Statistik Asas

| Pemilik Institusi | 93 total, 93 long only, 0 short only, 0 long/short - change of 10.59% MRQ |

| Purata Peruntukan Portfolio | 0.8378 % - change of -10.39% MRQ |

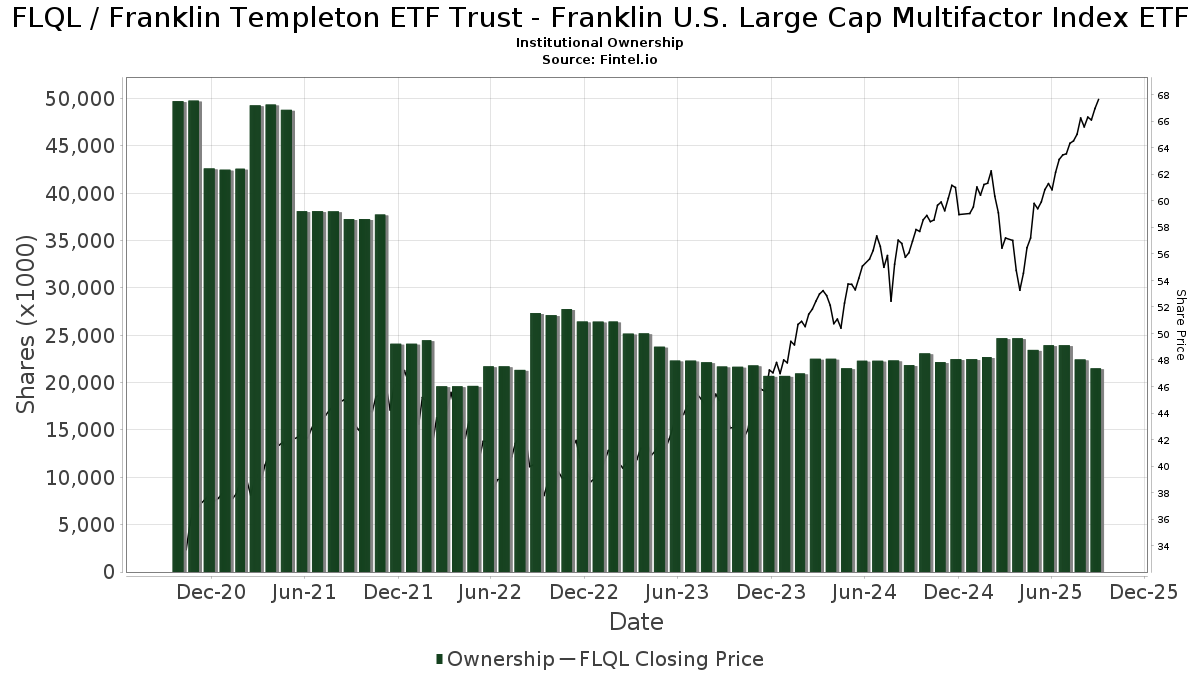

| Saham Institusi (Panjang) | 21,514,870 (ex 13D/G) - change of -2.44MM shares -10.18% MRQ |

| Nilai Institusi (Panjang) | $ 1,315,826 USD ($1000) |

Pemilikan Institusi dan Pemegang Saham

Franklin Templeton ETF Trust - Franklin U.S. Large Cap Multifactor Index ETF (US:FLQL) telah 93 pemilik institusi dan pemegang saham yang telah memfailkan borang 13D/G atau 13F dengan Suruhanjaya Bursa Sekuriti (SEC). Institusi ini memegang sejumlah 21,514,870 saham. Pemegang saham terbesar termasuk Franklin Resources Inc, Bank Of America Corp /de/, FGTZX - Franklin Growth Allocation Fund Advisor Class, FMTZX - Franklin Moderate Allocation Fund Advisor Class, Steward Partners Investment Advisory, Llc, Bank of New York Mellon Corp, Morgan Stanley, LPL Financial LLC, FTCZX - Franklin Conservative Allocation Fund Advisor Class, and Janney Montgomery Scott LLC .

Franklin Templeton ETF Trust - Franklin U.S. Large Cap Multifactor Index ETF (BATS:FLQL) struktur pemilikan institusi menunjukkan kedudukan semasa dalam syarikat mengikut institusi dan dana serta perubahan terkini dalam saiz kedudukan. Pemegang saham utama boleh termasuk pelabur individu, dana amanah, dana lindung nilai atau institusi. Jadual 13D menunjukkan bahawa pelabur memegang (atau menahan) lebih daripada 5% syarikat dan berhasrat (atau berniat) untuk secara aktif meneruskan perubahan dalam strategi perniagaan. Jadual 13G menunjukkan pelaburan pasif melebihi 5%.

The share price as of September 5, 2025 is 66.58 / share. Previously, on September 6, 2024, the share price was 54.57 / share. This represents an increase of 22.02% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (Skor Pengumpulan Pemilikan fka) mencari saham yang paling banyak dibeli oleh dana. Ia adalah hasil daripada model kuantitatif pelbagai faktor yang canggih yang mengenal pasti syarikat dengan tahap pengumpulan institusi tertinggi. Model pemarkahan ini menggunakan gabungan jumlah kenaikan dalam pemilik yang didedahkan, perubahan dalam peruntukan portfolio dalam pemilik tersebut dan metrik lain. Nombornya berjulat dari 0 hingga 100, dengan nombor yang lebih tinggi menunjukkan tahap pengumpulan yang lebih tinggi kepada rakannya, dan 50 adalah nombor purata.

Kekerapan Kemas Kini: Harian

Lihat Peneroka Pemilikan yang menyediakan senarai syarikat yang mempunyai kedudukan tertinggi.

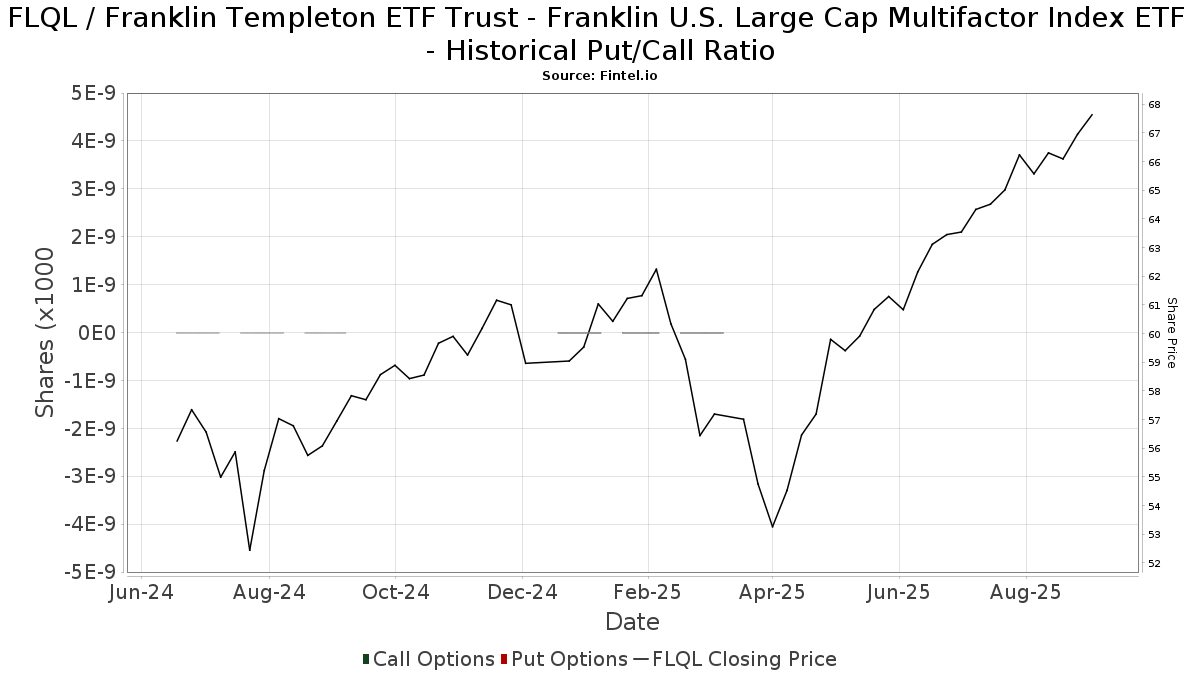

Nisbah Put/Call Institusi

Selain melaporkan isu ekuiti dan hutang standard, institusi yang mempunyai lebih daripada 100MM aset di bawah pengurusan juga mesti mendedahkan pegangan opsyen jual dan beli mereka. Memandangkan opsyen jual secara amnya menunjukkan sentimen negatif, dan opsyen beli menunjukkan sentimen positif, kita boleh mendapatkan gambaran keseluruhan sentimen institusi dengan merencanakan nisbah jual kepada beli. Carta di sebelah kanan memplotkan nisbah jual/beli sejarah untuk instrumen ini.

Menggunakan Nisbah Put/Callsebagai penunjuk sentimen pelabur mengatasi salah satu kekurangan utama menggunakan jumlah pemilikan institusi, iaitu sejumlah besar aset di bawah pengurusan dilaburkan secara pasif untuk menjejaki indeks. Dana yang diurus secara pasif biasanya tidak membeli opsyen, jadi penunjuk nisbah put/call mengekori rapat sentimen dana yang diurus secara aktif.

Pemfailan 13F dan NPORT

Butiran mengenai pemfailan 13F adalah percuma. Perincian mengenai pemfailan NP memerlukan keahlian premium. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup. Klik pautan ikon untuk melihat sejarah transaksi penuh.

Naik Taraf

untuk membuka data premium dan mengeksport ke Excel ![]() .

.

| Tarikh Fail | Sumber | Pelabur | Jenis | Purata Harga (Ang) |

Saham | ΔSaham (%) |

Nilai Dilaporkan ($1000) |

Δ Nilai (%) |

Peruntukan Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-30 | 13F | Bogart Wealth, LLC | 18,745 | 0.00 | 1,184 | 11.92 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 9,596 | 19.19 | 1 | |||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 16,159 | 1 | ||||||

| 2025-08-26 | NP | FLTFX - Franklin LifeSmart 2055 Retirement Target Fund Class A | 53,374 | 0.61 | 3,371 | 12.59 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 3,173 | 200 | ||||||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 5,518 | -15.34 | 349 | -5.18 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 84 | 0.00 | 5 | 0.00 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 50 | 0 | ||||||

| 2025-08-11 | 13F | Wbi Investments, Inc. | 5,109 | 0.00 | 323 | 11.81 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 202,598 | -7.12 | 12,796 | 3.94 | ||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 3,495 | 221 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 100,114 | 8.29 | 6,323 | 21.20 | ||||

| 2025-08-28 | NP | TFAGX - TFA AlphaGen Growth Fund Class I | 7,000 | 442 | ||||||

| 2025-07-31 | 13F | Arrien Investments, Inc. | 20,836 | 3.93 | 1,316 | 16.27 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1,188 | -1.49 | 75 | 10.29 | ||||

| 2025-08-14 | 13F | Fmr Llc | 4,944 | -13.88 | 312 | -3.41 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | -100.00 | 0 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 2,180,552 | 25.36 | 137,724 | 40.28 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 6,233 | -59.76 | 394 | -55.03 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 7,677 | 0.00 | 485 | 11.78 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 18,613 | 752.24 | 1,176 | 863.11 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 1,240 | 0.00 | 78 | 13.04 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 318 | 0.00 | 20 | 17.65 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 20 | |||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 37,866 | 5.51 | 2 | 0.00 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 568,511 | -1.33 | 35,907 | 10.42 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 42,154 | -22.79 | 2,662 | -13.60 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 136,883 | 46.52 | 8,584 | 63.83 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | -100.00 | 0 | ||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 902 | 0.00 | 57 | 12.00 | ||||

| 2025-08-08 | 13F | Glassman Wealth Services | 656 | 0.00 | 41 | 10.81 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 622 | 0.00 | 39 | 11.43 | ||||

| 2025-08-11 | 13F | Paul R. Ried Financial Group, LLC | 52,084 | -0.98 | 3,290 | 10.82 | ||||

| 2025-04-10 | 13F | Key Client Fiduciary Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Stifel Financial Corp | 14,449 | -4.03 | 913 | 7.42 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 36,400 | 2,299 | ||||||

| 2025-08-26 | NP | FLSJX - Franklin LifeSmart 2050 Retirement Target Fund Class A | 68,937 | -2.37 | 4,354 | 9.26 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 35 | -75.00 | 2 | -71.43 | ||||

| 2025-05-15 | 13F | National Wealth Management Group, LLC | 5,031 | 284 | ||||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 32 | 2 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 145,733 | -2.93 | 9,204 | 8.63 | ||||

| 2025-04-23 | 13F | Win Advisors, Inc | 0 | -100.00 | 0 | |||||

| 2025-08-26 | NP | FMTZX - Franklin Moderate Allocation Fund Advisor Class | 1,378,267 | -11.28 | 87,051 | -0.71 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 24,310 | -90.54 | 1,535 | -89.42 | ||||

| 2025-08-26 | NP | FLADX - Franklin LifeSmart 2040 Retirement Target Fund Class A | 65,192 | -2.65 | 4,118 | 8.94 | ||||

| 2025-07-29 | 13F | Crux Wealth Advisors | 23,554 | -54.25 | 1,488 | -48.81 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-22 | 13F | SOL Capital Management CO | 27,938 | 12.98 | 2 | 0.00 | ||||

| 2025-07-09 | 13F | Christopher J. Hasenberg, Inc | 57,285 | -53.71 | 3,618 | -48.40 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 82,305 | -0.83 | 5,198 | 10.97 | ||||

| 2025-08-11 | 13F | Core Wealth Partners LLC | 15,534 | 0.00 | 981 | 11.99 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 151,475 | 6.74 | 9,567 | 19.45 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 1,020,887 | 6.71 | 64,479 | 19.42 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 5,944 | -6.60 | 375 | 4.46 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 560,858 | 17.84 | 35,424 | 31.88 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 105,330 | 1.94 | 6,653 | 14.08 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 156,377 | 10.20 | 9,877 | 23.33 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 35,824 | 52.14 | 2,263 | 70.33 | ||||

| 2025-08-28 | NP | TFAFX - Tactical Growth Allocation Fund Class I | 1,900 | 120 | ||||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 4,996 | -79.01 | 317 | -76.47 | ||||

| 2025-08-12 | 13F | Leigh Baldwin & Co., Llc | 3,922 | -16.05 | 248 | -6.08 | ||||

| 2025-04-17 | 13F | Abound Wealth Management | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 899,593 | -3.32 | 56,818 | 8.19 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 5,048 | 2.58 | 319 | 14.80 | ||||

| 2025-08-26 | NP | FLRMX - Franklin LifeSmart 2020 Retirement Target Fund Class A | 13,503 | -9.85 | 853 | 0.83 | ||||

| 2025-08-13 | 13F/A | StoneX Group Inc. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 11,149 | -4.34 | 704 | 7.15 | ||||

| 2025-08-26 | NP | FTTAX - Franklin LifeSmart 2045 Retirement Target Fund CLASS A | 117,692 | -3.45 | 7,433 | 8.05 | ||||

| 2025-08-07 | 13F | Atala Financial Inc | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | Tiaa Trust, National Association | 3,334 | 211 | ||||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 1,286 | 81 | ||||||

| 2025-08-26 | NP | FTRCX - Franklin LifeSmart 2035 Retirement Target Fund CLASS C | 127,224 | -3.84 | 8,035 | 7.62 | ||||

| 2025-08-26 | NP | FTCZX - Franklin Conservative Allocation Fund Advisor Class | 470,802 | -13.86 | 29,736 | -3.61 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 35,895 | 17.45 | 2 | 100.00 | ||||

| 2025-05-06 | 13F | AE Wealth Management LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 361,334 | 17.87 | 22,822 | 31.90 | ||||

| 2025-07-28 | 13F | Sagespring Wealth Partners, Llc | 31,495 | -1.29 | 1,989 | 10.50 | ||||

| 2025-08-26 | NP | FGTZX - Franklin Growth Allocation Fund Advisor Class | 1,549,976 | -8.91 | 97,896 | 1.94 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 86,818 | -11.27 | 5,483 | -0.71 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 156,347 | 1.56 | 9,875 | 13.65 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 67,713 | -8.94 | 4,277 | 1.91 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 509 | 0.00 | 32 | 14.29 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 342,871 | 5.32 | 21,656 | 17.86 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 240 | -2.04 | 15 | 15.38 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 16,712 | 0.34 | 1,056 | 12.34 | ||||

| 2025-04-24 | 13F | Decker Retirement Planning Inc. | 0 | -100.00 | 0 | |||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 370,460 | -4.66 | 23 | 9.52 | ||||

| 2025-07-23 | 13F | Lakeshore Capital Group, Inc. | 35,049 | -1.67 | 2,214 | 10.04 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 1,010 | 0.00 | 64 | 10.53 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 63,859 | 14.80 | 4,033 | 28.48 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 1,355 | 86 | ||||||

| 2025-08-26 | NP | FTRTX - Franklin LifeSmart 2025 Retirement Target Fund CLASS A | 70,386 | -7.82 | 4,446 | 3.16 | ||||

| 2025-08-26 | NP | FLJSX - Franklin LifeSmart 2060 Retirement Target Fund Advisor Class | 11,555 | 5.96 | 730 | 18.54 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 8,591,482 | -10.12 | 542,638 | 0.58 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 27,727 | -2.52 | 1,751 | 9.10 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 53,296 | 1.85 | 3,366 | 13.99 | ||||

| 2025-08-26 | NP | FLRZX - Franklin LifeSmart 2030 Retirement Target Fund Advisor Class | 58,020 | -5.03 | 3,665 | 6.26 | ||||

| 2025-08-14 | 13F | Comerica Bank | 2,687 | 21.31 | 170 | 35.20 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 15,651 | -58.63 | 989 | -53.72 | ||||

| 2025-08-01 | 13F | Howard Capital Management Inc. | 84,940 | 84.01 | 5,380 | 106.53 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 137,468 | 4.44 | 8,682 | 16.88 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 4,621 | -7.93 | 292 | 2.83 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 182,427 | -0.95 | 12 | 10.00 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 4,527 | 286 |

Other Listings

| MX:FLQL |