BRP (TSX:DOO) Price Target Decreased by 20.32% to 67.32

The average one-year price target for BRP (TSX:DOO) has been revised to $67.32 / share. This is a decrease of 20.32% from the prior estimate of $84.49 dated March 17, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $39.39 to a high of $89.25 / share. The average price target represents an increase of 31.54% from the latest reported closing price of $51.18 / share.

BRP Maintains 1.73% Dividend Yield

At the most recent price, the company’s dividend yield is 1.73%.

Additionally, the company’s dividend payout ratio is -0.14. The payout ratio tells us how much of a company’s income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company’s income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company’s 3-Year dividend growth rate is 0.31% , demonstrating that it has increased its dividend over time.

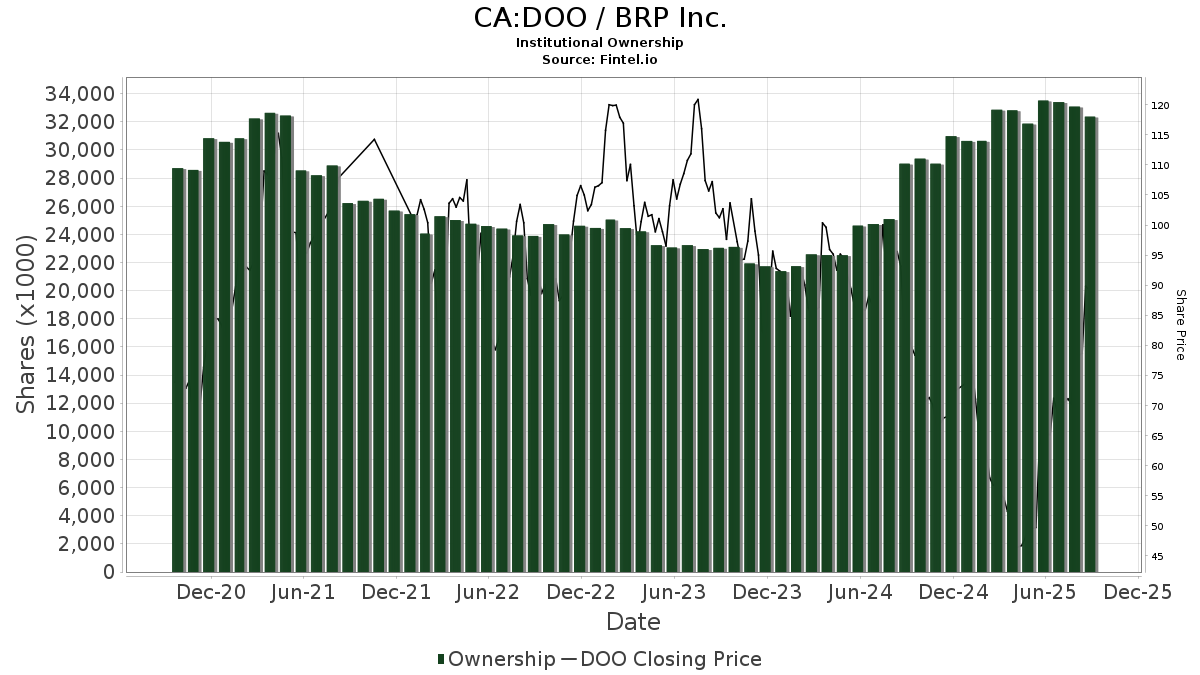

What is the Fund Sentiment?

There are 305 funds or institutions reporting positions in BRP. This is an decrease of 13 owner(s) or 4.09% in the last quarter. Average portfolio weight of all funds dedicated to DOO is 0.09%, an increase of 7.26%. Total shares owned by institutions increased in the last three months by 7.10% to 32,819K shares.

What are Other Shareholders Doing?

Beutel, Goodman & Co holds 3,254K shares representing 9.43% ownership of the company. In its prior filing, the firm reported owning 3,620K shares , representing a decrease of 11.25%. The firm decreased its portfolio allocation in DOO by 15.22% over the last quarter.

Turtle Creek Asset Management holds 2,971K shares representing 8.61% ownership of the company. In its prior filing, the firm reported owning 2,302K shares , representing an increase of 22.51%. The firm increased its portfolio allocation in DOO by 19.46% over the last quarter.

Price T Rowe Associates holds 2,399K shares representing 6.95% ownership of the company. In its prior filing, the firm reported owning 2,464K shares , representing a decrease of 2.71%. The firm decreased its portfolio allocation in DOO by 16.71% over the last quarter.

SMCWX - SMALLCAP WORLD FUND INC holds 1,971K shares representing 5.71% ownership of the company. In its prior filing, the firm reported owning 980K shares , representing an increase of 50.30%. The firm increased its portfolio allocation in DOO by 79.40% over the last quarter.

Capital World Investors holds 1,971K shares representing 5.71% ownership of the company. In its prior filing, the firm reported owning 980K shares , representing an increase of 50.30%. The firm increased its portfolio allocation in DOO by 68.61% over the last quarter.