Statistik Asas

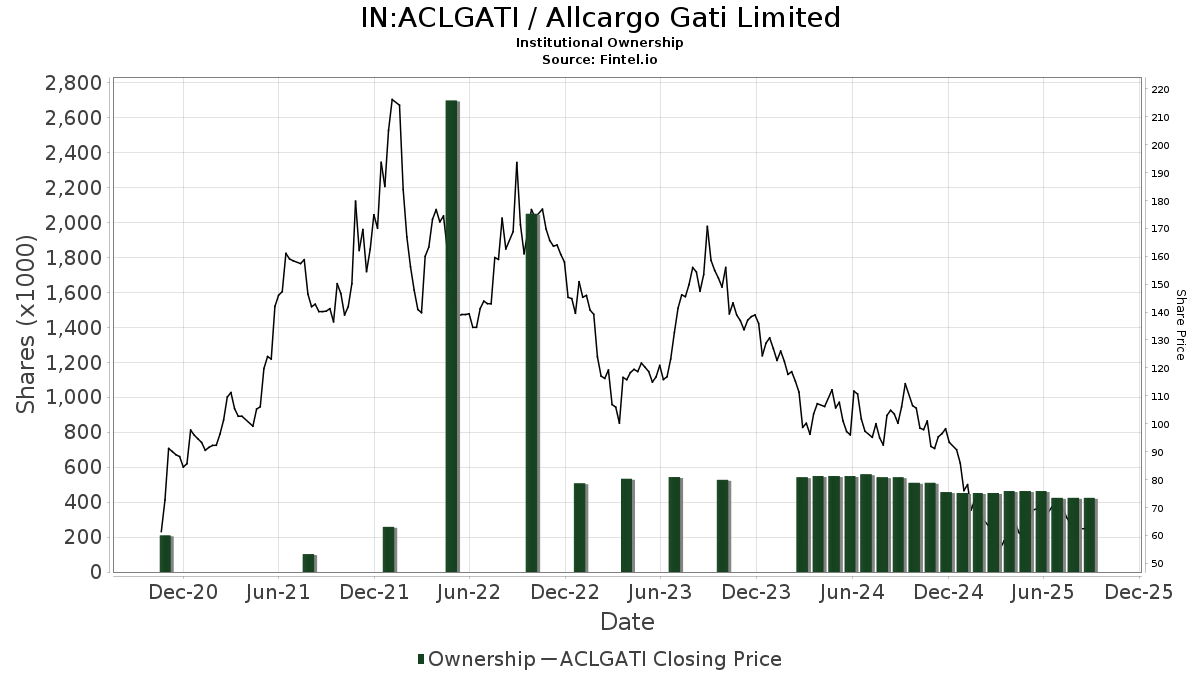

| Saham Institusi (Panjang) | 424,935 - 0.29% (ex 13D/G) - change of -0.04MM shares -8.30% MRQ |

| Nilai Institusi (Panjang) | $ 309 USD ($1000) |

Pemilikan Institusi dan Pemegang Saham

Allcargo Gati Limited (IN:ACLGATI) telah 9 pemilik institusi dan pemegang saham yang telah memfailkan borang 13D/G atau 13F dengan Suruhanjaya Bursa Sekuriti (SEC). Institusi ini memegang sejumlah 424,935 saham. Pemegang saham terbesar termasuk DFCEX - Emerging Markets Core Equity Portfolio - Institutional Class, Dfa Investment Trust Co - The Emerging Markets Small Cap Series, DFAX - Dimensional World ex U.S. Core Equity 2 ETF, DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Social Core Equity Portfolio Shares, DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Sustainability Core 1 Portfolio Institutional Class, DAADX - Emerging Markets ex China Core Equity Portfolio Institutional Class, DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Targeted Value Portfolio Institutional Class, DEXC - Dimensional Emerging Markets ex China Core Equity ETF, and DFSE - Dimensional Emerging Markets Sustainability Core 1 ETF .

Allcargo Gati Limited (NSEI:ACLGATI) struktur pemilikan institusi menunjukkan kedudukan semasa dalam syarikat mengikut institusi dan dana serta perubahan terkini dalam saiz kedudukan. Pemegang saham utama boleh termasuk pelabur individu, dana amanah, dana lindung nilai atau institusi. Jadual 13D menunjukkan bahawa pelabur memegang (atau menahan) lebih daripada 5% syarikat dan berhasrat (atau berniat) untuk secara aktif meneruskan perubahan dalam strategi perniagaan. Jadual 13G menunjukkan pelaburan pasif melebihi 5%.

The share price as of September 8, 2025 is 61.49 / share. Previously, on September 9, 2024, the share price was 100.20 / share. This represents a decline of 38.63% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (Skor Pengumpulan Pemilikan fka) mencari saham yang paling banyak dibeli oleh dana. Ia adalah hasil daripada model kuantitatif pelbagai faktor yang canggih yang mengenal pasti syarikat dengan tahap pengumpulan institusi tertinggi. Model pemarkahan ini menggunakan gabungan jumlah kenaikan dalam pemilik yang didedahkan, perubahan dalam peruntukan portfolio dalam pemilik tersebut dan metrik lain. Nombornya berjulat dari 0 hingga 100, dengan nombor yang lebih tinggi menunjukkan tahap pengumpulan yang lebih tinggi kepada rakannya, dan 50 adalah nombor purata.

Kekerapan Kemas Kini: Harian

Lihat Peneroka Pemilikan yang menyediakan senarai syarikat yang mempunyai kedudukan tertinggi.

Pemfailan 13F dan NPORT

Butiran mengenai pemfailan 13F adalah percuma. Perincian mengenai pemfailan NP memerlukan keahlian premium. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup. Klik pautan ikon untuk melihat sejarah transaksi penuh.

Naik Taraf

untuk membuka data premium dan mengeksport ke Excel ![]() .

.

Other Listings

| IN:532345 |