Statistik Asas

| Pemilik Institusi | 41 total, 41 long only, 0 short only, 0 long/short - change of 17.14% MRQ |

| Harga Saham | 30.60 |

| Purata Peruntukan Portfolio | 0.2404 % - change of 5.70% MRQ |

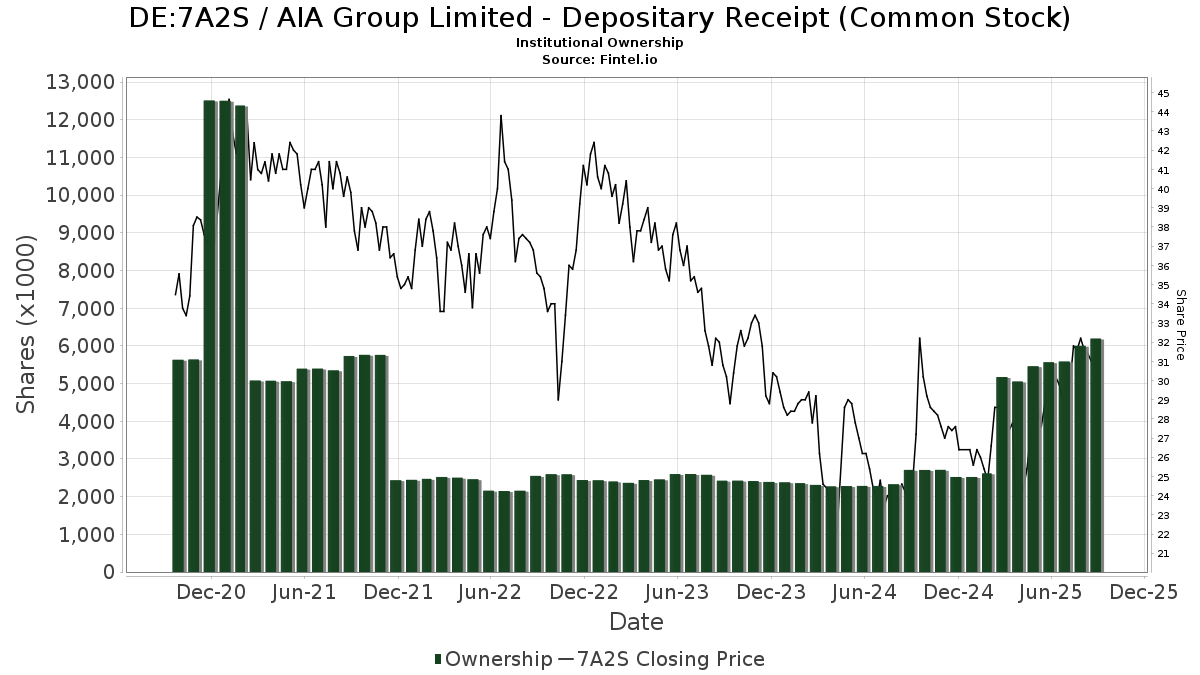

| Saham Institusi (Panjang) | 6,193,164 (ex 13D/G) - change of 0.63MM shares 11.26% MRQ |

| Nilai Institusi (Panjang) | $ 219,102 USD ($1000) |

Pemilikan Institusi dan Pemegang Saham

AIA Group Limited - Depositary Receipt (Common Stock) (DE:7A2S) telah 41 pemilik institusi dan pemegang saham yang telah memfailkan borang 13D/G atau 13F dengan Suruhanjaya Bursa Sekuriti (SEC). Institusi ini memegang sejumlah 6,193,164 saham. Pemegang saham terbesar termasuk DODBX - Dodge & Cox Balanced Fund, Aristotle Capital Management, LLC, FGFAX - Federated International Leaders Fund Class A Shares, Sustainable Growth Advisers, LP, CMIEX - Multi-Manager International Equity Strategies Fund Institutional Class, FILFX - Strategic Advisers International Fund, APIE - ActivePassive International Equity ETF, MFSI - MFS Active International ETF, Boston Common Asset Management, LLC, and Madison Asset Management, LLC .

AIA Group Limited - Depositary Receipt (Common Stock) (DB:7A2S) struktur pemilikan institusi menunjukkan kedudukan semasa dalam syarikat mengikut institusi dan dana serta perubahan terkini dalam saiz kedudukan. Pemegang saham utama boleh termasuk pelabur individu, dana amanah, dana lindung nilai atau institusi. Jadual 13D menunjukkan bahawa pelabur memegang (atau menahan) lebih daripada 5% syarikat dan berhasrat (atau berniat) untuk secara aktif meneruskan perubahan dalam strategi perniagaan. Jadual 13G menunjukkan pelaburan pasif melebihi 5%.

The share price as of September 5, 2025 is 30.60 / share. Previously, on September 9, 2024, the share price was 24.40 / share. This represents an increase of 25.41% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (Skor Pengumpulan Pemilikan fka) mencari saham yang paling banyak dibeli oleh dana. Ia adalah hasil daripada model kuantitatif pelbagai faktor yang canggih yang mengenal pasti syarikat dengan tahap pengumpulan institusi tertinggi. Model pemarkahan ini menggunakan gabungan jumlah kenaikan dalam pemilik yang didedahkan, perubahan dalam peruntukan portfolio dalam pemilik tersebut dan metrik lain. Nombornya berjulat dari 0 hingga 100, dengan nombor yang lebih tinggi menunjukkan tahap pengumpulan yang lebih tinggi kepada rakannya, dan 50 adalah nombor purata.

Kekerapan Kemas Kini: Harian

Lihat Peneroka Pemilikan yang menyediakan senarai syarikat yang mempunyai kedudukan tertinggi.

Pemfailan 13F dan NPORT

Butiran mengenai pemfailan 13F adalah percuma. Perincian mengenai pemfailan NP memerlukan keahlian premium. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup. Klik pautan ikon untuk melihat sejarah transaksi penuh.

Naik Taraf

untuk membuka data premium dan mengeksport ke Excel ![]() .

.