Statistik Asas

| Pemilik Institusi | 127 total, 123 long only, 1 short only, 3 long/short - change of 2.40% MRQ |

| Purata Peruntukan Portfolio | 0.2807 % - change of 7.12% MRQ |

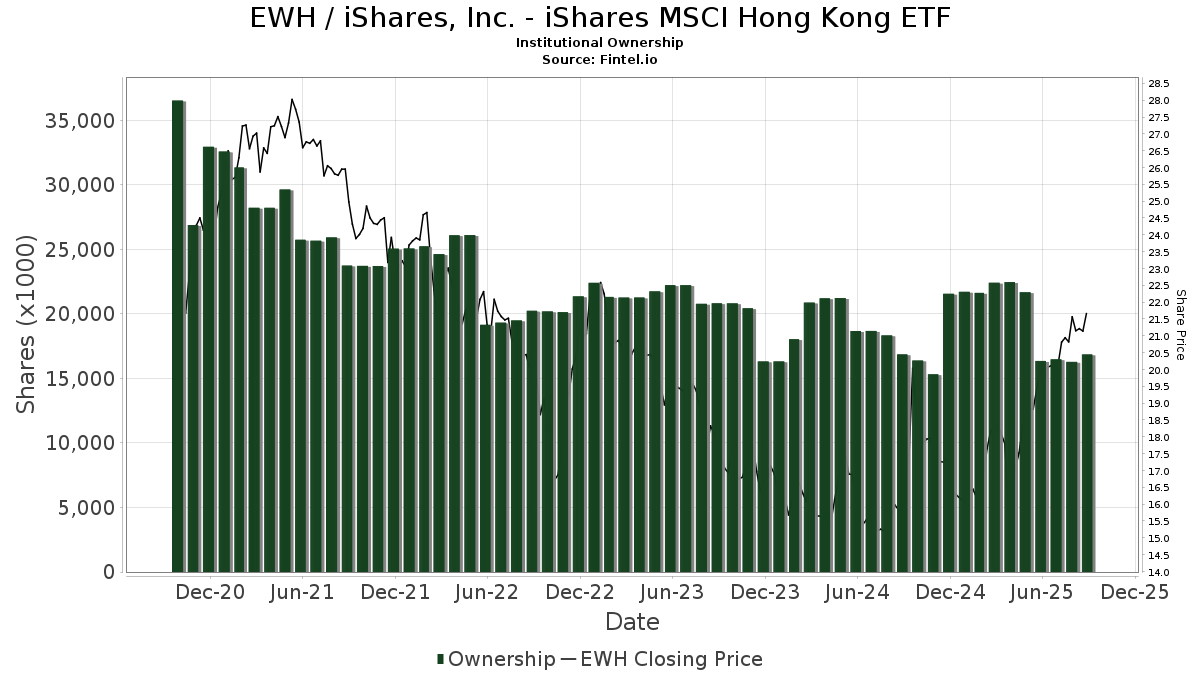

| Saham Institusi (Panjang) | 16,862,291 (ex 13D/G) - change of 0.51MM shares 3.09% MRQ |

| Nilai Institusi (Panjang) | $ 299,577 USD ($1000) |

Pemilikan Institusi dan Pemegang Saham

iShares, Inc. - iShares MSCI Hong Kong ETF (US:EWH) telah 127 pemilik institusi dan pemegang saham yang telah memfailkan borang 13D/G atau 13F dengan Suruhanjaya Bursa Sekuriti (SEC). Institusi ini memegang sejumlah 16,862,291 saham. Pemegang saham terbesar termasuk Wright Fund Managment, LLC, Morgan Stanley, Bank Julius Baer & Co. Ltd, Zurich, SG Americas Securities, LLC, D. E. Shaw & Co., Inc., Catalyst Capital Advisors LLC, MBXAX - Catalyst/Millburn Hedge Strategy Fund Class A, Millburn Ridgefield Corp, Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 50 Fund Investor Class, and Quadrature Capital Ltd .

iShares, Inc. - iShares MSCI Hong Kong ETF (ARCA:EWH) struktur pemilikan institusi menunjukkan kedudukan semasa dalam syarikat mengikut institusi dan dana serta perubahan terkini dalam saiz kedudukan. Pemegang saham utama boleh termasuk pelabur individu, dana amanah, dana lindung nilai atau institusi. Jadual 13D menunjukkan bahawa pelabur memegang (atau menahan) lebih daripada 5% syarikat dan berhasrat (atau berniat) untuk secara aktif meneruskan perubahan dalam strategi perniagaan. Jadual 13G menunjukkan pelaburan pasif melebihi 5%.

The share price as of September 5, 2025 is 21.18 / share. Previously, on September 9, 2024, the share price was 15.92 / share. This represents an increase of 33.04% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (Skor Pengumpulan Pemilikan fka) mencari saham yang paling banyak dibeli oleh dana. Ia adalah hasil daripada model kuantitatif pelbagai faktor yang canggih yang mengenal pasti syarikat dengan tahap pengumpulan institusi tertinggi. Model pemarkahan ini menggunakan gabungan jumlah kenaikan dalam pemilik yang didedahkan, perubahan dalam peruntukan portfolio dalam pemilik tersebut dan metrik lain. Nombornya berjulat dari 0 hingga 100, dengan nombor yang lebih tinggi menunjukkan tahap pengumpulan yang lebih tinggi kepada rakannya, dan 50 adalah nombor purata.

Kekerapan Kemas Kini: Harian

Lihat Peneroka Pemilikan yang menyediakan senarai syarikat yang mempunyai kedudukan tertinggi.

Nisbah Put/Call Institusi

Selain melaporkan isu ekuiti dan hutang standard, institusi yang mempunyai lebih daripada 100MM aset di bawah pengurusan juga mesti mendedahkan pegangan opsyen jual dan beli mereka. Memandangkan opsyen jual secara amnya menunjukkan sentimen negatif, dan opsyen beli menunjukkan sentimen positif, kita boleh mendapatkan gambaran keseluruhan sentimen institusi dengan merencanakan nisbah jual kepada beli. Carta di sebelah kanan memplotkan nisbah jual/beli sejarah untuk instrumen ini.

Menggunakan Nisbah Put/Callsebagai penunjuk sentimen pelabur mengatasi salah satu kekurangan utama menggunakan jumlah pemilikan institusi, iaitu sejumlah besar aset di bawah pengurusan dilaburkan secara pasif untuk menjejaki indeks. Dana yang diurus secara pasif biasanya tidak membeli opsyen, jadi penunjuk nisbah put/call mengekori rapat sentimen dana yang diurus secara aktif.

Pemfailan 13F dan NPORT

Butiran mengenai pemfailan 13F adalah percuma. Perincian mengenai pemfailan NP memerlukan keahlian premium. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup. Klik pautan ikon untuk melihat sejarah transaksi penuh.

Naik Taraf

untuk membuka data premium dan mengeksport ke Excel ![]() .

.

| Tarikh Fail | Sumber | Pelabur | Jenis | Purata Harga (Ang) |

Saham | ΔSaham (%) |

Nilai Dilaporkan ($1000) |

Δ Nilai (%) |

Peruntukan Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-12 | 13F | MAI Capital Management | 208 | 1.96 | 4 | 33.33 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 500 | 0.00 | 10 | 12.50 | ||||

| 2025-08-14 | 13F | SummitTX Capital, L.P. | 11,200 | 222 | ||||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 54,028 | 243.62 | 1,073 | 289.82 | ||||

| 2025-08-13 | 13F | Barclays Plc | Put | 0 | -100.00 | 0 | ||||

| 2025-07-23 | 13F | Viewpoint Capital Management LLC | 6,241 | 0.00 | 124 | 12.84 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 76,862 | -60.42 | 4,229 | 24.38 | ||||

| 2025-04-16 | 13F | Wealth Enhancement Advisory Services, Llc | Put | 0 | -100.00 | 0 | ||||

| 2025-08-12 | 13F | Zacks Investment Management | 21,664 | 430 | ||||||

| 2025-08-11 | 13F | Rahlfs Capital, Llc | 11,050 | 219 | ||||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 15,937 | 0.31 | 321 | 15.47 | ||||

| 2025-08-14 | 13F | Fmr Llc | 5,916 | 8.91 | 117 | 23.16 | ||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 16,352 | 325 | ||||||

| 2025-08-14 | 13F | Quantitative Investment Management, LLC | 59,004 | 1 | ||||||

| 2025-08-04 | 13F | JDM Financial Group LLC | 550 | 0.00 | 11 | 11.11 | ||||

| 2025-08-06 | 13F | Pekin Hardy Strauss, Inc. | 0 | -100.00 | 0 | |||||

| 2025-03-26 | NP | MNERX - MainStay Conservative ETF Allocation Fund Class R3 | 61,191 | 9.50 | 1,010 | 1.10 | ||||

| 2025-05-29 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 70 Fund Investor Class | 152,100 | 2,663 | ||||||

| 2025-08-13 | 13F | Korea Investment CORP | 132,000 | 0.00 | 2,622 | 13.41 | ||||

| 2025-07-21 | 13F | J. Safra Sarasin Holding AG | 0 | -100.00 | 0 | |||||

| 2025-07-31 | 13F | Wright Fund Managment, LLC | 1,407,375 | 0.00 | 24,643 | 0.00 | ||||

| 2025-08-12 | 13F | Elo Mutual Pension Insurance Co | 504,498 | 0.00 | 10,019 | 13.43 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 0 | |||||||

| 2025-05-29 | NP | SIRAX - Sierra Tactical All Asset Fund Class A | 517,500 | 9,061 | ||||||

| 2025-07-29 | 13F | Tradewinds Capital Management, LLC | 102 | 0.00 | 2 | 100.00 | ||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 1,925 | 0.00 | 38 | 18.75 | ||||

| 2025-08-14 | 13F/A | Bank Julius Baer & Co. Ltd, Zurich | 1,210,055 | 24,032 | ||||||

| 2025-07-22 | 13F | Chung Wu Investment Group, LLC | 8,500 | 169 | ||||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 400 | 0.00 | 8 | 0.00 | ||||

| 2025-07-31 | 13F | Sharper & Granite LLC | 82,575 | -1.19 | 1,661 | 13.47 | ||||

| 2025-08-05 | 13F | Advisors Preferred, LLC | 1,411 | 28 | ||||||

| 2025-05-14 | 13F | Flow Traders U.s. Llc | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 144,176 | 3,780.92 | 2,863 | 4,373.44 | ||||

| 2025-08-13 | 13F | Mount Yale Investment Advisors, LLC | 138 | 3 | ||||||

| 2025-03-26 | NP | MWFQX - MainStay Equity ETF Allocation Fund Class R3 | 129,177 | 14.38 | 2,131 | 5.60 | ||||

| 2025-05-13 | 13F | HighTower Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-05-02 | 13F | Whittier Trust Co | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 428,667 | -45.34 | 8,513 | -38.01 | ||||

| 2025-07-07 | 13F | Upper Left Wealth Management, LLC | 14,066 | 2.55 | 279 | 16.25 | ||||

| 2025-04-22 | 13F | Cambridge Investment Research Advisors, Inc. | 0 | -100.00 | 0 | |||||

| 2025-07-30 | 13F | Exencial Wealth Advisors, Llc | 46,936 | 6.80 | 932 | 21.20 | ||||

| 2025-08-13 | 13F | Provida Pension Fund Administrator | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-31 | 13F | Catalyst Capital Advisors LLC | 646,987 | -12.03 | 12,849 | -0.23 | ||||

| 2025-08-29 | NP | MBXAX - Catalyst/Millburn Hedge Strategy Fund Class A | 646,987 | -12.03 | 12,849 | -0.23 | ||||

| 2025-08-29 | NP | CGHIX - Timber Point Global Allocations Fund Institutional Class Shares | 10,000 | -50.00 | 199 | -43.43 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1,212,315 | -14.04 | 24,077 | -2.51 | ||||

| 2025-08-12 | 13F | Picton Mahoney Asset Management | 5,970 | -21.24 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 117,644 | 85.41 | 2,335 | 110.17 | ||||

| 2025-07-31 | 13F | United Community Bank | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 42,251 | -95.07 | 839 | -94.41 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 12,720 | -4.68 | 253 | 8.15 | ||||

| 2025-08-13 | 13F | National Bank Of Canada /fi/ | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 30,307 | -55.28 | 602 | -49.33 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 94,548 | 62.56 | 1,878 | 84.38 | ||||

| 2025-06-26 | NP | SSXU - Day Hagan/Ned Davis Research Smart Sector International ETF | 128,246 | 2,247 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 3,600 | 0.00 | 71 | 12.70 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 16,234 | 20.02 | 323 | 36.44 | ||||

| 2025-04-22 | 13F | Moisand Fitzgerald Tamayo, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Prudential Plc | 199,443 | 3,961 | ||||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 0 | -100.00 | 0 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 742,520 | 284.26 | 14,746 | 335.89 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 268 | 5 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 214 | -38.86 | 4 | -33.33 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 564,759 | -13.02 | 11,219 | -1.39 | ||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 20,400 | 29.94 | 405 | 47.81 | |||

| 2025-05-08 | 13F | New York Life Investment Management Llc | 0 | -100.00 | 0 | |||||

| 2025-07-24 | 13F | Blair William & Co/il | 2,896 | -22.21 | 58 | -12.31 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 27,834 | 316.74 | 553 | 371.79 | ||||

| 2025-07-10 | 13F | Contravisory Investment Management, Inc. | 25,720 | 511 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 16,800 | -93.32 | 334 | -92.44 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 0 | -100.00 | 0 | ||||

| 2025-08-28 | NP | TFAFX - Tactical Growth Allocation Fund Class I | 1,600 | 32 | ||||||

| 2025-08-05 | 13F | Harel Insurance Investments & Financial Services Ltd. | 5,000 | 108.33 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 322,199 | -16.08 | 6,399 | -4.82 | ||||

| 2025-07-16 | 13F | Banque Pictet & Cie Sa | 215,913 | 0.00 | 4,288 | 13.44 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 556 | 0.00 | 11 | 22.22 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 115 | 0.00 | 2 | 0.00 | ||||

| 2025-05-14 | 13F | Walleye Trading LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 220 | -37.85 | 4 | -33.33 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 26,525 | 12.75 | 1 | |||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-06-26 | NP | BlackRock ETF Trust - iShares International Country Rotation Active ETF | 2,415 | -27.24 | 42 | -22.22 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 476,469 | -1.35 | 9,463 | 11.88 | ||||

| 2025-08-28 | NP | ICCIX - Dynamic International Opportunity Fund Class I | 29,101 | -19.19 | 578 | -8.41 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 10,233 | -7.18 | 203 | 5.18 | ||||

| 2025-04-25 | 13F | Mmbg Investment Advisors Co. | 0 | -100.00 | 0 | |||||

| 2025-03-26 | NP | MDAKX - MainStay Moderate ETF Allocation Fund Class C | 194,616 | 11.09 | 3,211 | 2.59 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | -100.00 | 0 | ||||

| 2025-07-23 | 13F | Vontobel Holding Ltd. | 333,736 | -1.18 | 6,628 | 12.08 | ||||

| 2025-07-28 | 13F | Twin Tree Management, LP | 0 | -100.00 | 0 | |||||

| 2025-08-06 | 13F | Texas Yale Capital Corp. | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 1,431 | 0.00 | 28 | 12.00 | ||||

| 2025-08-13 | 13F | Taikang Asset Management (Hong Kong) Co Ltd | 55,029 | 0.00 | 1,093 | 13.40 | ||||

| 2025-08-13 | 13F | Capital Fund Management S.a. | 33,788 | 49.29 | 671 | 69.44 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 24,004 | 33.87 | 477 | 52.08 | ||||

| 2025-05-15 | 13F | Optiver Holding B.V. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 58 | 1 | ||||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 1,455 | 0.00 | 29 | 12.00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 616 | 0.00 | 12 | 20.00 | ||||

| 2025-07-22 | 13F | 4Thought Financial Group Inc. | 184 | 3.37 | 4 | 0.00 | ||||

| 2025-08-08 | 13F | Creative Planning | 10,553 | -0.01 | 210 | 13.59 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 10,100 | -79.72 | 201 | -77.04 | |||

| 2025-08-05 | 13F | Castlekeep Investment Advisors Llc | 20,757 | -3.42 | 412 | 9.57 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 12,229 | -92.56 | 243 | -91.59 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Capital Fund Management S.a. | Call | 14,400 | -54.29 | 286 | -48.28 | |||

| 2025-05-15 | 13F | Dai-ichi Life Holdings, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 179,958 | 4 | ||||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 1,195,271 | 738.32 | 24 | 1,050.00 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 43,000 | 854 | ||||||

| 2025-07-14 | 13F | Legacy Capital Group California, Inc. | 25,470 | 506 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 63,032 | -49.05 | 1,252 | -42.24 | ||||

| 2025-08-11 | 13F | Covestor Ltd | 7 | 0.00 | 0 | |||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 124,720 | 6.09 | 2,477 | 20.31 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Barings Llc | 208,539 | -8.67 | 4,142 | 3.58 | ||||

| 2025-07-29 | 13F | Millburn Ridgefield Corp | 646,987 | -12.03 | 12,849 | -0.23 | ||||

| 2025-08-13 | 13F | Baker Avenue Asset Management, LP | Put | 150,000 | -55.88 | 8 | -97.92 | |||

| 2025-05-07 | 13F | Drive Wealth Management, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 81,957 | 0.28 | 1,628 | 13.70 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 29,020 | 8.78 | 576 | 23.34 | ||||

| 2025-08-06 | 13F | Innealta Capital, Llc | 29,101 | -19.19 | 578 | -8.41 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 544,097 | -22.59 | 10,806 | -12.21 | ||||

| 2025-08-14 | 13F | Gotham Asset Management, LLC | 10,426 | 0.00 | 207 | 13.74 | ||||

| 2025-08-13 | 13F | Idaho Trust Bank | 29,514 | 25.87 | 586 | 42.93 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 9,036 | 179 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 48,311 | 29.52 | 959 | 46.86 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 0 | -100.00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1,837 | -37.81 | 36 | -41.94 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 192,022 | -3.68 | 3,814 | 9.26 | ||||

| 2025-07-31 | 13F | GenTrust, LLC | 20,561 | 6.03 | 408 | 20.35 | ||||

| 2025-08-14 | 13F | Comerica Bank | 1,112 | 11.87 | 22 | 29.41 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 500 | 0.00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 0 | -100.00 | 0 | ||||

| 2025-08-08 | 13F | Abc Arbitrage Sa | 17,827 | -80.52 | 354 | -77.90 | ||||

| 2025-07-29 | NP | HFND - Unlimited HFND Multi-Strategy Return Tracker ETF | 2,959 | 866.99 | 56 | 1,020.00 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 927 | -98.35 | 18 | -98.17 | ||||

| 2025-07-17 | 13F | Albion Financial Group /ut | 63,000 | 0.00 | 1,251 | 13.42 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 434,900 | 76.22 | 8,637 | 99.88 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 26,239 | -72.07 | 521 | -68.33 | ||||

| 2025-07-18 | 13F | USA Financial Portformulas Corp | 7,706 | -38.75 | 153 | -30.45 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 29 | 1 | ||||||

| 2025-03-26 | NP | MOEAX - MainStay Growth ETF Allocation Fund Class A | 163,359 | 11.17 | 2,695 | 2.67 | ||||

| 2025-08-05 | 13F | Gould Asset Management Llc /ca/ | 39,511 | -3.26 | 785 | 9.65 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 20 | 0.00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 17,106 | -68.19 | 340 | -63.97 | ||||

| 2025-05-29 | NP | Northern Lights Fund Trust - Sierra Tactical Core Growth Fund Investor Class Shares | 26,075 | 457 | ||||||

| 2025-05-29 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 50 Fund Investor Class | 568,800 | 9,960 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 33,500 | 665 | |||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 15,626 | -2.78 | 310 | 10.32 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 165,021 | 382.84 | 3,277 | 447.99 | ||||

| 2025-05-15 | 13F | Barclays Plc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 54,406 | -41.23 | 1,080 | -33.33 | ||||

| 2025-05-01 | 13F | Cwm, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | Put | 0 | -100.00 | 0 | -100.00 | |||

| 2025-08-14 | 13F | Horizon Investments, LLC | 27 | 107.69 | 1 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 87,564 | -46.51 | 1,739 | -39.32 | ||||

| 2025-05-29 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 30 Fund Instl Class | 142,900 | 2,502 | ||||||

| 2025-08-08 | NP | QALTX - Quantified Alternative Investment Fund Investor Class Shares | 1,411 | 28 | ||||||

| 2025-08-13 | 13F | Amundi | 23,414 | 7.90 | 471 | 24.01 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 70,005 | -21.62 | 1,390 | -11.07 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 15,828 | 314 | ||||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-04-28 | 13F | Pictet North America Advisors SA | 0 | -100.00 | 0 | |||||

| 2025-07-16 | 13F/A | CX Institutional | 584 | -32.56 | 0 | |||||

| 2025-05-15 | 13F | Crestline Management, LP | 0 | -100.00 | 0 |