Statistik Asas

| Pemilik Institusi | 16 total, 16 long only, 0 short only, 0 long/short - change of 0.00% MRQ |

| Purata Peruntukan Portfolio | 0.0083 % - change of -2.10% MRQ |

| Saham Diterbitkan | shares (source: Capital IQ) |

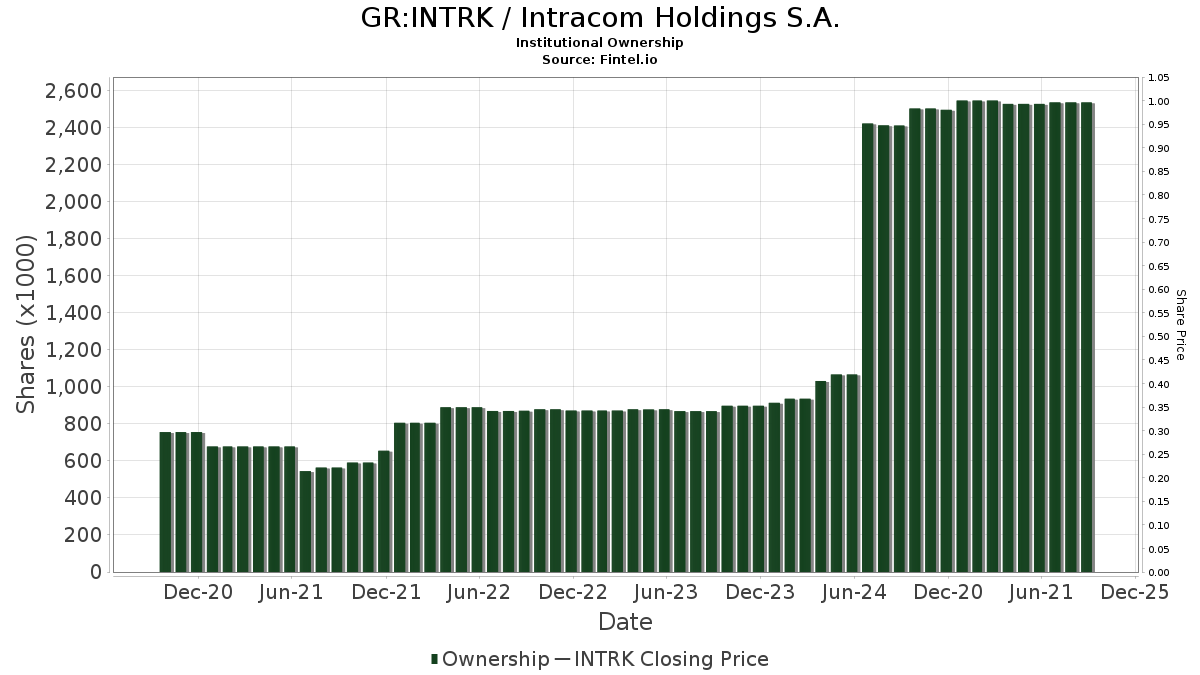

| Saham Institusi (Panjang) | 2,537,435 - 3.06% (ex 13D/G) - change of 0.01MM shares 0.32% MRQ |

| Nilai Institusi (Panjang) | $ 8,901 USD ($1000) |

Pemilikan Institusi dan Pemegang Saham

Intracom Holdings S.A. (GR:INTRK) telah 16 pemilik institusi dan pemegang saham yang telah memfailkan borang 13D/G atau 13F dengan Suruhanjaya Bursa Sekuriti (SEC). Institusi ini memegang sejumlah 2,537,435 saham. Pemegang saham terbesar termasuk VGTSX - Vanguard Total International Stock Index Fund Investor Shares, VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares, DFCEX - Emerging Markets Core Equity Portfolio - Institutional Class, Dimensional Emerging Markets Value Fund - Dimensional Emerging Markets Value Fund, VFSNX - Vanguard FTSE All-World ex-US Small-Cap Index Fund Institutional Shares, Dfa Investment Trust Co - The Emerging Markets Small Cap Series, EWX - SPDR(R) S&P(R) EMERGING MARKETS SMALL CAP ETF, AVEM - Avantis Emerging Markets Equity ETF, VT - Vanguard Total World Stock Index Fund ETF Shares, and DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Core Equity Portfolio Institutional Class Shares .

Intracom Holdings S.A. (ATSE:INTRK) struktur pemilikan institusi menunjukkan kedudukan semasa dalam syarikat mengikut institusi dan dana serta perubahan terkini dalam saiz kedudukan. Pemegang saham utama boleh termasuk pelabur individu, dana amanah, dana lindung nilai atau institusi. Jadual 13D menunjukkan bahawa pelabur memegang (atau menahan) lebih daripada 5% syarikat dan berhasrat (atau berniat) untuk secara aktif meneruskan perubahan dalam strategi perniagaan. Jadual 13G menunjukkan pelaburan pasif melebihi 5%.

Skor Sentimen Dana

Skor Sentimen Dana (Skor Pengumpulan Pemilikan fka) mencari saham yang paling banyak dibeli oleh dana. Ia adalah hasil daripada model kuantitatif pelbagai faktor yang canggih yang mengenal pasti syarikat dengan tahap pengumpulan institusi tertinggi. Model pemarkahan ini menggunakan gabungan jumlah kenaikan dalam pemilik yang didedahkan, perubahan dalam peruntukan portfolio dalam pemilik tersebut dan metrik lain. Nombornya berjulat dari 0 hingga 100, dengan nombor yang lebih tinggi menunjukkan tahap pengumpulan yang lebih tinggi kepada rakannya, dan 50 adalah nombor purata.

Kekerapan Kemas Kini: Harian

Lihat Peneroka Pemilikan yang menyediakan senarai syarikat yang mempunyai kedudukan tertinggi.

Pemfailan 13F dan NPORT

Butiran mengenai pemfailan 13F adalah percuma. Perincian mengenai pemfailan NP memerlukan keahlian premium. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup. Klik pautan ikon untuk melihat sejarah transaksi penuh.

Naik Taraf

untuk membuka data premium dan mengeksport ke Excel ![]() .

.

Other Listings

| DE:INTA | €3.54 |