Statistik Asas

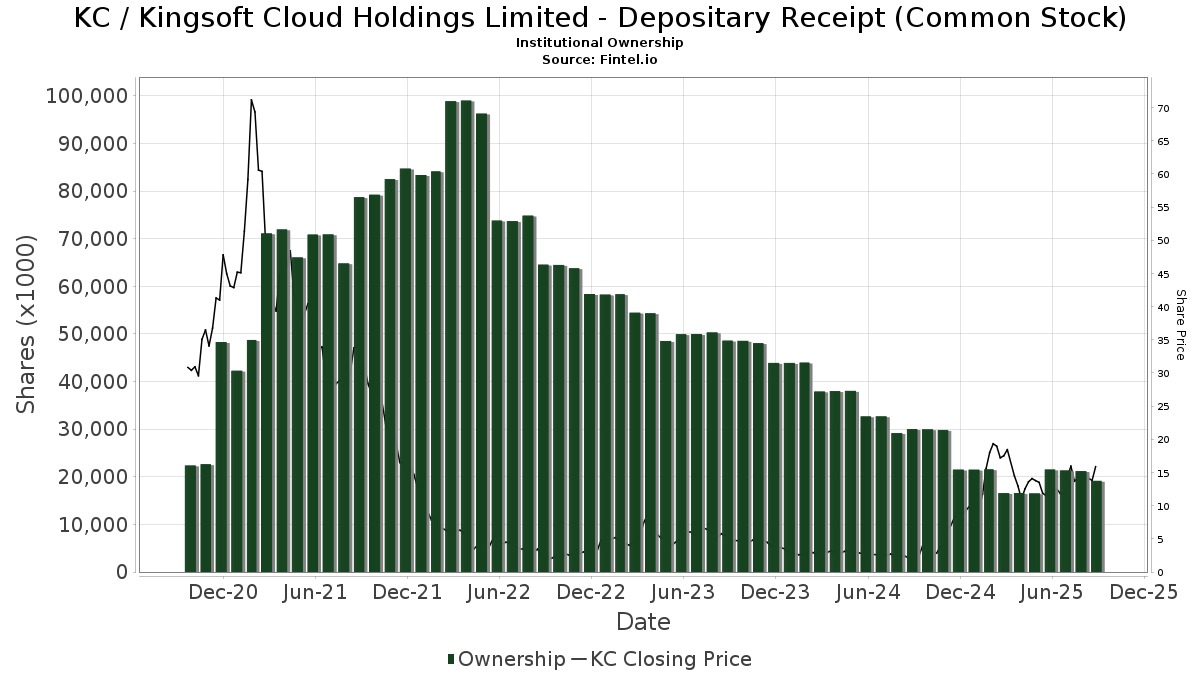

| Pemilik Institusi | 107 total, 101 long only, 0 short only, 6 long/short - change of -0.93% MRQ |

| Purata Peruntukan Portfolio | 0.1101 % - change of 3.18% MRQ |

| Saham Institusi (Panjang) | 19,153,685 (ex 13D/G) - change of -2.37MM shares -11.02% MRQ |

| Nilai Institusi (Panjang) | $ 229,850 USD ($1000) |

Pemilikan Institusi dan Pemegang Saham

Kingsoft Cloud Holdings Limited - Depositary Receipt (Common Stock) (US:KC) telah 107 pemilik institusi dan pemegang saham yang telah memfailkan borang 13D/G atau 13F dengan Suruhanjaya Bursa Sekuriti (SEC). Institusi ini memegang sejumlah 19,153,685 saham. Pemegang saham terbesar termasuk UBS Group AG, D. E. Shaw & Co., Inc., Morgan Stanley, Jpmorgan Chase & Co, State Street Corp, Ghisallo Capital Management LLC, XY Capital Ltd, LMR Partners LLP, Penserra Capital Management LLC, and SIXG - Defiance Next Gen Connectivity ETF .

Kingsoft Cloud Holdings Limited - Depositary Receipt (Common Stock) (NasdaqGS:KC) struktur pemilikan institusi menunjukkan kedudukan semasa dalam syarikat mengikut institusi dan dana serta perubahan terkini dalam saiz kedudukan. Pemegang saham utama boleh termasuk pelabur individu, dana amanah, dana lindung nilai atau institusi. Jadual 13D menunjukkan bahawa pelabur memegang (atau menahan) lebih daripada 5% syarikat dan berhasrat (atau berniat) untuk secara aktif meneruskan perubahan dalam strategi perniagaan. Jadual 13G menunjukkan pelaburan pasif melebihi 5%.

The share price as of September 5, 2025 is 13.83 / share. Previously, on September 6, 2024, the share price was 2.09 / share. This represents an increase of 561.72% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (Skor Pengumpulan Pemilikan fka) mencari saham yang paling banyak dibeli oleh dana. Ia adalah hasil daripada model kuantitatif pelbagai faktor yang canggih yang mengenal pasti syarikat dengan tahap pengumpulan institusi tertinggi. Model pemarkahan ini menggunakan gabungan jumlah kenaikan dalam pemilik yang didedahkan, perubahan dalam peruntukan portfolio dalam pemilik tersebut dan metrik lain. Nombornya berjulat dari 0 hingga 100, dengan nombor yang lebih tinggi menunjukkan tahap pengumpulan yang lebih tinggi kepada rakannya, dan 50 adalah nombor purata.

Kekerapan Kemas Kini: Harian

Lihat Peneroka Pemilikan yang menyediakan senarai syarikat yang mempunyai kedudukan tertinggi.

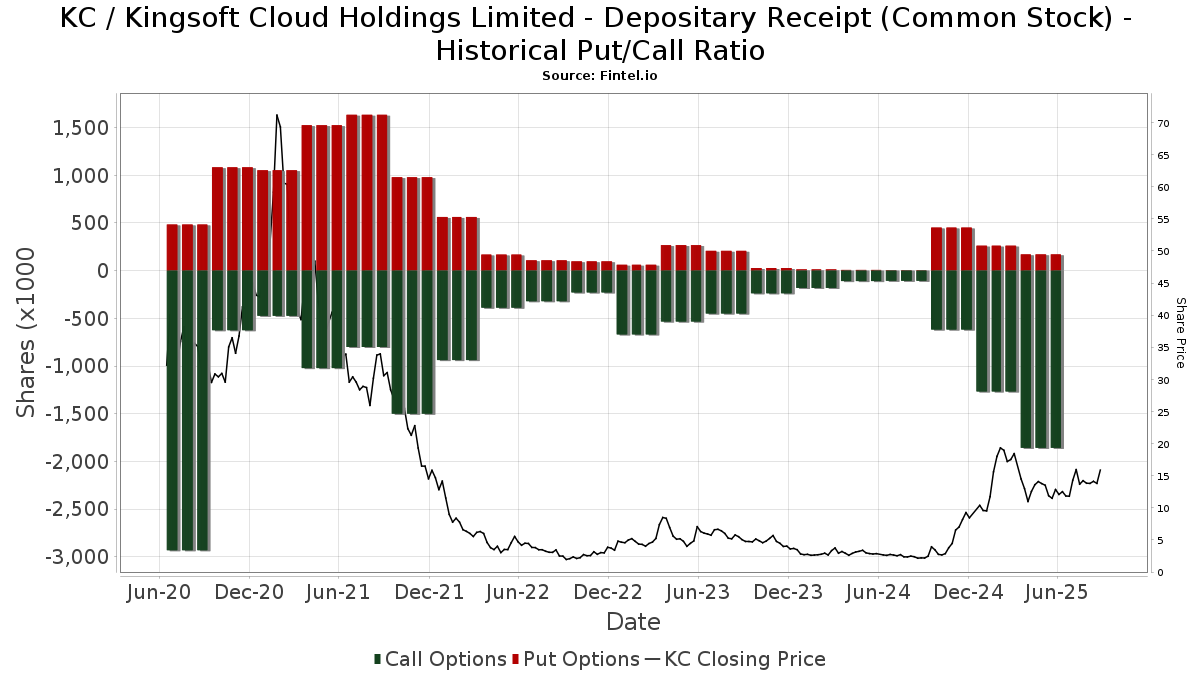

Nisbah Put/Call Institusi

Selain melaporkan isu ekuiti dan hutang standard, institusi yang mempunyai lebih daripada 100MM aset di bawah pengurusan juga mesti mendedahkan pegangan opsyen jual dan beli mereka. Memandangkan opsyen jual secara amnya menunjukkan sentimen negatif, dan opsyen beli menunjukkan sentimen positif, kita boleh mendapatkan gambaran keseluruhan sentimen institusi dengan merencanakan nisbah jual kepada beli. Carta di sebelah kanan memplotkan nisbah jual/beli sejarah untuk instrumen ini.

Menggunakan Nisbah Put/Callsebagai penunjuk sentimen pelabur mengatasi salah satu kekurangan utama menggunakan jumlah pemilikan institusi, iaitu sejumlah besar aset di bawah pengurusan dilaburkan secara pasif untuk menjejaki indeks. Dana yang diurus secara pasif biasanya tidak membeli opsyen, jadi penunjuk nisbah put/call mengekori rapat sentimen dana yang diurus secara aktif.

Pemfailan 13D/G

Kami membentangkan pemfailan 13D/G secara berasingan daripada pemfailan 13F kerana layanan yang berbeza oleh SEC. Pemfailan 13D/G boleh difailkan oleh kumpulan pelabur (dengan satu peneraju), manakala pemfailan 13F tidak boleh. Ini mengakibatkan situasi di mana pelabur yang boleh memfailkan 13D/G melaporkan satu nilai untuk jumlah saham (mewakili semua saham yang dimiliki oleh kumpulan pelabur), tetapi kemudian memfailkan 13F dengan melaporkan nilai yang berbeza untuk jumlah saham (mewakili sepenuhnya saham mereka sendiri. pemilikan). Ini bermakna pemilikan saham pemfailan 13D/G dan pemfailan 13F selalunya tidak dapat dibandingkan secara langsung, jadi kami membentangkannya secara berasingan.

Nota: Mulai 16 Mei 2021, kami tidak lagi menunjukkan pemilik yang tidak memfailkan 13D/G pada tahun lepas. Sebelum ini, kami telah menunjukkan sejarah penuh pemfailan 13D/G. Secara umum, entiti yang dikehendaki memfailkan pemfailan 13D/G mesti memfailkan sekurang-kurangnya setiap tahun sebelum menyerahkan pemfailan penutup. Walau bagaimanapun, dana kadangkala keluar dari jawatan tanpa menyerahkan pemfailan penutup (iaitu, ia ditamatkan), jadi memaparkan sejarah penuh kadangkala boleh mengakibatkan kekeliruan tentang pemilikan semasa. Untuk mengelakkan kekeliruan, kini kami hanya menunjukkan pemilik "semasa" - iaitu - pemilik yang telah memfailkan pada tahun lepas.

Upgrade to unlock premium data.

| Tarikh Fail | Borang | Pelabur | Saham Terdahulu |

Saham Terkini |

ΔSaham (Peratus) |

Pemilikan (Peratus) |

ΔPemilikan (Peratus) |

|

|---|---|---|---|---|---|---|---|---|

| 2024-11-14 | CANADA PENSION PLAN INVESTMENT BOARD | 330,609,120 | 187,031,790 | -43.43 | 4.90 | -43.68 |

Pemfailan 13F dan NPORT

Butiran mengenai pemfailan 13F adalah percuma. Perincian mengenai pemfailan NP memerlukan keahlian premium. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup. Klik pautan ikon untuk melihat sejarah transaksi penuh.

Naik Taraf

untuk membuka data premium dan mengeksport ke Excel ![]() .

.

| Tarikh Fail | Sumber | Pelabur | Jenis | Purata Harga (Ang) |

Saham | ΔSaham (%) |

Nilai Dilaporkan ($1000) |

Δ Nilai (%) |

Peruntukan Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | Walleye Capital LLC | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Oaktree Capital Management Lp | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 17,447 | 18.99 | 218 | 3.81 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 316,472 | -18.07 | 3,962 | -28.56 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-01 | 13F | Belvedere Trading LLC | Call | 50,500 | 1.00 | 632 | -11.98 | |||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | XY Capital Ltd | 647,543 | 85.59 | 8,107 | 61.82 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Call | 0 | -100.00 | 0 | -100.00 | |||

| 2025-05-15 | 13F | Tiger Pacific Capital LP | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 54,551 | -59.18 | 683 | -64.44 | ||||

| 2025-06-17 | NP | GSEQX - Goldman Sachs Multi-Manager Global Equity Fund Class R6 Shares | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 0 | -100.00 | 0 | |||||

| 2025-05-13 | 13F | Quantbot Technologies LP | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 1,780 | 0.00 | 22 | -12.00 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | Put | 0 | -100.00 | 0 | ||||

| 2025-06-27 | NP | PGJ - Invesco Golden Dragon China ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 32,230 | -36.47 | 438 | -31.24 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 17,843 | -55.71 | 223 | -61.42 | ||||

| 2025-07-15 | 13F | Compagnie Lombard Odier SCmA | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Oaktree Fund Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 192,671 | 338.70 | 2 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 499 | 219.87 | 6 | 200.00 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 8,000 | 100 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 229,000 | 97.07 | 3 | 100.00 | |||

| 2025-08-28 | NP | KOMP - SPDR S&P Kensho New Economies Composite ETF This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 156,689 | 1,962 | ||||||

| 2025-05-15 | 13F | Voloridge Investment Management, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 38,962 | 158.95 | 488 | 125.46 | ||||

| 2025-08-14 | 13F | Ghisallo Capital Management LLC | 695,000 | 8,701 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 12,200 | -9.83 | 153 | -21.65 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 87,134 | -89.47 | 1,091 | -90.83 | ||||

| 2025-05-08 | 13F | XTX Topco Ltd | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | Call | 88,200 | 0.00 | 1,104 | -12.80 | |||

| 2025-08-14 | 13F/A | Barclays Plc | 100,775 | 1 | ||||||

| 2025-07-23 | NP | XAIX - Xtrackers Artificial Intelligence and Big Data ETF | 1,454 | 0.00 | 16 | -30.43 | ||||

| 2025-08-14 | 13F | State Street Corp | 936,203 | 26.34 | 11,721 | 10.15 | ||||

| 2025-07-15 | 13F | Burns Matteson Capital Management, LLC | 9,534 | 119 | ||||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Call | 159,000 | 0.44 | 1,991 | -12.45 | |||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | Put | 31,200 | -52.29 | 391 | -58.47 | |||

| 2025-08-13 | 13F | Invesco Ltd. | 24,622 | -32.01 | 308 | -40.77 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | Call | 43,000 | -49.29 | 538 | -55.79 | |||

| 2025-08-18 | 13F/A | Nomura Holdings Inc | 14,000 | 175 | ||||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 20,812 | 36.04 | 278 | 46.32 | ||||

| 2025-08-14 | 13F | LMR Partners LLP | 518,200 | 1,114.52 | 6,488 | 959.97 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | Personal Cfo Solutions, Llc | 10,962 | -10.57 | 137 | -22.16 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 37,460 | -0.07 | 469 | -13.01 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 15,472 | 194 | ||||||

| 2025-05-13 | 13F | Northern Trust Corp | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Barometer Capital Management Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 317,425 | 140,977.78 | 3,974 | 132,366.67 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 90,623 | 150.13 | 1,135 | 118.08 | ||||

| 2025-05-15 | 13F | Centiva Capital, LP | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | Claro Advisors LLC | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 1,073 | -0.09 | 13 | -13.33 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 436 | 8,620.00 | 5 | |||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 25,403 | -41.72 | 284 | -60.20 | ||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 38,246 | -62.80 | 479 | -67.62 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 224 | -82.11 | 3 | -88.24 | ||||

| 2025-05-15 | 13F | Verition Fund Management LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Stifel Financial Corp | 30,627 | -0.95 | 383 | -13.74 | ||||

| 2025-08-14 | 13F | Scientech Research LLC | 0 | -100.00 | 0 | |||||

| 2025-08-25 | NP | AADR - AdvisorShares Dorsey Wright ADR ETF | 59,552 | 18.02 | 746 | 2.90 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Man Group plc | 0 | -100.00 | 0 | |||||

| 2025-07-24 | NP | ONEQ - Fidelity Nasdaq Composite Index Tracking Stock This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 14,163 | -42.51 | 158 | -60.70 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 86,481 | 13.51 | 1,083 | -1.10 | ||||

| 2025-08-11 | 13F | Dorsey Wright & Associates | 87,347 | -38.64 | 1,094 | -46.48 | ||||

| 2025-08-28 | NP | SPGM - SPDR(R) Portfolio MSCI Global Stock Market ETF | 12,013 | 2.93 | 150 | -10.18 | ||||

| 2025-08-08 | 13F | Alberta Investment Management Corp | 12,942 | 0.00 | 162 | -12.43 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 2,128 | 27 | ||||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 85,000 | 1,069 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 12,300 | 155 | |||||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 475,654 | 6 | ||||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 3,300 | -5.71 | 41 | -18.00 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 25,400 | -22.09 | 318 | -32.05 | |||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 233 | 0.00 | 3 | -33.33 | ||||

| 2025-08-13 | 13F/A | StoneX Group Inc. | 20,701 | 26.67 | 92 | -7.07 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 19,178 | 6.51 | 240 | -6.98 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 52,715 | -17.51 | 660 | -28.14 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 731 | 9 | ||||||

| 2025-06-30 | NP | TRFM - AAM Transformers ETF | 8,405 | -59.16 | 114 | -55.81 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | Call | 0 | -100.00 | 0 | ||||

| 2025-08-14 | 13F | Diversify Wealth Management, Llc | 66,274 | 28.46 | 887 | 38.44 | ||||

| 2025-05-30 | NP | EHLS - Even Herd Long Short ETF | 9,376 | 135 | ||||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Archer Investment Corp | 998 | 0.00 | 12 | -14.29 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 40,706 | 229.58 | 506 | 187.50 | ||||

| 2025-06-26 | NP | DFSE - Dimensional Emerging Markets Sustainability Core 1 ETF | 544 | 0.00 | 7 | 16.67 | ||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 21,055 | 76.15 | 264 | 110.40 | ||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 23,146 | 290 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 271,263 | 51.48 | 3,396 | 32.09 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1,311,106 | -53.17 | 16,415 | -59.17 | ||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 2 | 0 | ||||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 433,843 | -64.36 | 5,432 | -68.93 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 17,500 | -20.45 | 219 | -30.48 | |||

| 2025-08-14 | 13F | UBS Group AG | 4,406,480 | -2.45 | 55,169 | -14.95 | ||||

| 2025-05-29 | 13F/A | Legal & General Group Plc | 20,552 | 0.00 | 52 | -17.74 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 273,900 | 225.30 | 3,429 | 183.62 | |||

| 2025-08-14 | 13F | Jane Street Group, Llc | 276,297 | 11.33 | 3,459 | -2.92 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-04-28 | 13F | WT Asset Management Ltd | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 118,900 | 27.58 | 1,489 | 11.21 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 77,800 | -26.95 | 974 | -36.30 | |||

| 2025-08-28 | NP | SSGVX - State Street Global Equity ex-U.S. Index Portfolio State Street Global All Cap Equity ex-U.S. Index Portfolio This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 32,200 | 0.00 | 403 | -12.77 | ||||

| 2025-07-30 | NP | CLOU - Global X Cloud Computing ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 67,934 | -80.39 | 759 | -86.60 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | Call | 66,700 | 835 | |||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 4,174,300 | 19.89 | 52,262 | 4.53 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 48,213 | -92.60 | 604 | -93.55 | ||||

| 2025-06-18 | NP | RTNAX - Tax-Managed International Equity Fund Class A | 68,377 | 929 | ||||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 171,639 | 1.35 | 2,149 | -11.68 | ||||

| 2025-08-29 | 13F | Infini Capital Management Ltd | 180,400 | 2,259 | ||||||

| 2025-05-14 | 13F | HAP Trading, LLC | Put | 0 | -100.00 | 0 | ||||

| 2025-08-08 | 13F | Central Asset Investments & Management Holdings (HK) Ltd | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 54,723 | -44.24 | 685 | -51.38 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 72 | -92.67 | 1 | -100.00 | ||||

| 2025-06-23 | NP | UGPIX - UltraChina ProFund Investor Class | 6,148 | -21.19 | 84 | -15.31 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 1,110 | 0.00 | 14 | -13.33 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 888 | 0.00 | 0 | |||||

| 2025-05-14 | 13F | Walleye Trading LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 73,574 | -32.20 | 921 | -40.89 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 18,477 | -8.10 | 231 | -19.79 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 48,454 | -47.14 | 607 | -53.95 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 646 | -97.59 | 8 | -97.92 | ||||

| 2025-07-29 | 13F | Beverly Hills Private Wealth, LLC | 10,057 | 126 | ||||||

| 2025-07-15 | 13F | Maseco Llp | 142 | 2 | ||||||

| 2025-08-04 | 13F | AdvisorShares Investments LLC | 59,552 | 18.02 | 746 | 6.58 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 27,400 | -59.45 | 343 | -64.64 | ||||

| 2025-04-09 | 13F | CenterStar Asset Management, LLC | Call | 0 | -100.00 | 0 | ||||

| 2025-08-08 | 13F | Abc Arbitrage Sa | 134,331 | 49.05 | 1,682 | 29.91 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 274,300 | 24.01 | 3,434 | 8.12 | |||

| 2025-05-05 | 13F | Yeomans Consulting Group, Inc. | 0 | -100.00 | 0 | |||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 23,487 | 81.14 | 262 | 24.17 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 29,600 | -51.95 | 371 | -58.14 | |||

| 2025-08-11 | 13F | Principal Securities, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-26 | NP | OEQAX - Oaktree Emerging Markets Equity Fund Class A | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 363,500 | 59.92 | 4,551 | 39.43 | |||

| 2025-07-28 | 13F | Bayforest Capital Ltd | 28,020 | 417.55 | 351 | 354.55 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-22 | NP | SIXG - Defiance Next Gen Connectivity ETF | 475,654 | -1.94 | 5,955 | -14.50 | ||||

| 2025-05-14 | 13F | Sequoia China Equity Partners (Hong Kong) Ltd | 0 | -100.00 | 0 | |||||

| 2025-05-14 | 13F | Group One Trading, L.p. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 0 | -100.00 | 0 | -100.00 | |||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 15,245 | 191 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 2,450 | -1.29 | 31 | -14.29 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 621 | -0.32 | 8 | -12.50 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 237,290 | 2,971 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 68,377 | -90.71 | 856 | -91.90 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 674 | 8 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 1,129,120 | 2,541.34 | 14,137 | 2,206.04 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 3,057 | -79.70 | 39 | -81.94 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 8,172 | -56.99 | 102 | -61.51 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 80,000 | 0.00 | 1,002 | -12.80 | |||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 2,490 | -65.70 | 31 | -70.19 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 75,000 | 939 |

Other Listings

| DE:KS7 | €11.30 |