Statistik Asas

| Pemilik Institusi | 183 total, 183 long only, 0 short only, 0 long/short - change of -1.60% MRQ |

| Purata Peruntukan Portfolio | 0.2607 % - change of 33.38% MRQ |

| Saham Institusi (Panjang) | 50,185,193 (ex 13D/G) - change of 2.50MM shares 5.24% MRQ |

| Nilai Institusi (Panjang) | $ 243,182 USD ($1000) |

Pemilikan Institusi dan Pemegang Saham

Nuveen Credit Strategies Income Fund (US:JQC) telah 183 pemilik institusi dan pemegang saham yang telah memfailkan borang 13D/G atau 13F dengan Suruhanjaya Bursa Sekuriti (SEC). Institusi ini memegang sejumlah 50,185,193 saham. Pemegang saham terbesar termasuk Morgan Stanley, Oak Hill Advisors Lp, Guggenheim Capital Llc, Invesco Ltd., Sit Investment Associates Inc, Wells Fargo & Company/mn, Absolute Investment Advisers Llc, PCEF - Invesco CEF Income Composite ETF, Pathstone Holdings, LLC, and Raymond James Financial Inc .

Nuveen Credit Strategies Income Fund (NYSE:JQC) struktur pemilikan institusi menunjukkan kedudukan semasa dalam syarikat mengikut institusi dan dana serta perubahan terkini dalam saiz kedudukan. Pemegang saham utama boleh termasuk pelabur individu, dana amanah, dana lindung nilai atau institusi. Jadual 13D menunjukkan bahawa pelabur memegang (atau menahan) lebih daripada 5% syarikat dan berhasrat (atau berniat) untuk secara aktif meneruskan perubahan dalam strategi perniagaan. Jadual 13G menunjukkan pelaburan pasif melebihi 5%.

The share price as of September 5, 2025 is 5.45 / share. Previously, on September 9, 2024, the share price was 5.87 / share. This represents a decline of 7.16% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (Skor Pengumpulan Pemilikan fka) mencari saham yang paling banyak dibeli oleh dana. Ia adalah hasil daripada model kuantitatif pelbagai faktor yang canggih yang mengenal pasti syarikat dengan tahap pengumpulan institusi tertinggi. Model pemarkahan ini menggunakan gabungan jumlah kenaikan dalam pemilik yang didedahkan, perubahan dalam peruntukan portfolio dalam pemilik tersebut dan metrik lain. Nombornya berjulat dari 0 hingga 100, dengan nombor yang lebih tinggi menunjukkan tahap pengumpulan yang lebih tinggi kepada rakannya, dan 50 adalah nombor purata.

Kekerapan Kemas Kini: Harian

Lihat Peneroka Pemilikan yang menyediakan senarai syarikat yang mempunyai kedudukan tertinggi.

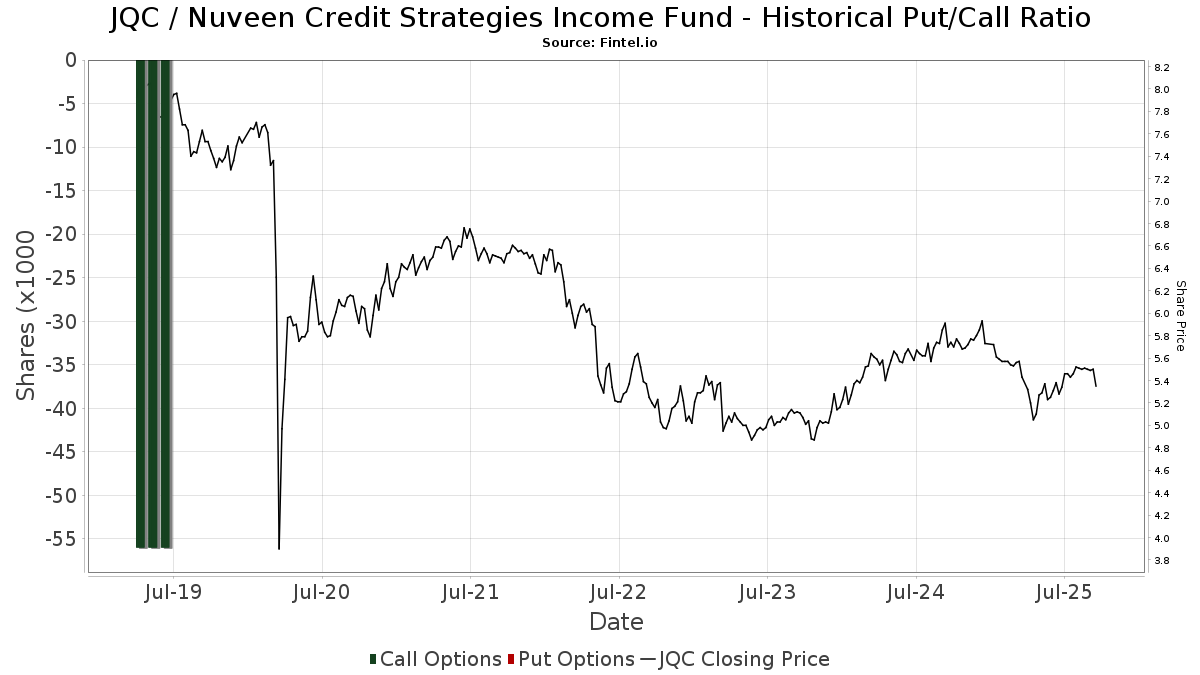

Nisbah Put/Call Institusi

Selain melaporkan isu ekuiti dan hutang standard, institusi yang mempunyai lebih daripada 100MM aset di bawah pengurusan juga mesti mendedahkan pegangan opsyen jual dan beli mereka. Memandangkan opsyen jual secara amnya menunjukkan sentimen negatif, dan opsyen beli menunjukkan sentimen positif, kita boleh mendapatkan gambaran keseluruhan sentimen institusi dengan merencanakan nisbah jual kepada beli. Carta di sebelah kanan memplotkan nisbah jual/beli sejarah untuk instrumen ini.

Menggunakan Nisbah Put/Callsebagai penunjuk sentimen pelabur mengatasi salah satu kekurangan utama menggunakan jumlah pemilikan institusi, iaitu sejumlah besar aset di bawah pengurusan dilaburkan secara pasif untuk menjejaki indeks. Dana yang diurus secara pasif biasanya tidak membeli opsyen, jadi penunjuk nisbah put/call mengekori rapat sentimen dana yang diurus secara aktif.

Pemfailan 13D/G

Kami membentangkan pemfailan 13D/G secara berasingan daripada pemfailan 13F kerana layanan yang berbeza oleh SEC. Pemfailan 13D/G boleh difailkan oleh kumpulan pelabur (dengan satu peneraju), manakala pemfailan 13F tidak boleh. Ini mengakibatkan situasi di mana pelabur yang boleh memfailkan 13D/G melaporkan satu nilai untuk jumlah saham (mewakili semua saham yang dimiliki oleh kumpulan pelabur), tetapi kemudian memfailkan 13F dengan melaporkan nilai yang berbeza untuk jumlah saham (mewakili sepenuhnya saham mereka sendiri. pemilikan). Ini bermakna pemilikan saham pemfailan 13D/G dan pemfailan 13F selalunya tidak dapat dibandingkan secara langsung, jadi kami membentangkannya secara berasingan.

Nota: Mulai 16 Mei 2021, kami tidak lagi menunjukkan pemilik yang tidak memfailkan 13D/G pada tahun lepas. Sebelum ini, kami telah menunjukkan sejarah penuh pemfailan 13D/G. Secara umum, entiti yang dikehendaki memfailkan pemfailan 13D/G mesti memfailkan sekurang-kurangnya setiap tahun sebelum menyerahkan pemfailan penutup. Walau bagaimanapun, dana kadangkala keluar dari jawatan tanpa menyerahkan pemfailan penutup (iaitu, ia ditamatkan), jadi memaparkan sejarah penuh kadangkala boleh mengakibatkan kekeliruan tentang pemilikan semasa. Untuk mengelakkan kekeliruan, kini kami hanya menunjukkan pemilik "semasa" - iaitu - pemilik yang telah memfailkan pada tahun lepas.

Upgrade to unlock premium data.

| Tarikh Fail | Borang | Pelabur | Saham Terdahulu |

Saham Terkini |

ΔSaham (Peratus) |

Pemilikan (Peratus) |

ΔPemilikan (Peratus) |

|

|---|---|---|---|---|---|---|---|---|

| 2024-11-08 | MORGAN STANLEY | 8,064,766 | 5,953,390 | -26.18 | 4.40 | -25.42 |

Pemfailan 13F dan NPORT

Butiran mengenai pemfailan 13F adalah percuma. Perincian mengenai pemfailan NP memerlukan keahlian premium. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup. Klik pautan ikon untuk melihat sejarah transaksi penuh.

Naik Taraf

untuk membuka data premium dan mengeksport ke Excel ![]() .

.

| Tarikh Fail | Sumber | Pelabur | Jenis | Purata Harga (Ang) |

Saham | ΔSaham (%) |

Nilai Dilaporkan ($1000) |

Δ Nilai (%) |

Peruntukan Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 82,452 | 0.00 | 444 | 0.23 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 2,529,455 | 9.70 | 13,634 | 9.90 | ||||

| 2025-08-12 | 13F | DCF Advisers, LLC | 371,713 | 14.47 | 2,004 | 14.72 | ||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 373,043 | -6.82 | 2,011 | -6.64 | ||||

| 2025-07-23 | 13F | Tcfg Wealth Management, Llc | 19,093 | 0.00 | 103 | 0.00 | ||||

| 2025-08-14 | 13F | Polar Asset Management Partners Inc. | 1,495,667 | 70.10 | 8,062 | 70.42 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 232,347 | -12.69 | 1,253 | -12.50 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 74,608 | 39.43 | 402 | 40.07 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Balanced Income Plus Portfolio Class A | 12,530 | 0.00 | 68 | 0.00 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1,262 | 0.00 | 7 | 0.00 | ||||

| 2025-07-10 | 13F | Atticus Wealth Management, Llc | 1,799 | 0.00 | 10 | 0.00 | ||||

| 2025-08-27 | NP | ACEFX - Absolute Strategies Fund Institutional Shares | 62,100 | 124,100.00 | 335 | |||||

| 2025-07-21 | 13F | Hilltop National Bank | 700 | 40.00 | 4 | 50.00 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 1,289,447 | 11.88 | 6,950 | 12.10 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 4,365 | 3.12 | 24 | 4.55 | ||||

| 2025-08-15 | 13F | Provenance Wealth Advisors, LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-17 | 13F | Venture Visionary Partners LLC | 483,595 | 0.00 | 2,607 | 0.19 | ||||

| 2025-08-06 | 13F | Disciplined Investors, L.L.C. | 13,329 | -18.73 | 72 | -19.32 | ||||

| 2025-07-14 | 13F | Occidental Asset Management, LLC | 13,477 | -0.44 | 73 | 0.00 | ||||

| 2025-07-24 | 13F | Accredited Investor Services, Llc | 30,496 | 17.79 | 164 | 17.99 | ||||

| 2025-08-15 | 13F | First Heartland Consultants, Inc. | 31,012 | 0.00 | 167 | 0.60 | ||||

| 2025-07-16 | 13F | Castleview Partners, Llc | 216,087 | 1,165 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 298,997 | -81.85 | 1,612 | -81.82 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 77,016 | -15.31 | 415 | -15.13 | ||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 29,256 | 0.78 | 158 | 0.64 | ||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 25,965 | 140 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 259,922 | 79.38 | 1,401 | 79.72 | ||||

| 2025-07-11 | 13F | Seacrest Wealth Management, Llc | 40,498 | -0.52 | 218 | -0.46 | ||||

| 2025-08-08 | 13F | Fiera Capital Corp | 185,336 | -0.89 | 999 | -0.80 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 67,933 | 10.87 | 366 | 11.25 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 65,559 | 264.22 | 353 | 267.71 | ||||

| 2025-08-08 | 13F | Creative Planning | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | StoneX Group Inc. | 18,492 | -37.49 | 100 | -37.74 | ||||

| 2025-07-15 | 13F | Absolute Investment Advisers Llc | 1,847,341 | 9,957 | ||||||

| 2025-05-30 | NP | Rivernorth Opportunities Fund, Inc. | 100 | -99.96 | 1 | -100.00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 248,766 | 96.94 | 1,341 | 97.35 | ||||

| 2025-08-14 | 13F | Quarry LP | 749,998 | 85.54 | 4,042 | 85.92 | ||||

| 2025-05-06 | 13F | AE Wealth Management LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-10 | 13F | Stolper Co | 238,694 | 10.71 | 1 | 0.00 | ||||

| 2025-07-09 | 13F | VisionPoint Advisory Group, LLC | 27,082 | 146 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 84,126 | -1.58 | 453 | -1.31 | ||||

| 2025-08-28 | NP | YYY - Amplify High Income ETF | 938,691 | 2.58 | 5,060 | 2.78 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 92,965 | 269.61 | 501 | 271.11 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Opportunity Income Plus Portfolio Class A | 25,612 | 0.00 | 138 | 0.73 | ||||

| 2025-07-15 | 13F | Retirement Income Solutions, Inc | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 1,631,883 | 2,002.35 | 8,796 | 1,858.80 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 251,166 | 15.15 | 1 | 0.00 | ||||

| 2025-08-14 | 13F | Robinson Capital Management, Llc | 120,650 | 650 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 17,787 | -76.66 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 794,908 | 35.41 | 4,285 | 35.66 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 24,290 | 64.85 | 131 | 64.56 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 198,167 | 7.14 | 1,079 | 7.26 | ||||

| 2025-07-30 | 13F | Forum Financial Management, LP | 15,000 | 0.00 | 81 | 0.00 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Diversified Income Plus Portfolio Class A | 31,444 | 0.00 | 169 | 0.00 | ||||

| 2025-05-14 | 13F | Huntington National Bank | 10 | |||||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 2,710 | 8.40 | 15 | 15.38 | ||||

| 2025-07-28 | NP | PCEF - Invesco CEF Income Composite ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1,717,513 | 30.35 | 8,983 | 22.84 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Multi-Hedge Strategies Fund Variable Annuity | 591 | 278.85 | 3 | |||||

| 2025-06-27 | NP | Calamos ETF Trust - Calamos CEF Income & Arbitrage ETF | 120,972 | 7.69 | 638 | 1.59 | ||||

| 2025-07-14 | 13F | Maryland Capital Advisors Inc. | 5,000 | 27 | ||||||

| 2025-08-05 | 13F | Fullcircle Wealth Llc | 104,188 | 37.87 | 573 | 48.06 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 401 | 0.00 | 2 | 0.00 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 32,140 | 190.60 | 173 | 193.22 | ||||

| 2025-07-31 | 13F | Anchor Capital Management Group Inc | 175,000 | 0.00 | 943 | 0.21 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 375,696 | -9.74 | 2,025 | -9.56 | ||||

| 2025-05-30 | NP | RNDLX - RiverNorth/DoubleLine Strategic Income Fund Class R | 100 | -99.88 | 1 | -100.00 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 63,386 | -70.39 | 342 | -70.37 | ||||

| 2025-05-30 | NP | RNOTX - RiverNorth/Oaktree High Income Fund Class R | 100 | -99.87 | 1 | -100.00 | ||||

| 2025-08-15 | 13F | Prevail Innovative Wealth Advisors, Llc | 354,680 | 35.45 | 1,912 | 35.72 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 83,123 | 9.28 | 0 | |||||

| 2025-07-21 | 13F | Future Financial Wealth Managment LLC | 91,476 | 493 | ||||||

| 2025-07-08 | 13F | Allen Mooney & Barnes Investment Advisors LLC | 14,601 | 0.00 | 79 | 0.00 | ||||

| 2025-08-14 | 13F | First Foundation Advisors | 12,000 | 0.00 | 65 | 0.00 | ||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 56,474 | 0.00 | 304 | 0.33 | ||||

| 2025-08-08 | 13F | Meridian Wealth Management, LLC | 57,762 | 1.49 | 311 | 1.63 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 18,860 | -21.09 | 102 | -21.09 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 163,884 | -19.09 | 883 | -18.92 | ||||

| 2025-08-14 | 13F | Ausdal Financial Partners, Inc. | 161,713 | -0.08 | 872 | 0.11 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 27,897 | -1.43 | 153 | 0.00 | ||||

| 2025-08-06 | 13F | North Capital, Inc. | 0 | -100.00 | 0 | |||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 10,325 | -4.62 | 56 | -9.84 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 85,296 | -0.12 | 460 | 0.00 | ||||

| 2025-08-11 | 13F | HHM Wealth Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 933 | 0.00 | 5 | 0.00 | ||||

| 2025-07-21 | 13F | First National Bank & Trust Co Of Newtown | 114,520 | -0.06 | 617 | 0.16 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 67,313 | 16.78 | 366 | 16.93 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 0 | -100.00 | 0 | |||||

| 2025-07-24 | NP | DFRAX - DWS Floating Rate Fund Class A | 63,386 | -70.39 | 332 | -72.14 | ||||

| 2025-08-13 | 13F | Icon Advisers Inc/co | 64,776 | 349 | ||||||

| 2025-08-06 | 13F | Tabor Asset Management, LP | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 550 | 0.00 | 3 | 0.00 | ||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 150,459 | 19.80 | 811 | 20.00 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 34,629 | -1.85 | 187 | -1.59 | ||||

| 2025-07-15 | 13F | DKM Wealth Management, Inc. | 15,000 | 0.00 | 81 | 0.00 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 75,180 | 79.44 | 405 | 80.00 | ||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 391,087 | -50.00 | 2 | -50.00 | ||||

| 2025-04-23 | 13F | Navis Wealth Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | Elequin Capital Lp | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | Keyes, Stange & Wooten Wealth Management, LLC | 26,820 | 2.44 | 145 | 2.86 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 10,147 | -12.67 | 55 | -12.90 | ||||

| 2025-08-13 | 13F | Fiduciary Group LLC | 12,950 | 0.00 | 70 | 0.00 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 35,771 | -1.84 | 193 | -7.25 | ||||

| 2025-08-14 | 13F | Garden State Investment Advisory Services LLC | 12,773 | 0.48 | 69 | 0.00 | ||||

| 2025-08-08 | 13F | City Of London Investment Management Co Ltd | 635,847 | 238.70 | 3,427 | 239.64 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 44,624 | 54.49 | 241 | 54.84 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 9,000 | 0.00 | 49 | 0.00 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100.00 | 0 | |||||

| 2025-06-26 | NP | ATCAX - Anchor Risk Managed Credit Strategies Fund Advisor Class Shares | 175,000 | 0.00 | 915 | -5.77 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1,912,762 | 1.42 | 10,310 | 1.61 | ||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | -100.00 | 0 | |||||

| 2025-07-17 | 13F | Halbert Hargrove Global Advisors, Llc | 3,000 | 0.00 | 16 | 0.00 | ||||

| 2025-06-26 | NP | AABFX - Thrivent Balanced Income Plus Fund Class A | 12,898 | 0.00 | 68 | -6.94 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 15,250 | 82 | ||||||

| 2025-08-07 | 13F | Encompass More Asset Management | 125,476 | 0.80 | 676 | 1.05 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 10,414 | 56 | ||||||

| 2025-08-13 | 13F | Walleye Capital LLC | 0 | -100.00 | 0 | |||||

| 2025-08-28 | NP | RNCOX - RiverNorth Core Opportunity Fund Class R | 81,830 | 81,730.00 | 441 | |||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 8,061 | 0.99 | 43 | 10.26 | ||||

| 2025-08-05 | 13F | Shaker Financial Services, LLC | 24,452 | 135 | ||||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 17,115 | 0.00 | 92 | 0.00 | ||||

| 2025-08-27 | NP | RYMSX - Guggenheim Multi-Hedge Strategies Fund Class P | 351 | 194.96 | 2 | |||||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 948,351 | 3.64 | 5 | 25.00 | ||||

| 2025-05-30 | NP | Rivernorth/doubleline Strategic Opportunity Fund, Inc. | 100 | -99.97 | 1 | -100.00 | ||||

| 2025-08-14 | 13F | Alpine Global Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | NWF Advisory Services Inc. | 49,800 | 268 | ||||||

| 2025-08-14 | 13F | Comerica Bank | 29,246 | -62.66 | 158 | -62.71 | ||||

| 2025-08-27 | NP | AAHYX - Thrivent Diversified Income Plus Fund Class A | 50,149 | 0.00 | 270 | 0.37 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 4,492 | 0.00 | 24 | 0.00 | ||||

| 2025-08-07 | 13F | Readystate Asset Management Lp | 291,903 | 1,573 | ||||||

| 2025-06-26 | NP | AAINX - Thrivent Opportunity Income Plus Fund Class A | 102,539 | 0.00 | 540 | -5.76 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-08 | 13F | Calamos Advisors LLC | 120,972 | 12.00 | 652 | 12.22 | ||||

| 2025-08-01 | 13F | Ashton Thomas Private Wealth, LLC | 19,721 | 51.21 | 107 | 52.86 | ||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 0 | -100.00 | 0 | |||||

| 2025-08-04 | 13F | Kovack Advisors, Inc. | 56,940 | 89.80 | 307 | 90.06 | ||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 846 | 20.00 | 5 | 33.33 | ||||

| 2025-08-11 | 13F | WPG Advisers, LLC | 6,151 | -22.25 | 33 | -21.43 | ||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 130,257 | -2.25 | 702 | -1.96 | ||||

| 2025-04-21 | 13F | ORG Partners LLC | 0 | -100.00 | 0 | |||||

| 2025-07-11 | 13F | Annex Advisory Services, LLC | 16,725 | 0.00 | 90 | 1.12 | ||||

| 2025-05-14 | 13F | Van Hulzen Asset Management, LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Sit Investment Associates Inc | 2,225,536 | 487.58 | 12 | 450.00 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 5,041 | 0.00 | 0 | |||||

| 2025-05-08 | 13F | Private Advisory Group LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-10 | 13F | Sovran Advisors, LLC | 214,914 | -44.28 | 1,173 | -39.29 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 1,532,147 | -4.91 | 8,258 | -4.73 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 10,640,087 | 8.66 | 57,350 | 8.87 | ||||

| 2025-06-30 | NP | CVY - Invesco Zacks Multi-Asset Income ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 130,300 | -3.40 | 687 | -8.90 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 3,000 | 0.00 | 0 | |||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 51,758 | 1.92 | 279 | 1.83 | ||||

| 2025-08-14 | 13F | Cohen & Steers, Inc. | 734,738 | 0.00 | 4 | 0.00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 81,153 | 437 | ||||||

| 2025-07-07 | 13F | Centurion Wealth Management LLC | 66,465 | -2.06 | 358 | -7.25 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100.00 | 0 | |||||

| 2025-08-08 | 13F | Family Firm, Inc. | 124,051 | 2.86 | 669 | 3.09 | ||||

| 2025-08-05 | 13F | Kesler, Norman & Wride, LLC | 11,151 | -1.02 | 60 | 0.00 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 552,310 | 20.37 | 2,977 | 20.58 | ||||

| 2025-08-08 | 13F/A | Ignite Planners, LLC | 17,891 | 28.68 | 98 | 32.43 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 56,897 | 310 | ||||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 360,249 | -9.05 | 1,942 | -8.92 | ||||

| 2025-08-14 | 13F | Cable Car Capital LLC | 0 | -100.00 | 0 | |||||

| 2025-07-30 | NP | HYIN - WisdomTree Alternative Income Fund N/A | 407,112 | 46.47 | 2,129 | 38.07 | ||||

| 2025-05-08 | 13F | Plante Moran Financial Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Virtu Financial LLC | 21,661 | 78.21 | 0 | |||||

| 2025-07-16 | 13F | PFS Partners, LLC | 1,000 | 5 | ||||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 211,630 | 10.18 | 1,141 | 10.36 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 16,200 | 0.00 | 87 | 0.00 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 41 | -92.26 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Oak Hill Advisors Lp | 3,301,932 | -50.35 | 17,797 | -0.51 | ||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 0 | -100.00 | 0 | |||||

| 2025-07-23 | 13F | Sax Wealth Advisors, Llc | 12,374 | 0.00 | 67 | 0.00 | ||||

| 2025-07-25 | NP | FCEF - First Trust CEF Income Opportunity ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 144,026 | -26.36 | 753 | -30.60 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 48,686 | 262 | ||||||

| 2025-08-12 | 13F | Landscape Capital Management, L.l.c. | 291,952 | -11.23 | 1,574 | -11.08 | ||||

| 2025-08-20 | NP | LSPAX - LoCorr Spectrum Income Fund Class A | 137,766 | 20.00 | 743 | 20.26 | ||||

| 2025-06-25 | NP | VPC - Virtus Private Credit Strategy ETF | 225,536 | 41.95 | 1,189 | 33.78 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 0 | -100.00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 129,605 | 9.81 | 699 | 9.92 | ||||

| 2025-07-16 | 13F | Formidable Asset Management, LLC | 18,300 | 0.00 | 98 | 0.00 | ||||

| 2025-08-13 | 13F | Thomas J. Herzfeld Advisors, Inc. | 676,389 | 3,646 | ||||||

| 2025-05-15 | 13F | Ancora Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 235 | 1 | ||||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 19,780 | 0.00 | 107 | 0.00 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 45,378 | -11.87 | 245 | -11.91 | ||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 350 | 0.00 | 2 | 0.00 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | -100.00 | 0 | |||||

| 2025-07-15 | 13F | Main Street Group, LTD | 500 | 0.00 | 3 | 0.00 | ||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Almitas Capital LLC | 63,388 | 342 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 23,400 | 0.33 | 0 | |||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 330 | 0.00 | 2 | 0.00 | ||||

| 2025-04-15 | 13F | Noble Wealth Management PBC | 2,000 | 11 | ||||||

| 2025-05-07 | 13F | Sheaff Brock Investment Advisors, LLC | 12,650 | 0.00 | 68 | -4.23 | ||||

| 2025-07-11 | 13F | Quad-Cities Investment Group, LLC | 23,262 | -30.70 | 125 | -30.56 | ||||

| 2025-05-09 | 13F | Cornerstone Advisors, LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 8,902 | 138.28 | 48 | 147.37 | ||||

| 2025-08-11 | 13F | SFI Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 36,748 | -4.34 | 0 | |||||

| 2025-08-25 | NP | IOBAX - ICON FLEXIBLE BOND FUND Investor Class | 64,776 | 349 | ||||||

| 2025-04-24 | 13F | Total Wealth Planning & Management, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 2,815,113 | 12.87 | 15,173 | 13.08 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 21,394 | 0.00 | 115 | 0.00 | ||||

| 2025-08-01 | 13F | Alexander Labrunerie & Co., Inc. | 47,903 | 32.37 | 258 | 32.99 | ||||

| 2025-05-06 | 13F | WT Wealth Management | 15,488 | 0.00 | 83 | -5.68 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 13,155 | 6.05 | 71 | 6.06 | ||||

| 2025-08-12 | 13F | Bokf, Na | 0 | -100.00 | 0 | |||||

| 2025-08-27 | NP | RBNAX - Robinson Opportunistic Income Fund Class A Shares | 120,000 | 647 | ||||||

| 2025-08-14 | 13F | Stifel Financial Corp | 340,699 | 1.79 | 1,836 | 2.00 | ||||

| 2025-07-15 | 13F | BKA Wealth Consulting, Inc. | 145,963 | -29.50 | 787 | -29.38 | ||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 1,800 | 0.00 | 0 | |||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 46,963 | 95.03 | 253 | 96.12 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 55,101 | 1.97 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 2,230 | -40.21 | 12 | -40.00 | ||||

| 2025-08-13 | 13F | Yakira Capital Management, Inc. | 253,121 | -72.78 | 1,364 | -72.74 | ||||

| 2025-08-14 | 13F | Rivernorth Capital Management, Llc | 81,830 | 441 |