Statistik Asas

| Pemilik Institusi | 68 total, 68 long only, 0 short only, 0 long/short - change of 9.68% MRQ |

| Purata Peruntukan Portfolio | 0.0606 % - change of -18.42% MRQ |

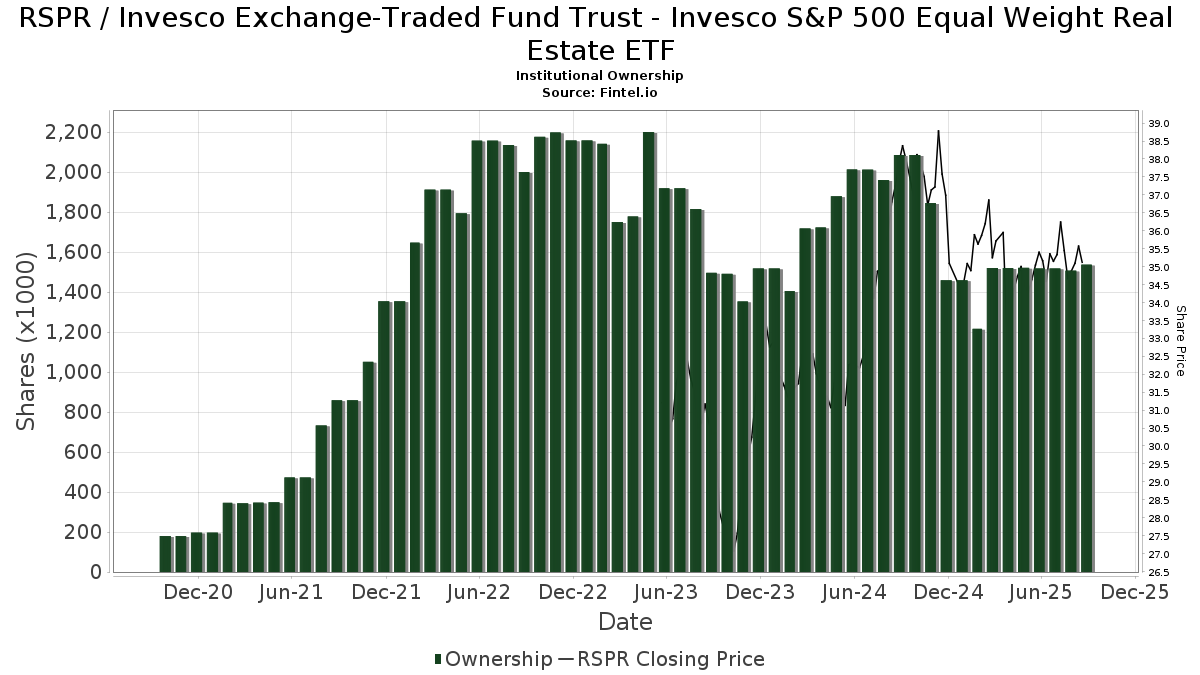

| Saham Institusi (Panjang) | 1,537,722 (ex 13D/G) - change of 0.02MM shares 1.24% MRQ |

| Nilai Institusi (Panjang) | $ 52,738 USD ($1000) |

Pemilikan Institusi dan Pemegang Saham

Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight Real Estate ETF (US:RSPR) telah 68 pemilik institusi dan pemegang saham yang telah memfailkan borang 13D/G atau 13F dengan Suruhanjaya Bursa Sekuriti (SEC). Institusi ini memegang sejumlah 1,537,722 saham. Pemegang saham terbesar termasuk IFP Advisors, Inc, LPL Financial LLC, Morgan Stanley, Raymond James Financial Inc, Kestra Advisory Services, LLC, Gerber Kawasaki Wealth & Investment Management, Capital Management Associates, Inc, Equitable Holdings, Inc., Goldman Sachs Group Inc, and Bank Of America Corp /de/ .

Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight Real Estate ETF (ARCA:RSPR) struktur pemilikan institusi menunjukkan kedudukan semasa dalam syarikat mengikut institusi dan dana serta perubahan terkini dalam saiz kedudukan. Pemegang saham utama boleh termasuk pelabur individu, dana amanah, dana lindung nilai atau institusi. Jadual 13D menunjukkan bahawa pelabur memegang (atau menahan) lebih daripada 5% syarikat dan berhasrat (atau berniat) untuk secara aktif meneruskan perubahan dalam strategi perniagaan. Jadual 13G menunjukkan pelaburan pasif melebihi 5%.

The share price as of September 5, 2025 is 35.79 / share. Previously, on September 9, 2024, the share price was 37.34 / share. This represents a decline of 4.16% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (Skor Pengumpulan Pemilikan fka) mencari saham yang paling banyak dibeli oleh dana. Ia adalah hasil daripada model kuantitatif pelbagai faktor yang canggih yang mengenal pasti syarikat dengan tahap pengumpulan institusi tertinggi. Model pemarkahan ini menggunakan gabungan jumlah kenaikan dalam pemilik yang didedahkan, perubahan dalam peruntukan portfolio dalam pemilik tersebut dan metrik lain. Nombornya berjulat dari 0 hingga 100, dengan nombor yang lebih tinggi menunjukkan tahap pengumpulan yang lebih tinggi kepada rakannya, dan 50 adalah nombor purata.

Kekerapan Kemas Kini: Harian

Lihat Peneroka Pemilikan yang menyediakan senarai syarikat yang mempunyai kedudukan tertinggi.

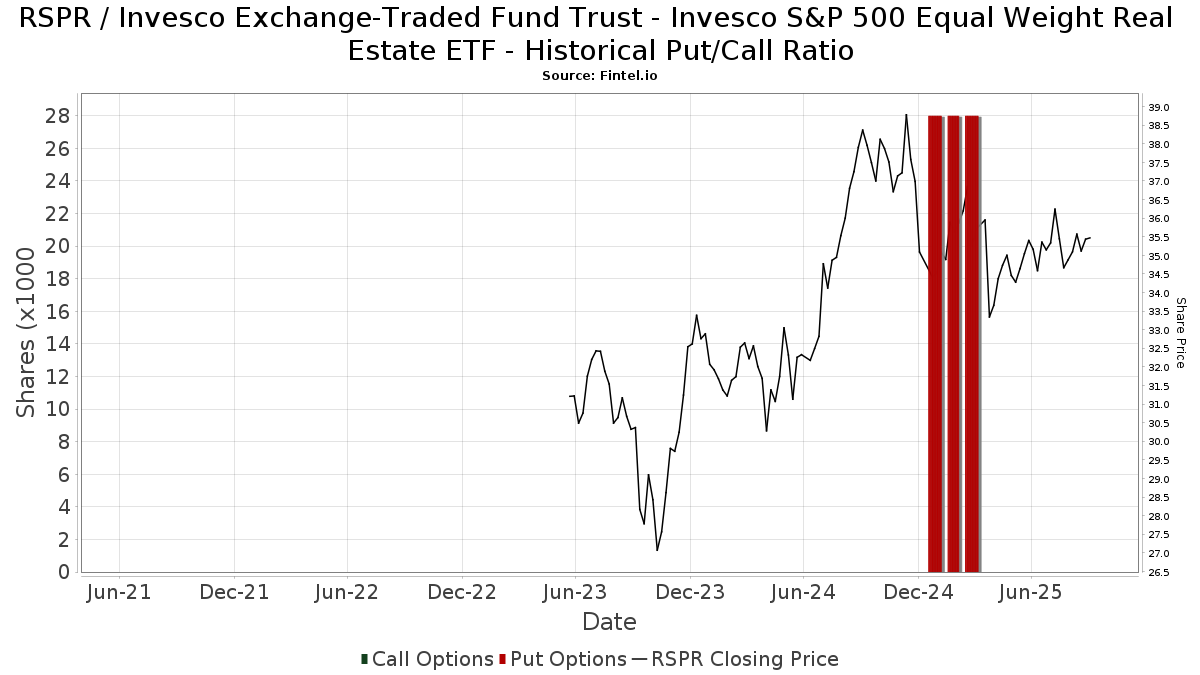

Nisbah Put/Call Institusi

Selain melaporkan isu ekuiti dan hutang standard, institusi yang mempunyai lebih daripada 100MM aset di bawah pengurusan juga mesti mendedahkan pegangan opsyen jual dan beli mereka. Memandangkan opsyen jual secara amnya menunjukkan sentimen negatif, dan opsyen beli menunjukkan sentimen positif, kita boleh mendapatkan gambaran keseluruhan sentimen institusi dengan merencanakan nisbah jual kepada beli. Carta di sebelah kanan memplotkan nisbah jual/beli sejarah untuk instrumen ini.

Menggunakan Nisbah Put/Callsebagai penunjuk sentimen pelabur mengatasi salah satu kekurangan utama menggunakan jumlah pemilikan institusi, iaitu sejumlah besar aset di bawah pengurusan dilaburkan secara pasif untuk menjejaki indeks. Dana yang diurus secara pasif biasanya tidak membeli opsyen, jadi penunjuk nisbah put/call mengekori rapat sentimen dana yang diurus secara aktif.

Pemfailan 13F dan NPORT

Butiran mengenai pemfailan 13F adalah percuma. Perincian mengenai pemfailan NP memerlukan keahlian premium. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup. Klik pautan ikon untuk melihat sejarah transaksi penuh.

Naik Taraf

untuk membuka data premium dan mengeksport ke Excel ![]() .

.

| Tarikh Fail | Sumber | Pelabur | Jenis | Purata Harga (Ang) |

Saham | ΔSaham (%) |

Nilai Dilaporkan ($1000) |

Δ Nilai (%) |

Peruntukan Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-25 | 13F | Cwm, Llc | 61 | 29.79 | 0 | |||||

| 2025-07-28 | 13F | 5th Street Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 2,930 | -66.70 | 103 | -67.52 | ||||

| 2025-04-15 | 13F | Noble Wealth Management PBC | 1,225 | -2.00 | 44 | 0.00 | ||||

| 2025-07-24 | 13F | Costello Asset Management, INC | 150 | 0.00 | 5 | 0.00 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 11,463 | 12.70 | 402 | 10.47 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 5,747 | 0.60 | 201 | -1.47 | ||||

| 2025-07-22 | 13F | Kickstand Ventures, Llc. | 6,672 | -8.94 | 234 | -10.73 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 31 | 0.00 | 1 | 0.00 | ||||

| 2025-07-22 | 13F | Duncan Williams Asset Management, LLC | 6,672 | 234 | ||||||

| 2025-08-12 | 13F | BlackRock, Inc. | 80 | 3 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 126,441 | 27.82 | 4,429 | 25.40 | ||||

| 2025-05-13 | 13F | Bank Of Montreal /can/ | 0 | -100.00 | 0 | |||||

| 2025-07-16 | 13F | Cadent Capital Advisors, LLC | 22,838 | -2.96 | 800 | -4.88 | ||||

| 2025-07-14 | 13F/A | Seek First Inc. | 6,123 | 0.59 | 214 | -1.38 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 24,245 | -11.66 | 849 | -13.37 | ||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 320 | 0.63 | 11 | 0.00 | ||||

| 2025-08-05 | 13F | EPG Wealth Management LLC | 67 | 0.00 | 2 | 0.00 | ||||

| 2025-08-12 | 13F | Fortem Financial Group, Llc | 10,930 | -0.75 | 383 | -2.80 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 24 | 0.00 | 1 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 241,874 | -7.89 | 8,473 | -9.65 | ||||

| 2025-08-08 | 13F | Financial Gravity Companies, Inc. | 39 | -13.33 | 1 | 0.00 | ||||

| 2025-07-23 | 13F | Capital Management Associates, Inc | 40,200 | -32.94 | 1,408 | -34.21 | ||||

| 2025-08-05 | 13F | Scarborough Advisors, LLC | 5 | 0 | ||||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 0 | -100.00 | 0 | |||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-04 | 13F | Quaker Wealth Management, LLC | Put | 0 | -100.00 | 0 | -100.00 | |||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 17,702 | 0.54 | 620 | -1.27 | ||||

| 2025-08-08 | 13F | Collaborative Wealth Managment Inc. | 16,917 | -18.40 | 593 | -20.00 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 65 | 2 | ||||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 4,081 | 0.00 | 143 | -2.07 | ||||

| 2025-07-15 | 13F | Burns Matteson Capital Management, LLC | 21,742 | 152.08 | 762 | 147.88 | ||||

| 2025-07-15 | 13F | Oxinas Partners Wealth Management LLC | 21,364 | -3.49 | 748 | -5.32 | ||||

| 2025-08-04 | 13F | Quaker Wealth Management, LLC | 28,945 | 1,014 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 680 | 267.57 | 24 | 283.33 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 4,266 | 0.00 | 149 | -1.97 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 37,062 | 9.83 | 1,298 | 7.72 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 32,330 | 28.40 | 1,133 | 25.92 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 128,738 | 4.92 | 4,510 | 2.92 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 7 | 0.00 | 0 | |||||

| 2025-08-14 | 13F | Gerber Kawasaki Wealth & Investment Management | 43,968 | -19.17 | 1,540 | -20.70 | ||||

| 2025-08-13 | 13F | Financial Freedom, LLC | 284 | 0.00 | 10 | -10.00 | ||||

| 2025-08-07 | 13F | Meridian Financial Partners LLC | 6,125 | 0.00 | 0 | |||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 16,901 | 7.00 | 592 | 4.96 | ||||

| 2025-08-14 | 13F | UBS Group AG | 9,851 | 1.43 | 345 | -0.29 | ||||

| 2025-05-02 | 13F | Sigma Planning Corp | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 2 | 0 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 10,615 | -19.75 | 372 | -21.19 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 8,730 | 306 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 29,712 | 2.73 | 1,041 | 0.78 | ||||

| 2025-07-17 | 13F | Walker Asset Management, LLC | 8,051 | -4.67 | 282 | -6.31 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 44,751 | 15.86 | 1,568 | 13.63 | ||||

| 2025-07-22 | 13F | Berger Financial Group, Inc | 5,788 | -0.02 | 203 | -1.94 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 23,448 | 8.28 | 821 | 6.21 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 308,087 | 2.06 | 10,792 | 0.12 | ||||

| 2025-08-13 | 13F | Green Harvest Asset Management LLC | 6,900 | -2.25 | 242 | -4.37 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-15 | 13F | Sheets Smith Wealth Management | 21,089 | 739 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 27,543 | -0.44 | 965 | -2.23 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 14,757 | 1 | ||||||

| 2025-08-01 | 13F | James Investment Research Inc | 18,305 | -3.12 | 641 | -4.90 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 49 | 0.00 | 2 | 0.00 | ||||

| 2025-08-13 | 13F/A | StoneX Group Inc. | 9,392 | -2.90 | 281 | -13.00 | ||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | 3,400 | 0.00 | 119 | -1.65 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 9,033 | 4.90 | 0 | |||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 13,301 | -31.60 | 466 | -33.00 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 5,379 | 7.04 | 188 | 6.82 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 11,470 | 402 | ||||||

| 2025-04-30 | 13F | Sofos Investments, Inc. | 45 | -55.88 | 2 | -66.67 | ||||

| 2025-07-25 | 13F | Wealth Advisory Team LLC | 5,747 | 201 | ||||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 6,999 | 0.00 | 245 | -1.61 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | -100.00 | 0 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 147 | 0.00 | 5 | 0.00 | ||||

| 2025-07-29 | 13F | Interactive Financial Advisors | 27,335 | 1.45 | 958 | -0.52 | ||||

| 2025-05-12 | 13F | Jpmorgan Chase & Co | 0 | -100.00 | 0 | |||||

| 2025-03-21 | 13F | Prostatis Group LLC | 0 | -100.00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 7,503 | -13.17 | 263 | -14.94 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 10,979 | -8.80 | 385 | -10.49 |

Other Listings

| MX:RSPR |