Dynavox Group AB (OM:DYVOX) Price Target Decreased by 12.08% to 74.26

The average one-year price target for Dynavox Group AB (OM:DYVOX) has been revised to 74,26 kr / share. This is a decrease of 12.08% from the prior estimate of 84,46 kr dated March 30, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 60,60 kr to a high of 89,25 kr / share. The average price target represents an increase of 30.96% from the latest reported closing price of 56,70 kr / share.

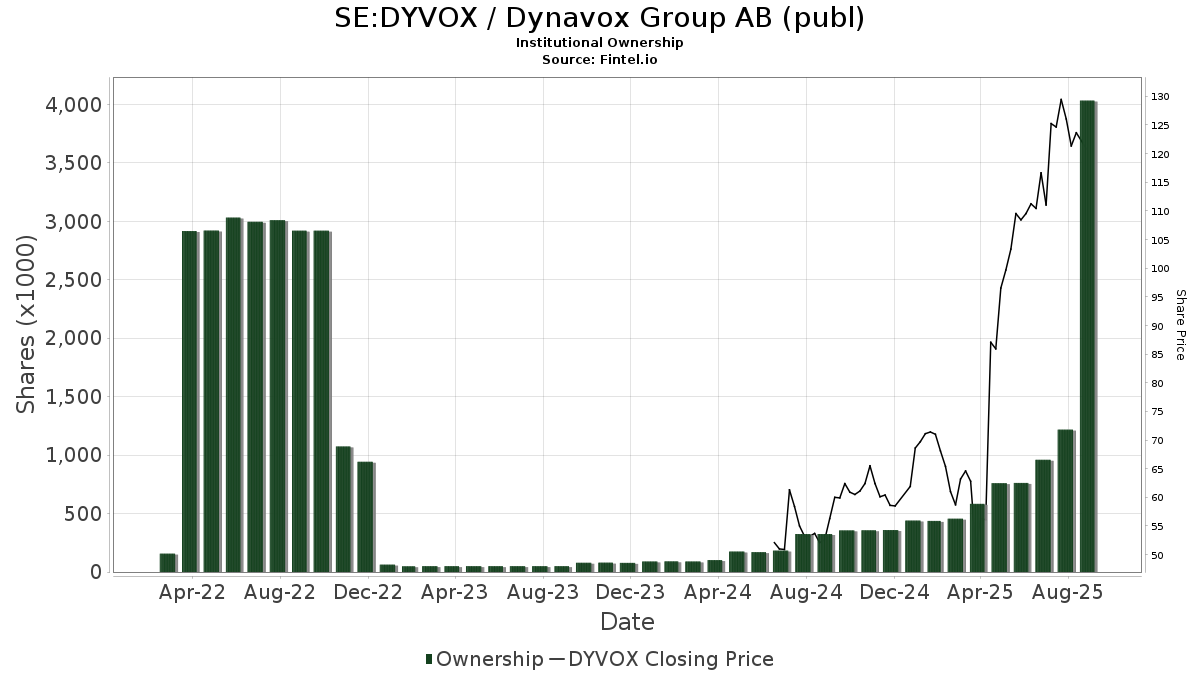

What is the Fund Sentiment?

There are 26 funds or institutions reporting positions in Dynavox Group AB. This is an increase of 9 owner(s) or 52.94% in the last quarter. Average portfolio weight of all funds dedicated to DYVOX is 0.01%, an increase of 5.58%. Total shares owned by institutions increased in the last three months by 71.73% to 752K shares.

What are Other Shareholders Doing?

AVDV - Avantis International Small Cap Value ETF holds 299K shares representing 0.29% ownership of the company. In its prior filing, the firm reported owning 178K shares , representing an increase of 40.37%. The firm increased its portfolio allocation in DYVOX by 63.45% over the last quarter.

OWSMX - Old Westbury Small & Mid Cap Strategies Fund holds 118K shares representing 0.11% ownership of the company. In its prior filing, the firm reported owning 97K shares , representing an increase of 18.18%. The firm increased its portfolio allocation in DYVOX by 41.00% over the last quarter.

DFIS - Dimensional International Small Cap ETF holds 51K shares representing 0.05% ownership of the company.

AVDE - Avantis International Equity ETF holds 49K shares representing 0.05% ownership of the company. In its prior filing, the firm reported owning 1K shares , representing an increase of 98.12%. The firm increased its portfolio allocation in DYVOX by 5,225.45% over the last quarter.

GWX - SPDR(R) S&P(R) International Small Cap ETF holds 40K shares representing 0.04% ownership of the company. In its prior filing, the firm reported owning 41K shares , representing a decrease of 1.01%. The firm increased its portfolio allocation in DYVOX by 5.02% over the last quarter.