.54 | 133.75 | 3.7590 | 3.7590 | |||||

| US009066AB74 / CONVERTIBLE ZERO | 117.28 | -20.38 | 3.2963 | -1.1110 | |||||

| US90353TAJ97 / CONVERTIBLE ZERO | 115.72 | 60.43 | 3.2524 | 1.0942 | |||||

| ON SEMICONDUCTOR CORP / NOTE 0.500% 3/0 (682189AU9) | 109.87 | 0.0000 | |||||||

| US345370CZ16 / CONVERTIBLE ZERO | 104.75 | 122.95 | 2.9442 | 1.5383 | |||||

| VCIT / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Corporate Bond ETF | 1.25 | 127.27 | 103.65 | 130.50 | 2.9131 | 1.5676 | |||

| SHOP / Shopify Inc. | 74.18 | 73.03 | 2.0849 | 1.1524 | |||||

| HPE.PRC / Hewlett Packard Enterprise Company - Preferred Security | 1.20 | -14.29 | 70.90 | 5.65 | 1.9928 | -0.0154 | |||

| GLD / SPDR Gold Trust | Put | 0.23 | 70.11 | 1.9705 | 1.9705 | ||||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.72 | -14.71 | 69.43 | -14.35 | 1.9515 | -0.4741 | |||

| WESTERN DIGITAL CORP / NOTE 3.000%11/1 (958102AT2) | 62.83 | 0.0000 | |||||||

| QQQ / Invesco QQQ Trust, Series 1 | Call | 0.11 | -72.08 | 61.62 | -67.15 | 1.7318 | -3.8805 | ||

| US62886HBK68 / CONV. NOTE | 60.32 | 21.36 | 1.6953 | 0.2081 | |||||

| US02376RAF91 / American Airlines Group Inc | 60.25 | 11.54 | 1.6932 | 0.0771 | |||||

| WAYFAIR INC / NOTE 3.500%11/1 (94419LAR2) | 53.14 | 0.0000 | |||||||

| FYBR / Frontier Communications Parent, Inc. | 1.44 | 55.62 | 52.51 | 57.96 | 1.4759 | 0.4812 | |||

| PNM / PNM Resources, Inc. | 0.93 | 52.11 | 1.4645 | 1.4645 | |||||

| FOUR.PRA / Shift4 Payments, Inc. - Preferred Stock | 0.44 | 50.75 | 1.4265 | 1.4265 | |||||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | Put | 0.50 | 47.88 | 1.3458 | 1.3458 | ||||

| JAZZ / Jazz Pharmaceuticals plc | 45.02 | 155.11 | 1.2652 | 0.7372 | |||||

| US596278AB74 / CONV. NOTE | 44.97 | 29,877.33 | 1.2638 | 1.1748 | |||||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | Put | 0.50 | -17.25 | 43.82 | -19.78 | 1.2315 | -0.4028 | ||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | Call | 0.42 | -75.29 | 37.06 | -76.05 | 1.0417 | -3.5887 | ||

| MICROCHIP TECHNOLOGY INC. / NOTE 0.750% 6/0 (595017BG8) | 36.88 | 0.0000 | |||||||

| DEXCOM INC / NOTE 0.375% 5/1 (252131AM9) | 36.20 | 0.0000 | |||||||

| GLD / SPDR Gold Trust | Call | 0.10 | 30.48 | 0.8567 | 0.8567 | ||||

| SPY / SPDR S&P 500 ETF | Put | 0.05 | 29.35 | 0.8248 | 0.8248 | ||||

| US10806XAD49 / BRIDGEBIO PHARMA INC | 29.26 | 40.05 | 0.8224 | 0.1972 | |||||

| US84921RAB69 / Spotify USA Inc | 29.05 | 0.8166 | 0.8166 | ||||||

| AKAMAI TECHNOLOGIES INC / NOTE 1.125% 2/1 (00971TAN1) | 28.05 | 0.0000 | |||||||

| US26142RAB06 / DraftKings, Inc. | 27.28 | 107.56 | 0.7668 | 0.3735 | |||||

| US19260QAB32 / Coinbase Global Inc | 26.67 | 55.45 | 0.7495 | 0.2362 | |||||

| ARKK / ARK ETF Trust - ARK Innovation ETF | Put | 0.38 | 26.36 | 0.7408 | 0.7408 | ||||

| IWM / iShares Trust - iShares Russell 2000 ETF | Put | 0.10 | 21.58 | 0.6065 | 0.6065 | ||||

| CCIR / Cohen Circle Acquisition Corp. I | 1.86 | 0.00 | 20.39 | -2.14 | 0.5732 | -0.0504 | |||

| AMED / Amedisys, Inc. | Put | 0.20 | 19.68 | 0.5531 | 0.5531 | ||||

| SKX / Skechers U.S.A., Inc. | 0.31 | 19.42 | 0.5458 | 0.5458 | |||||

| THE REALREAL INC / DEBT 4.000% 2/1 (88339PAJ0) | 17.79 | 0.0000 | |||||||

| NEE.PRT / NextEra Energy, Inc. - Debt/Equity Composite Units | 0.35 | -36.36 | 15.48 | -37.77 | 0.4350 | -0.3092 | |||

| US26210CAD65 / Dropbox, Inc. | 14.71 | 2.85 | 0.4135 | -0.0145 | |||||

| US18915MAC10 / CONVERTIBLE ZERO | 14.09 | 159.27 | 0.3960 | 0.2183 | |||||

| CCJ / Cameco Corporation | 0.19 | 167.86 | 13.92 | 383.10 | 0.3912 | 0.3050 | |||

| US26210CAC82 / Dropbox, Inc., Conv. | 13.86 | -26.10 | 0.3895 | -0.1716 | |||||

| BLCO / Bausch + Lomb Corporation | 1.02 | 151.25 | 13.28 | 125.45 | 0.3732 | 0.1970 | |||

| FLUOR CORP / NOTE 1.125% 8/1 (343412AJ1) | 13.14 | 0.0000 | |||||||

| US30063PAB13 / Exas 3/8 3/15/27 Bond | 12.67 | 3.40 | 0.3560 | -0.0105 | |||||

| CZR / Caesars Entertainment, Inc. | 0.43 | 244.00 | 12.21 | 290.62 | 0.3431 | 0.2496 | |||

| WULF / TeraWulf Inc. | 2.70 | 11.81 | 0.3318 | 0.3318 | |||||

| US902252AB17 / Tyler Technologies Inc | 11.10 | 0.3120 | 0.3120 | ||||||

| UNH / UnitedHealth Group Incorporated | Call | 0.04 | 10.92 | 0.3069 | 0.3069 | ||||

| CENTERPOINT ENERGY INC / NOTE 4.250% 8/1 (15189TBD8) | 10.84 | 0.0000 | |||||||

| US682189AS48 / CONVERTIBLE ZERO | 10.67 | -11.14 | 0.2998 | -2.1887 | |||||

| ATUS / Altice USA, Inc. | 4.75 | 8.02 | 10.17 | -13.10 | 0.2859 | -0.0643 | |||

| IHS / IHS Holding Limited | 1.80 | -14.27 | 10.02 | -8.68 | 0.2817 | -0.0467 | |||

| MSFT / Microsoft Corporation | 0.02 | 9.95 | 0.2796 | 0.2796 | |||||

| NEE.PRS / NextEra Energy, Inc. - Debt/Equity Composite Units | 0.20 | -77.78 | 9.44 | -78.27 | 0.2654 | -1.0352 | |||

| US30063PAC95 / EXACT SCIENCES CORP CONV 0.375% 03/01/2028 | 8.92 | 44.77 | 0.2506 | 0.0663 | |||||

| WBD / Warner Bros. Discovery, Inc. | 0.77 | 8.88 | 0.2495 | 0.2495 | |||||

| NN / NextNav Inc. | 0.58 | 111.12 | 8.74 | 163.68 | 0.2457 | 0.1465 | |||

| AXL / American Axle & Manufacturing Holdings, Inc. | Call | 2.08 | 8.47 | 0.2381 | 0.2381 | ||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.07 | 0.00 | 8.41 | -14.23 | 0.2365 | -0.0571 | |||

| NVDA / NVIDIA Corporation | 0.05 | 7.90 | 0.2220 | 0.2220 | |||||

| V / Visa Inc. | Put | 0.02 | 7.88 | 0.2215 | 0.2215 | ||||

| CORZ / Core Scientific, Inc. | 0.46 | 7.87 | 0.2212 | 0.2212 | |||||

| SNPS / Synopsys, Inc. | Call | 0.01 | 7.69 | 0.2161 | 0.2161 | ||||

| LITE / Lumentum Holdings Inc. | 0.08 | 7.34 | 0.2063 | 0.2063 | |||||

| US94419LAF85 / CONV. NOTE | 7.14 | 52.60 | 0.2008 | 0.0607 | |||||

| MIR / Mirion Technologies, Inc. | 0.31 | 6.76 | 0.1900 | 0.1900 | |||||

| UNIT / Unity Group LLC | 1.54 | 87.36 | 6.64 | 60.60 | 0.1867 | 0.0629 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | 6.24 | 0.1754 | 0.1754 | |||||

| URA / Global X Funds - Global X Uranium ETF | 0.15 | 5.82 | 0.1636 | 0.1636 | |||||

| VFC / V.F. Corporation | 0.47 | 5.55 | 0.1561 | 0.1561 | |||||

| GFR / Greenfire Resources Ltd. | 1.16 | -17.24 | 5.16 | -37.12 | 0.1451 | -0.1006 | |||

| STX / Seagate Technology Holdings plc | 0.03 | 4.96 | 0.1395 | 0.1395 | |||||

| PLTR / Palantir Technologies Inc. | 0.04 | 4.77 | 0.1341 | 0.1341 | |||||

| DLR / Digital Realty Trust, Inc. | 0.03 | 54.55 | 4.74 | 88.06 | 0.1333 | 0.0578 | |||

| INTC / Intel Corporation | 0.19 | 0.00 | 4.32 | -1.37 | 0.1215 | -0.0096 | |||

| DLTR / Dollar Tree, Inc. | 0.04 | 3.96 | 0.1113 | 0.1113 | |||||

| U / Unity Software Inc. | 0.15 | 3.73 | 0.1049 | 0.1049 | |||||

| MU / Micron Technology, Inc. | 0.03 | 3.70 | 0.1039 | 0.1039 | |||||

| PROGRESS SOFTWARE CORP / NOTE 3.500% 3/0 (743312AD2) | 2.90 | 0.0000 | |||||||

| EWZ / iShares, Inc. - iShares MSCI Brazil ETF | 0.10 | 2.88 | 0.0811 | 0.0811 | |||||

| EWY / iShares, Inc. - iShares MSCI South Korea ETF | 0.04 | 2.66 | 0.0746 | 0.0746 | |||||

| DHI / D.R. Horton, Inc. | 0.02 | 2.58 | 0.0725 | 0.0725 | |||||

| HPE / Hewlett Packard Enterprise Company | 0.12 | 2.56 | 0.0718 | 0.0718 | |||||

| LEN / Lennar Corporation | 0.02 | 2.54 | 0.0715 | 0.0715 | |||||

| EWW / iShares, Inc. - iShares MSCI Mexico ETF | 0.04 | 2.42 | 0.0681 | 0.0681 | |||||

| EQT / EQT Corporation | 0.04 | -73.34 | 2.33 | -70.91 | 0.0656 | -0.1743 | |||

| EYE / National Vision Holdings, Inc. | 0.10 | 2.30 | 0.0647 | 0.0647 | |||||

| ARGT / Global X Funds - Global X MSCI Argentina ETF | 0.03 | -28.00 | 2.29 | -24.47 | 0.0643 | -0.0263 | |||

| DG / Dollar General Corporation | 0.02 | 2.29 | 0.0643 | 0.0643 | |||||

| TAC / TransAlta Corporation | 0.20 | 0.00 | 2.16 | 15.65 | 0.0607 | 0.0048 | |||

| DDOG / Datadog, Inc. | 0.02 | -3.09 | 2.15 | 31.23 | 0.0604 | 0.0114 | |||

| KVUE / Kenvue Inc. | Call | 0.10 | 2.09 | 0.0588 | 0.0588 | ||||

| AMCX / AMC Networks Inc. | 0.32 | 2.03 | 0.0571 | 0.0571 | |||||

| EC / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 0.20 | 100.00 | 1.77 | 69.54 | 0.0497 | 0.0185 | |||

| TRIP / Tripadvisor, Inc. | Call | 0.12 | 0.00 | 1.57 | -7.88 | 0.0440 | -0.0069 | ||

| CODI / Compass Diversified | Put | 0.20 | 1.27 | 0.0358 | 0.0358 | ||||

| AMCR / Amcor plc | Call | 0.11 | 0.00 | 1.05 | -5.26 | 0.0294 | -0.0036 | ||

| RH / RH | 0.01 | 1.02 | 0.0287 | 0.0287 | |||||

| TKR / The Timken Company | 0.01 | 1.02 | 0.0285 | 0.0285 | |||||

| EHTH / eHealth, Inc. | 0.23 | -22.47 | 1.01 | -49.55 | 0.0284 | -0.0315 | |||

| HTZWW / Hertz Global Holdings, Inc. - Equity Warrant | 0.20 | 0.00 | 0.73 | 61.50 | 0.0205 | 0.0070 | |||

| VRM / Vroom, Inc. | 0.01 | -51.41 | 0.41 | -52.91 | 0.0116 | -0.0146 | |||

| PSN / Parsons Corporation | 0.00 | 0.35 | 0.0099 | 0.0099 | |||||

| TDS / Telephone and Data Systems, Inc. | 0.01 | 0.00 | 0.33 | -8.24 | 0.0094 | -0.0015 | |||

| THCH / TH International Limited | 0.10 | 0.00 | 0.30 | 1.02 | 0.0083 | -0.0004 | |||

| NOTE / FiscalNote Holdings, Inc. | Call | 0.10 | -50.00 | 0.05 | -67.08 | 0.0015 | -0.0033 | ||

| CCIRW / Cohen Circle Acquisition Corp. I - Equity Warrant | 0.03 | 0.00 | 0.05 | 11.11 | 0.0014 | 0.0001 | |||

| NOTE.WS / FiscalNote Holdings, Inc. - Equity Warrant | 0.15 | 0.00 | 0.01 | -44.00 | 0.0004 | -0.0004 | |||

| SPR / Spirit AeroSystems Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TGI / Triumph Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RDUS / Radius Recycling, Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| KWEB / KraneShares Trust - KraneShares CSI China Internet ETF | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| DFS / Discover Financial Services | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ALB.PRA / Albemarle Corporation - Preferred Stock | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HEES / H&E Equipment Services, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VSH / Vishay Intertechnology, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| QQQ / Invesco QQQ Trust, Series 1 | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.7015 | |||

| ANSS / ANSYS, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BTDR / Bitdeer Technologies Group | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMED / Amedisys, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5716 | ||||

| OMC / Omnicom Group Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NVDA / NVIDIA Corporation | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.0811 | |||

| ALRM / Alarm.com Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MNMD / Mind Medicine (MindMed) Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| NET / Cloudflare, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.3132 | ||||

| CWB / SPDR Series Trust - SPDR Bloomberg Convertible Securities ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| AAL / American Airlines Group Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WMIH / Mr. Cooper Group Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CPRI / Capri Holdings Limited | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| AZEK / The AZEK Company Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| X / United States Steel Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| EVRI / Everi Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BA / The Boeing Company | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| NN / NextNav Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.1402 | |||

| COF / Capital One Financial Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| SWTX / SpringWorks Therapeutics, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| BERY / Berry Global Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0911 |