Statistik Asas

| Pemilik Institusi | 269 total, 266 long only, 0 short only, 3 long/short - change of 5.91% MRQ |

| Purata Peruntukan Portfolio | 0.2356 % - change of 18.69% MRQ |

| Saham Institusi (Panjang) | 74,711,586 (ex 13D/G) - change of 0.33MM shares 0.44% MRQ |

| Nilai Institusi (Panjang) | $ 1,598,705 USD ($1000) |

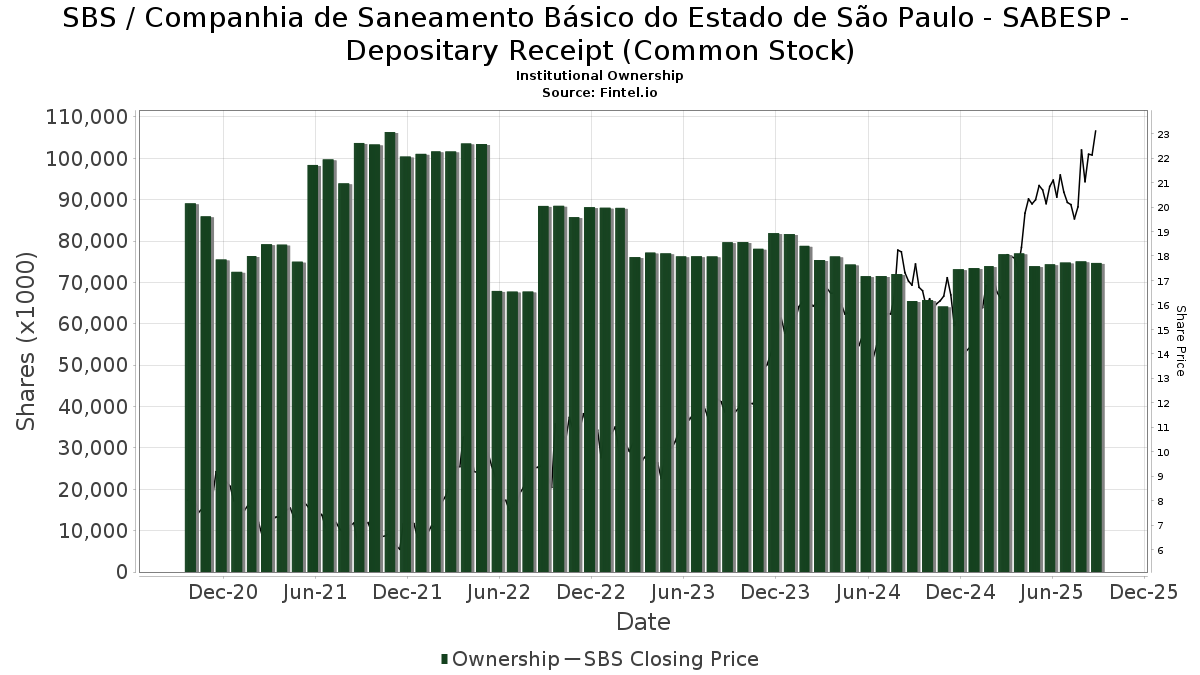

Pemilikan Institusi dan Pemegang Saham

Companhia de Saneamento Básico do Estado de São Paulo - SABESP - Depositary Receipt (Common Stock) (US:SBS) telah 269 pemilik institusi dan pemegang saham yang telah memfailkan borang 13D/G atau 13F dengan Suruhanjaya Bursa Sekuriti (SEC). Institusi ini memegang sejumlah 74,711,586 saham. Pemegang saham terbesar termasuk Impax Asset Management Group plc, Deutsche Bank Ag\, Amundi, BlackRock, Inc., Bank Of America Corp /de/, Citigroup Inc, Letko, Brosseau & Associates Inc, Mackenzie Financial Corp, Vanguard Group Inc, and American Century Companies Inc .

Companhia de Saneamento Básico do Estado de São Paulo - SABESP - Depositary Receipt (Common Stock) (NYSE:SBS) struktur pemilikan institusi menunjukkan kedudukan semasa dalam syarikat mengikut institusi dan dana serta perubahan terkini dalam saiz kedudukan. Pemegang saham utama boleh termasuk pelabur individu, dana amanah, dana lindung nilai atau institusi. Jadual 13D menunjukkan bahawa pelabur memegang (atau menahan) lebih daripada 5% syarikat dan berhasrat (atau berniat) untuk secara aktif meneruskan perubahan dalam strategi perniagaan. Jadual 13G menunjukkan pelaburan pasif melebihi 5%.

The share price as of September 5, 2025 is 23.16 / share. Previously, on September 6, 2024, the share price was 16.95 / share. This represents an increase of 36.61% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (Skor Pengumpulan Pemilikan fka) mencari saham yang paling banyak dibeli oleh dana. Ia adalah hasil daripada model kuantitatif pelbagai faktor yang canggih yang mengenal pasti syarikat dengan tahap pengumpulan institusi tertinggi. Model pemarkahan ini menggunakan gabungan jumlah kenaikan dalam pemilik yang didedahkan, perubahan dalam peruntukan portfolio dalam pemilik tersebut dan metrik lain. Nombornya berjulat dari 0 hingga 100, dengan nombor yang lebih tinggi menunjukkan tahap pengumpulan yang lebih tinggi kepada rakannya, dan 50 adalah nombor purata.

Kekerapan Kemas Kini: Harian

Lihat Peneroka Pemilikan yang menyediakan senarai syarikat yang mempunyai kedudukan tertinggi.

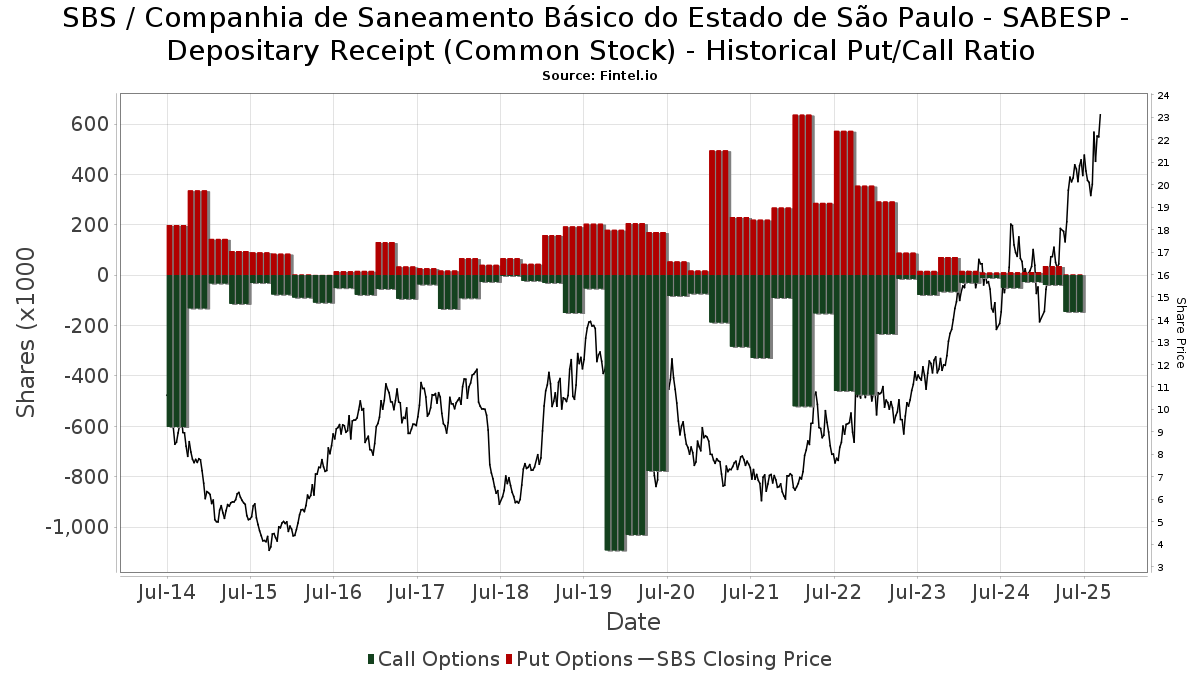

Nisbah Put/Call Institusi

Selain melaporkan isu ekuiti dan hutang standard, institusi yang mempunyai lebih daripada 100MM aset di bawah pengurusan juga mesti mendedahkan pegangan opsyen jual dan beli mereka. Memandangkan opsyen jual secara amnya menunjukkan sentimen negatif, dan opsyen beli menunjukkan sentimen positif, kita boleh mendapatkan gambaran keseluruhan sentimen institusi dengan merencanakan nisbah jual kepada beli. Carta di sebelah kanan memplotkan nisbah jual/beli sejarah untuk instrumen ini.

Menggunakan Nisbah Put/Callsebagai penunjuk sentimen pelabur mengatasi salah satu kekurangan utama menggunakan jumlah pemilikan institusi, iaitu sejumlah besar aset di bawah pengurusan dilaburkan secara pasif untuk menjejaki indeks. Dana yang diurus secara pasif biasanya tidak membeli opsyen, jadi penunjuk nisbah put/call mengekori rapat sentimen dana yang diurus secara aktif.

Pemfailan 13F dan NPORT

Butiran mengenai pemfailan 13F adalah percuma. Perincian mengenai pemfailan NP memerlukan keahlian premium. Baris hijau menunjukkan kedudukan baharu. Baris merah menunjukkan kedudukan tertutup. Klik pautan ikon untuk melihat sejarah transaksi penuh.

Naik Taraf

untuk membuka data premium dan mengeksport ke Excel ![]() .

.

| Tarikh Fail | Sumber | Pelabur | Jenis | Purata Harga (Ang) |

Saham | ΔSaham (%) |

Nilai Dilaporkan ($1000) |

Δ Nilai (%) |

Peruntukan Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 1,100 | 0.00 | 23 | 21.05 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 172,280 | -3.65 | 3,785 | 18.51 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 31,422 | -1.74 | 690 | 20.84 | ||||

| 2025-05-15 | 13F | Barclays Plc | 0 | -100.00 | 0 | |||||

| 2025-03-24 | 13F/A | Wellington Management Group Llp | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-25 | 13F | Yousif Capital Management, Llc | 11,115 | 5.36 | 244 | 29.79 | ||||

| 2025-08-22 | NP | AAAAX - DWS RREEF Real Assets Fund Class A | 698,570 | 19.41 | 15,348 | 46.89 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 12,837 | 5.04 | 282 | 29.36 | ||||

| 2025-08-14 | 13F | Fmr Llc | 171,282 | 0.04 | 3,763 | 23.09 | ||||

| 2025-08-15 | 13F | Strategic Investment Advisors / MI | 14,983 | 329 | ||||||

| 2025-07-29 | NP | GIMFX - GMO Implementation Fund | 4,300 | -91.67 | 88 | -82.98 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 2,885 | 88.19 | 63 | 133.33 | ||||

| 2025-05-05 | 13F | Transce3nd, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-07 | 13F | Profund Advisors Llc | 20,388 | 3.63 | 448 | 27.35 | ||||

| 2025-06-23 | NP | UUPIX - Ultraemerging Markets Profund Investor Class | 1,733 | 0.35 | 35 | 29.63 | ||||

| 2025-08-13 | 13F | Groupe la Francaise | 76,868 | 19.43 | 1,681 | 44.79 | ||||

| 2025-04-24 | NP | ZEMRX - American Beacon Ninety One Emerging Markets Equity Fund R6 Class | 245,431 | 3,954 | ||||||

| 2025-08-19 | 13F/A | Pitcairn Co | 61,171 | -13.36 | 1,344 | 6.50 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 113,558 | -2.65 | 2,495 | 19.73 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 12,337 | 8.19 | 271 | 33.50 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 1,101 | 53.99 | 24 | 100.00 | ||||

| 2025-07-29 | NP | GBFFX - GMO Benchmark-Free Fund Class III | 4,400 | -90.20 | 90 | -85.00 | ||||

| 2025-06-26 | NP | DFAX - Dimensional World ex U.S. Core Equity 2 ETF | 29,128 | 11.91 | 592 | 40.62 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 469 | -1.47 | 0 | |||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 581,647 | 151.63 | 12,779 | 209.54 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | Call | 112,200 | 293.68 | 2,465 | 384.28 | |||

| 2025-07-28 | NP | SPILX - Symmetry Panoramic International Equity Fund Class I Shares | 10,614 | 0.00 | 218 | 28.24 | ||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | -100.00 | 0 | |||||

| 2025-08-06 | 13F | Metis Global Partners, LLC | 24,919 | 22.15 | 547 | 50.27 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | Put | 2,400 | -92.66 | 53 | -91.10 | |||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 879,836 | 4.20 | 19,330 | 28.18 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 58,786 | 0.27 | 1 | 0.00 | ||||

| 2025-05-15 | 13F | Capstone Investment Advisors, Llc | 0 | -100.00 | 0 | |||||

| 2025-07-23 | 13F | Vontobel Holding Ltd. | 79,451 | 1,746 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 0 | -100.00 | 0 | |||||

| 2025-06-24 | NP | FFTY - Innovator IBD(R) 50 ETF | 59,831 | 1,216 | ||||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 7,293,314 | 18.32 | 160,234 | 45.55 | ||||

| 2025-07-11 | 13F | Perpetual Ltd | 793,566 | 0.36 | 17,435 | 23.45 | ||||

| 2025-07-18 | 13F | Robeco Institutional Asset Management B.V. | 905,784 | -32.83 | 19,900 | -17.37 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 108 | 13.68 | 2 | 100.00 | ||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 1,305 | 29 | ||||||

| 2025-07-16 | 13F | Signaturefd, Llc | 9,342 | 2.48 | 205 | 26.54 | ||||

| 2025-07-16 | 13F | Highline Wealth Partners Llc | 48 | 1 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | -100.00 | 0 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 32,793 | -20.59 | 720 | -2.31 | ||||

| 2025-08-28 | NP | QEMM - SPDR MSCI Emerging Markets StrategicFactors ETF | 616 | -3.90 | 14 | 18.18 | ||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 56,836 | 0.00 | 1,249 | 22.96 | ||||

| 2025-08-26 | NP | AVEWX - Ave Maria World Equity Fund | 104,000 | 28.40 | 2,285 | 57.95 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 2,728 | 6.52 | 60 | 31.11 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 55,097 | -4.56 | 1,210 | 17.36 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 2,098,584 | -12.25 | 46,106 | 7.94 | ||||

| 2025-06-24 | NP | Innovator ETFs Trust - Innovator IBD Breakout Opportunities ETF | 2,835 | 58 | ||||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-06-26 | NP | DFAE - Dimensional Emerging Core Equity Market ETF | 92,040 | 54.59 | 1,871 | 94.29 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 3,652,780 | 8.46 | 80,252 | 33.42 | ||||

| 2025-04-11 | 13F | First Affirmative Financial Network | 17,932 | 3.25 | 320 | 29.03 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 1 | 0.00 | 0 | |||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 279 | -51.56 | 6 | -40.00 | ||||

| 2025-08-13 | 13F | Nkcfo Llc | 19,000 | 0.00 | 0 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 962,942 | 32.46 | 21,156 | 62.94 | ||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 433,083 | -44.89 | 9,493 | -32.38 | ||||

| 2025-08-14 | 13F | UBS Group AG | 423,319 | -4.00 | 9,300 | 18.10 | ||||

| 2025-08-12 | 13F | Handelsbanken Fonder AB | 44,945 | 0.00 | 1 | |||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 255 | 0.00 | 6 | 25.00 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 1,846 | 42.66 | 41 | 73.91 | ||||

| 2025-06-11 | NP | SLANX - DWS Latin America Equity Fund Class A | 40,250 | 0.00 | 818 | 25.65 | ||||

| 2025-03-11 | 13F | Anchor Pointe Wealth Management, LLC | 10,045 | 144 | ||||||

| 2025-08-07 | 13F | Hughes Financial Services, LLC | 500 | 0.00 | 10 | 11.11 | ||||

| 2025-08-08 | 13F | KBC Group NV | 30,310 | 3.83 | 1 | |||||

| 2025-08-26 | NP | Profunds - Profund Vp Emerging Markets | 7,806 | 20.78 | 171 | 48.70 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 56,724 | 2,540.78 | 1,024 | 2,594.74 | ||||

| 2025-07-23 | 13F | Maryland State Retirement & Pension System | 557,685 | -4.36 | 12,252 | 17.66 | ||||

| 2025-07-28 | 13F | Ativo Capital Management LLC | 74,051 | 1,627 | ||||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 1,917 | 12.63 | 42 | 40.00 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 317,673 | 10.15 | 6,979 | 35.52 | ||||

| 2025-08-14 | 13F | BTG Pactual Asset Management US LLC | 0 | -100.00 | 0 | |||||

| 2025-07-28 | NP | AVEEX - Avantis Emerging Markets Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 38,845 | 0.00 | 798 | 27.52 | ||||

| 2025-08-22 | NP | TOLLX - DWS RREEF Global Infrastructure Fund Class A | 651,246 | 8.97 | 14,308 | 34.04 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 2,342 | 246.45 | 51 | 325.00 | ||||

| 2025-08-15 | 13F | Binnacle Investments Inc | 379 | 0.00 | 8 | 33.33 | ||||

| 2025-08-26 | NP | IGF - iShares Global Infrastructure ETF | 1,059,290 | 13.65 | 23,273 | 39.80 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 3,159 | 373.61 | 69 | 527.27 | ||||

| 2025-08-08 | 13F | Letko, Brosseau & Associates Inc | 2,253,589 | -4.20 | 49,511 | 17.85 | ||||

| 2025-08-29 | NP | LIVR - Intelligent Livermore ETF | 10,008 | 220 | ||||||

| 2025-08-08 | 13F | Mitsubishi UFJ Trust & Banking Corp | 10,707 | 0.00 | 235 | 23.04 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 400 | 4,900.00 | 9 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 26,700 | 385.45 | 587 | 497.96 | |||

| 2025-08-01 | 13F | Rossby Financial, LCC | 7,979 | 1.15 | 175 | 10.06 | ||||

| 2025-08-08 | 13F | Impax Asset Management Group plc | 9,140,360 | -15.71 | 200,083 | 3.67 | ||||

| 2025-08-26 | NP | NMFIX - Multi-manager Global Listed Infrastructure Fund | 10,569 | -47.07 | 232 | -34.83 | ||||

| 2025-04-22 | 13F | Verde Servicos Internacionais S.A. | 0 | -100.00 | 0 | |||||

| 2025-07-21 | 13F | Credential Qtrade Securities Inc. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 1,002,308 | 22.56 | 22,021 | 50.76 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 11,559 | 0.34 | 254 | 23.41 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | -100.00 | 0 | |||||

| 2025-08-29 | NP | Gabelli Global Utility & Income Trust | 2,500 | 0.00 | 55 | 22.73 | ||||

| 2025-07-29 | 13F | Wcm Investment Management, Llc | 215,024 | 0.25 | 4,509 | 16.93 | ||||

| 2025-06-26 | NP | DFSE - Dimensional Emerging Markets Sustainability Core 1 ETF | 10,400 | 246.67 | 211 | 339.58 | ||||

| 2025-08-11 | 13F | Banque Cantonale Vaudoise | 1,563 | -36.28 | 0 | |||||

| 2025-08-20 | NP | REMG - Emerging Markets Equity Active ETF | 4,060 | 89 | ||||||

| 2025-07-07 | 13F | Northwest & Ethical Investments L.P. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 31,830 | 0.00 | 699 | 23.06 | ||||

| 2025-08-13 | 13F | Qtron Investments LLC | 30,746 | 15.58 | 675 | 42.11 | ||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 351,614 | -2.93 | 8 | 16.67 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 105 | 0.00 | 2 | 100.00 | ||||

| 2025-08-04 | 13F | ELCO Management Co., LLC | 14,840 | 326 | ||||||

| 2025-08-11 | 13F | Raiffeisen Bank International AG | 24,050 | 9.14 | 491 | 23.74 | ||||

| 2025-03-27 | NP | CCNR - ALPS | CoreCommodity Natural Resources ETF | 130,439 | 88.45 | 2,111 | 91.99 | ||||

| 2025-06-26 | NP | DFEM - Dimensional Emerging Markets Core Equity 2 ETF | 123,258 | 103.87 | 2,506 | 156.13 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 26,468 | 2.09 | 582 | 25.49 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 492 | 382.35 | 11 | 900.00 | ||||

| 2025-08-13 | 13F | RWC Asset Management LLP | 27,437 | 603 | ||||||

| 2025-05-14 | 13F | Flow Traders U.s. Llc | 0 | -100.00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 15,964 | -8.30 | 351 | 12.90 | ||||

| 2025-08-06 | 13F | Legacy Investment Solutions, LLC | 177 | 0.00 | 4 | 50.00 | ||||

| 2025-08-14 | 13F | Bridgefront Capital, LLC | 9,307 | -15.11 | 204 | 4.62 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 21,104 | -21.70 | 464 | -3.73 | ||||

| 2025-07-28 | NP | NSI - National Security Emerging Markets Index ETF | 763 | 37.97 | 16 | 87.50 | ||||

| 2025-04-24 | 13F | Allspring Global Investments Holdings, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 571,530 | 13.33 | 12,503 | 38.75 | ||||

| 2025-08-12 | 13F | CenterBook Partners LP | 129,866 | 2,853 | ||||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 5,041 | 856.55 | 0 | |||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 11,591 | -0.22 | 255 | 22.71 | ||||

| 2025-08-11 | 13F | Inspire Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 486 | 0.00 | 11 | 25.00 | ||||

| 2025-08-13 | 13F | Amundi | 5,878,451 | -0.04 | 110,114 | 3.64 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1,538 | 34 | ||||||

| 2025-05-15 | 13F | Jain Global LLC | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 62 | 106.67 | 1 | |||||

| 2025-07-25 | 13F | JustInvest LLC | 27,854 | 39.05 | 612 | 71.15 | ||||

| 2025-08-14 | 13F | Riggs Asset Managment Co. Inc. | 139 | 3 | ||||||

| 2025-08-15 | 13F | WealthCollab, LLC | 1,420 | 0.00 | 31 | 24.00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 9,991 | 220 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 179 | 0.00 | 4 | 0.00 | ||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 48,495 | 5.09 | 1,065 | 29.25 | ||||

| 2025-08-26 | NP | FIW - First Trust Water ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1,388,925 | 0.57 | 30,515 | 23.71 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 24,963 | 7.42 | 548 | 31.41 | ||||

| 2025-08-13 | 13F | Measured Wealth Private Client Group, LLC | 14,560 | 320 | ||||||

| 2025-08-11 | 13F | Trium Capital LLP | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 0 | 0 | ||||||

| 2025-08-13 | 13F | Manning & Napier Advisors Llc | 567,059 | 1,134.37 | 12,458 | 2,831.29 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 74,272 | 1,632 | ||||||

| 2025-08-11 | 13F | Integrated Quantitative Investments LLC | 75,168 | 47.39 | 1,651 | 81.43 | ||||

| 2025-05-13 | 13F | Quantbot Technologies LP | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-28 | NP | AVXC - Avantis Emerging Markets ex-China Equity ETF | 14,203 | 37.45 | 292 | 75.30 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 48,063 | 3,842.82 | 987 | 5,094.74 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100.00 | 0 | |||||

| 2025-06-18 | NP | RTXAX - Tax-Managed Real Assets Fund Class A | 36,851 | 0.00 | 749 | 25.67 | ||||

| 2025-07-21 | 13F | Qrg Capital Management, Inc. | 24,305 | 68.18 | 534 | 106.59 | ||||

| 2025-06-27 | NP | KBIWX - KBI GLOBAL INVESTORS AQUARIUS FUND Institutional Shares | 44,385 | -9.26 | 902 | 14.03 | ||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 18,933 | -13.14 | 416 | 6.68 | ||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 10,008 | 220 | ||||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 721 | 16 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 88,448 | -6.41 | 1,943 | 15.17 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 2,008,471 | 56.90 | 44,126 | 93.01 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1,486,129 | -36.49 | 32,650 | -21.87 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 27,128 | -4.43 | 596 | 17.79 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 1,399,273 | 0.84 | 30,742 | 24.04 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 9,921 | 344.09 | 218 | 456.41 | ||||

| 2025-06-30 | NP | VGTSX - Vanguard Total International Stock Index Fund Investor Shares | 698,508 | 0.00 | 14,201 | 25.65 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 6,103 | 0.00 | 134 | 22.94 | ||||

| 2025-07-22 | 13F | Iron Horse Wealth Management, LLC | 88 | 0.00 | 2 | 0.00 | ||||

| 2025-08-08 | 13F | POM Investment Strategies, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 24,922 | 548 | ||||||

| 2025-04-25 | NP | PRDAX - Diversified Real Asset Fund Class A | 50,170 | -7.27 | 808 | -2.06 | ||||

| 2025-08-14 | 13F | Wexford Capital Lp | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 1,337 | -55.37 | 29 | -45.28 | ||||

| 2025-05-05 | 13F | Creekmur Asset Management LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 31,720 | 697 | ||||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 57,729 | -12.35 | 1,031 | 9.33 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 795,239 | -54.50 | 17,471 | -44.03 | ||||

| 2025-06-30 | NP | VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares | 1,166,239 | 0.00 | 23,710 | 25.65 | ||||

| 2025-08-04 | 13F | Pinnacle Associates Ltd | 10,700 | 0.00 | 235 | 23.04 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Quilter Plc | 773,773 | -10.27 | 17,000 | 10.38 | ||||

| 2025-05-15 | 13F | Cullen Capital Management, LLC | 11,762 | 210 | ||||||

| 2025-05-06 | 13F | Y-Intercept (Hong Kong) Ltd | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 12,516 | 23.52 | 275 | 52.22 | ||||

| 2025-06-26 | NP | DEXC - Dimensional Emerging Markets ex China Core Equity ETF | 6,900 | 38.00 | 140 | 75.00 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 9,839 | -18.14 | 216 | 0.93 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 3,152,070 | 54.86 | 69,251 | 90.50 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 0 | -100.00 | 0 | |||||

| 2025-08-26 | NP | PXDIX - PAX ESG BETA DIVIDEND FUND Institutional Class | 94,812 | 0.00 | 2,083 | 23.04 | ||||

| 2025-06-25 | NP | EXOSX - Overseas Series Class I | 213,714 | 4,345 | ||||||

| 2025-08-05 | 13F | Advisors Preferred, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-14 | 13F | Abound Wealth Management | 11 | 0.00 | 0 | |||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 30 | -89.55 | 1 | -100.00 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 29,924 | 22.52 | 657 | 50.69 | ||||

| 2025-08-13 | 13F | Victory Capital Management Inc | 11,429 | 0.00 | 251 | 23.04 | ||||

| 2025-08-14 | 13F | DZ BANK AG Deutsche Zentral Genossenschafts Bank, Frankfurt am Main | 523,030 | 26.03 | 11,491 | 55.04 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 15,894 | -1.37 | 349 | 21.60 | ||||

| 2025-08-11 | 13F | B. Metzler seel. Sohn & Co. AG | 57,023 | 0.00 | 1,253 | 22.99 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 0 | -100.00 | 0 | |||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 56 | 80.65 | 1 | |||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 259,373 | -16.93 | 5,698 | 2.19 | ||||

| 2025-08-11 | 13F | Pinnacle Wealth Planning Services, Inc. | 30,040 | 0.71 | 66 | 22.64 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 3,154 | -9.73 | 69 | 11.29 | ||||

| 2025-05-15 | 13F | GWM Advisors LLC | 0 | -100.00 | 0 | |||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 17 | 0.00 | 0 | |||||

| 2025-07-29 | NP | RBB FUND, INC. - Aquarius International Fund | 10,993 | 0.00 | 226 | 27.12 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 11,058 | 0 | ||||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 29 | 16.00 | 1 | |||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Sustainability Core 1 Portfolio Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 5,079 | 70.55 | 103 | 114.58 | ||||

| 2025-08-08 | 13F | Itau Unibanco Holding S.A. | 494,142 | -14.73 | 10,856 | 108,460.00 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 100 | 0 | |||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 18,977 | 12,551.33 | 0 | |||||

| 2025-05-14 | 13F | Custom Index Systems, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 2,900 | 0 | |||||

| 2025-06-27 | NP | DAINX - Dunham International Stock Fund Class A | 33,914 | -17.91 | 689 | 17.98 | ||||

| 2025-05-06 | 13F | Genoa Capital Gestora de Recursos Ltda. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-21 | 13F | Credential Securities Inc. | 134 | 0.00 | 1 | -100.00 | ||||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 0 | -100.00 | 0 | |||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 28 | 1 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 64,910 | 478.62 | 1,426 | 613.00 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 26,647 | 0.28 | 1 | |||||

| 2025-05-15 | 13F | Schonfeld Strategic Advisors LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 12,491 | 0.49 | 274 | 23.42 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 74,094 | -10.63 | 1,628 | 9.93 | ||||

| 2025-08-05 | 13F | Cherry Tree Wealth Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-26 | NP | AWTAX - AllianzGI Global Water Fund Class A | 1,361,191 | -0.96 | 29,905 | 21.83 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 12,276 | 270 | ||||||

| 2025-03-28 | NP | GIZAX - Invesco Global Infrastructure Fund Class A | 45,392 | 49.49 | 734 | 54.85 | ||||

| 2025-04-25 | 13F | J.Safra Asset Management Corp | 0 | -100.00 | 0 | |||||

| 2025-08-27 | NP | CFWAX - Calvert Global Water Fund Class A | 391,752 | -18.21 | 8,607 | 0.61 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 29,030 | 4.11 | 638 | 27.91 | ||||

| 2025-07-14 | 13F | Kapitalo Investimentos Ltda | 475,316 | 10,443 | ||||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 0 | -100.00 | 0 | |||||

| 2025-08-27 | NP | TPDAX - Timothy Plan Defensive Strategies Fund Class A | 4,258 | 0.00 | 94 | 22.37 | ||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 1,676 | -90.32 | 37 | -88.35 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 17,108 | 376 | ||||||

| 2025-06-27 | NP | PHO - Invesco Water Resources ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 789,052 | -31.91 | 16,041 | -14.44 | ||||

| 2025-08-12 | 13F | Gitterman Wealth Management, LLC | 23,933 | 95.40 | 526 | 140.83 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 60,488 | 17.87 | 1,329 | 44.98 | ||||

| 2025-08-14 | 13F | VPR Management LLC | 28,680 | 0.00 | 630 | 23.05 | ||||

| 2025-07-10 | 13F | Kozak & Associates, Inc. | 427 | 0.00 | 9 | 14.29 | ||||

| 2025-08-26 | NP | EMIF - iShares Emerging Markets Infrastructure ETF | 24,693 | -31.38 | 543 | -15.58 | ||||

| 2025-08-12 | 13F | SPX Equities Gestao de Recursos Ltda | 186,068 | -59.61 | 4,088 | -50.32 | ||||

| 2025-08-13 | 13F | Federated Hermes, Inc. | 78,794 | 0.00 | 1,731 | 23.03 | ||||

| 2025-08-08 | NP | QGBLX - Quantified Global Fund Investor Class | 17,474 | 10.89 | 384 | 36.30 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 4,164 | 9.09 | 91 | 33.82 | ||||

| 2025-08-08 | 13F | Creative Planning | 30,764 | 31.48 | 676 | 61.87 | ||||

| 2025-08-14 | 13F | State Street Corp | 481,179 | -1.47 | 10,572 | 21.20 | ||||

| 2025-05-15 | 13F | Marshall Wace, Llp | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 68,283 | -81.90 | 1,500 | -77.73 | ||||

| 2025-08-14 | 13F | Axa S.a. | 21,051 | 0.00 | 462 | 23.20 | ||||

| 2025-06-26 | NP | SNTKX - Steward International Enhanced Index Fund Class A | 45,558 | 0.00 | 926 | 25.64 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 30,793 | 141.80 | 677 | 197.80 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 112,323 | -29.29 | 2,468 | -13.01 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 6,034 | 133 | ||||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 1,926,895 | 7.81 | 42,334 | 32.62 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 16,984 | 33.15 | 373 | 64.32 | ||||

| 2025-07-22 | 13F | Capital Advisors Inc/ok | 0 | -100.00 | 0 | |||||

| 2025-08-08 | 13F | Principal Financial Group Inc | 46,570 | 1,023 | ||||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 1,412,525 | -2.36 | 31,033 | 20.11 | ||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 26,500 | 52.00 | 582 | 87.14 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 19,417 | 11.15 | 427 | 36.98 | ||||

| 2025-03-28 | NP | GERIX - Goldman Sachs Emerging Markets Equity Insights Fund Institutional | 308,300 | 0.00 | 4,988 | 1.84 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 50,001 | 18.36 | 1,099 | 45.62 | ||||

| 2025-08-06 | 13F | Legacy Wealth Managment, LLC/ID | 177 | 0.00 | 4 | 0.00 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 26,747 | -19.88 | 588 | -1.51 | ||||

| 2025-08-11 | 13F | Vanguard Group Inc | 2,076,976 | 1.36 | 45,631 | 24.69 | ||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 16,861 | 0 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 256 | 69.54 | 5 | 150.00 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 2,365,558 | -4.36 | 51,971 | 17.65 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 1,164,123 | 10.62 | 25,579 | 36.10 | ||||

| 2025-07-18 | 13F | Generali Investments CEE, investicni spolecnost, a.s. | 109,986 | 0.00 | 2,416 | 23.01 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 3,511 | 0.00 | 77 | 24.19 | ||||

| 2025-06-23 | NP | UBPIX - Ultralatin America Profund Investor Class | 9,090 | -6.18 | 185 | 17.95 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 200 | 4 | |||||

| 2025-08-26 | NP | WCMVX - WCM Focused International Value Fund Institutional Class Shares | 52,830 | 0.00 | 1,161 | 23.01 | ||||

| 2025-08-11 | 13F | Duff & Phelps Investment Management Co | 1,361,191 | -0.96 | 29,905 | 21.83 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 21,506 | 3.11 | 472 | 26.88 | ||||

| 2025-06-17 | NP | GRASX - Goldman Sachs Multi-Manager Real Assets Strategy Fund Class R6 Shares | 148,416 | 13.83 | 3,017 | 43.05 | ||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 19,255 | -0.90 | 423 | 52.16 | ||||

| 2025-07-28 | NP | AVEM - Avantis Emerging Markets Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 544,830 | 21.87 | 11,191 | 55.40 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 29,770 | 23,526.98 | 654 | 65,300.00 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 3,800 | -5.00 | 83 | 16.90 | |||

| 2025-04-18 | NP | AVSE - Avantis Responsible Emerging Markets Equity ETF | 5,443 | 0.00 | 88 | 4.82 | ||||

| 2025-08-27 | NP | RYWTX - Emerging Markets 2x Strategy Fund Class A | 2,433 | 169.44 | 53 | 231.25 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 2,285 | 18.64 | 0 | |||||

| 2025-08-04 | 13F | Strs Ohio | 1,631,700 | 0.00 | 35,848 | 23.01 | ||||

| 2025-08-14 | 13F | Banco BTG Pactual S.A. | 1,091,340 | -3.00 | 23,977 | 19.33 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 103,410 | 11.58 | 2,224 | 33.98 | ||||

| 2025-06-26 | NP | Dfa Investment Trust Co - The Emerging Markets Series This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 131,581 | 48.96 | 2,675 | 87.19 | ||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 52,170 | 229.19 | 1,146 | 304.95 | ||||

| 2025-08-25 | NP | EITEX - Parametric Tax-Managed Emerging Markets Fund Institutional Class | 48,898 | 0.00 | 1,074 | 23.02 | ||||

| 2025-08-14 | 13F | Pingora Partners LLC | 1,998 | 0.00 | 44 | 22.86 | ||||

| 2025-07-30 | 13F | Schwartz Investment Counsel Inc | 104,000 | 28.40 | 2,285 | 57.95 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 31,124 | -84.28 | 684 | -80.68 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 21,041 | 42.70 | 462 | 75.67 | ||||

| 2025-05-15 | 13F | Two Sigma Investments, Lp | 0 | -100.00 | 0 | |||||

| 2025-08-28 | NP | GII - SPDR(R) S&P GLOBAL INFRASTRUCTURE ETF | 77,721 | 2.55 | 1,708 | 26.16 | ||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 23,699 | -54.55 | 521 | -44.15 | ||||

| 2025-05-16 | NP | NATIONWIDE VARIABLE INSURANCE TRUST - NVIT GS Emerging Markets Equity Insights Fund Class Y | 12,700 | -88.95 | 227 | -86.27 | ||||

| 2025-08-08 | 13F | Allianz Se | 18,649 | 410 | ||||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 913 | 12.44 | 16 | 45.45 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 3,225 | 7.18 | 71 | 32.08 | ||||

| 2025-08-26 | NP | EHLS - Even Herd Long Short ETF | 24,922 | 70.02 | 548 | 126.03 | ||||

| 2025-08-14 | 13F | Erste Asset Management GmbH | 8,790 | 184 | ||||||

| 2025-07-24 | NP | FLOWX - Fidelity Water Sustainability Fund | 113,416 | 0.00 | 2,330 | 27.48 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 6 | 0 | ||||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | MAI Capital Management | 6,344 | 32.00 | 139 | 63.53 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 73 | 0.00 | 2 | 0.00 | ||||

| 2025-08-14 | 13F | CoreCommodity Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-28 | NP | TWMIX - Emerging Markets Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1,116,084 | 22,924 | ||||||

| 2025-07-24 | 13F | Lester Murray Antman dba SimplyRich | 19,194 | 30.70 | 0 | |||||

| 2025-05-06 | 13F | Winch Advisory Services, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 204 | 0.00 | 4 | 33.33 | ||||

| 2025-06-26 | NP | DAADX - Emerging Markets ex China Core Equity Portfolio Institutional Class | 15,888 | 0.00 | 323 | 25.68 | ||||

| 2025-07-29 | 13F | Nordea Investment Management Ab | 66,821 | -21.17 | 1,441 | -4.51 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 60,735 | 5.78 | 1 | 0.00 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-28 | NP | TOLZ - ProShares DJ Brookfield Global Infrastructure ETF | 50,877 | 13.27 | 1,045 | 44.54 | ||||

| 2025-06-26 | NP | JHAAX - Multi-Asset Absolute Return Fund Class A | 3,145 | -19.81 | 64 | 0.00 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 27,112 | 64.10 | 596 | 101.69 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 72,400 | -25.13 | 1,591 | -7.93 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 33,984 | 747 | ||||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | -100.00 | 0 |