Statistik Asas

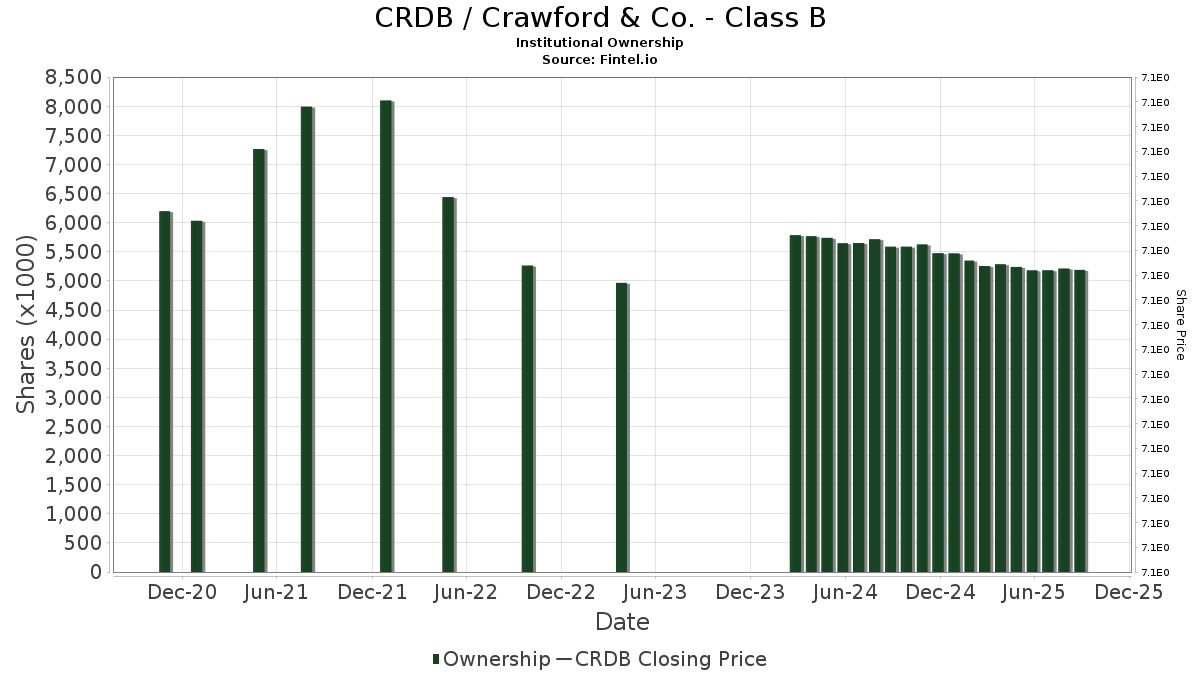

| Pemilik Institusi | 65 total, 65 long only, 0 short only, 0 long/short - change of 1.56% MRQ |

| Purata Peruntukan Portfolio | 0.0526 % - change of -24.94% MRQ |

| Saham Institusi (Panjang) | 5,189,875 (ex 13D/G) - change of 0.01MM shares 0.18% MRQ |

| Nilai Institusi (Panjang) | $ 54,075 USD ($1000) |

Pemilikan Institusi dan Pemegang Saham

Crawford & Co. - Class B (US:CRDB) telah 65 pemilik institusi dan pemegang saham yang telah memfailkan borang 13D/G atau 13F dengan Suruhanjaya Bursa Sekuriti (SEC). Institusi ini memegang sejumlah 5,189,875 saham. Pemegang saham terbesar termasuk Vanguard Group Inc, Truist Financial Corp, VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, Renaissance Technologies Llc, Capital Management Corp /va, Dimensional Fund Advisors Lp, BlackRock, Inc., Minerva Advisors LLC, VEXMX - Vanguard Extended Market Index Fund Investor Shares, and Shayne & Co., Llc .

Crawford & Co. - Class B (NYSE:CRDB) struktur pemilikan institusi menunjukkan kedudukan semasa dalam syarikat mengikut institusi dan dana serta perubahan terkini dalam saiz kedudukan. Pemegang saham utama boleh termasuk pelabur individu, dana amanah, dana lindung nilai atau institusi. Jadual 13D menunjukkan bahawa pelabur memegang (atau menahan) lebih daripada 5% syarikat dan berhasrat (atau berniat) untuk secara aktif meneruskan perubahan dalam strategi perniagaan. Jadual 13G menunjukkan pelaburan pasif melebihi 5%.

Skor Sentimen Dana

Skor Sentimen Dana (Skor Pengumpulan Pemilikan fka) mencari saham yang paling banyak dibeli oleh dana. Ia adalah hasil daripada model kuantitatif pelbagai faktor yang canggih yang mengenal pasti syarikat dengan tahap pengumpulan institusi tertinggi. Model pemarkahan ini menggunakan gabungan jumlah kenaikan dalam pemilik yang didedahkan, perubahan dalam peruntukan portfolio dalam pemilik tersebut dan metrik lain. Nombornya berjulat dari 0 hingga 100, dengan nombor yang lebih tinggi menunjukkan tahap pengumpulan yang lebih tinggi kepada rakannya, dan 50 adalah nombor purata.

Kekerapan Kemas Kini: Harian

Lihat Peneroka Pemilikan yang menyediakan senarai syarikat yang mempunyai kedudukan tertinggi.

Nisbah Put/Call Institusi

Selain melaporkan isu ekuiti dan hutang standard, institusi yang mempunyai lebih daripada 100MM aset di bawah pengurusan juga mesti mendedahkan pegangan opsyen jual dan beli mereka. Memandangkan opsyen jual secara amnya menunjukkan sentimen negatif, dan opsyen beli menunjukkan sentimen positif, kita boleh mendapatkan gambaran keseluruhan sentimen institusi dengan merencanakan nisbah jual kepada beli. Carta di sebelah kanan memplotkan nisbah jual/beli sejarah untuk instrumen ini.

Menggunakan Nisbah Put/Callsebagai penunjuk sentimen pelabur mengatasi salah satu kekurangan utama menggunakan jumlah pemilikan institusi, iaitu sejumlah besar aset di bawah pengurusan dilaburkan secara pasif untuk menjejaki indeks. Dana yang diurus secara pasif biasanya tidak membeli opsyen, jadi penunjuk nisbah put/call mengekori rapat sentimen dana yang diurus secara aktif.

Pemfailan 13D/G

Kami membentangkan pemfailan 13D/G secara berasingan daripada pemfailan 13F kerana layanan yang berbeza oleh SEC. Pemfailan 13D/G boleh difailkan oleh kumpulan pelabur (dengan satu peneraju), manakala pemfailan 13F tidak boleh. Ini mengakibatkan situasi di mana pelabur yang boleh memfailkan 13D/G melaporkan satu nilai untuk jumlah saham (mewakili semua saham yang dimiliki oleh kumpulan pelabur), tetapi kemudian memfailkan 13F dengan melaporkan nilai yang berbeza untuk jumlah saham (mewakili sepenuhnya saham mereka sendiri. pemilikan). Ini bermakna pemilikan saham pemfailan 13D/G dan pemfailan 13F selalunya tidak dapat dibandingkan secara langsung, jadi kami membentangkannya secara berasingan.

Nota: Mulai 16 Mei 2021, kami tidak lagi menunjukkan pemilik yang tidak memfailkan 13D/G pada tahun lepas. Sebelum ini, kami telah menunjukkan sejarah penuh pemfailan 13D/G. Secara umum, entiti yang dikehendaki memfailkan pemfailan 13D/G mesti memfailkan sekurang-kurangnya setiap tahun sebelum menyerahkan pemfailan penutup. Walau bagaimanapun, dana kadangkala keluar dari jawatan tanpa menyerahkan pemfailan penutup (iaitu, ia ditamatkan), jadi memaparkan sejarah penuh kadangkala boleh mengakibatkan kekeliruan tentang pemilikan semasa. Untuk mengelakkan kekeliruan, kini kami hanya menunjukkan pemilik "semasa" - iaitu - pemilik yang telah memfailkan pada tahun lepas.

Upgrade to unlock premium data.

| Tarikh Fail | Borang | Pelabur | Saham Terdahulu |

Saham Terkini |

ΔSaham (Peratus) |

Pemilikan (Peratus) |

ΔPemilikan (Peratus) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-04-30 | VANGUARD GROUP INC | 939,845 | 958,169 | 1.95 | 5.00 | 2.67 |

Pemfailan 13F dan NPORT

Butiran mengenai pemfailan 13F adalah percuma. Perincian mengenai pemfailan NP memerlukan keahlian premium. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup. Klik pautan ikon untuk melihat sejarah transaksi penuh.

Naik Taraf

untuk membuka data premium dan mengeksport ke Excel ![]() .

.